FHA Mortgage Insurance Premium Dropping January 26, 2015

FHA Mortgage Insurance Premium Dropping January 26, 2015

FHA Mortgage Insurance Premium being lowered on all new FHA Case Numbers assigned on or after January 26, 2015, as announced by HUD Secretary Julian Castro on January 8, 2015, per an executive order by President Obama. FHA will reduce the annual mortgage insurance that borrowers will pay by 0.5%. FHA made this official with the publication of the Mortgagee Letter 2015-01. Call 302-703-0727 to Apply for an FHA Loan or APPLY ONLINE

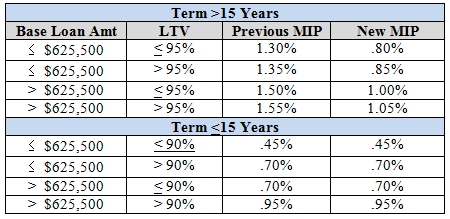

Below is a table that shows the changes to the annual mortgage insurance premiums for FHA Loans:

The Highlights of the New Rule are as follows:

• The annual premium is Reduced by 50 basis points (0.5%) on both purchase and refinance transactions.

• Applies to all FHA loans w/ terms greater than 15 years

• There is no change in premium on 15 years or shorter terms

• All loan types are affected except streamline refinances that are refinancing existing FHA loans endorsed before May 31, 2009

• Hawaiian homelands (Section 247) are also excluded.

• There is no change to the upfront premium (1.75%) or the life of loan requirement

FHA Streamline Refinance with New Lower Mortgage Insurance

Anybody that has gotten an FHA Loan since 2012 could probably save hundreds of dollars per month by refinancing their FHA loan with an FHA Streamline Refinance to lower the rate and lower their monthly mortgage insurance by taking advantage of this new rule.

This change to the annual mortgage insurance premium will be seen by a borrower in a lower monthly mortgage insurance premium on their mortgage payment. This could be a savings of $80 to $100 per month for borrowers using an FHA loan to purchase a home.

If you would like to apply for an FHA Loan to purchase or refinance a home in Delaware, Maryland, or Pennsylvania please call the John Thomas Team with Primary Residential Mortgage at 302-703-0727 or you can APPLY ONLINE.

If you would like to apply for an FHA Loan to purchase or refinance a home in Delaware, Maryland, or Pennsylvania please call the John Thomas Team with Primary Residential Mortgage at 302-703-0727 or you can APPLY ONLINE.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713