Mortgage Rates Weekly Update for January 9 2017

Mortgage Rates Weekly Update for January 9, 2017

Mortgage Rates Weekly Update for January 9, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

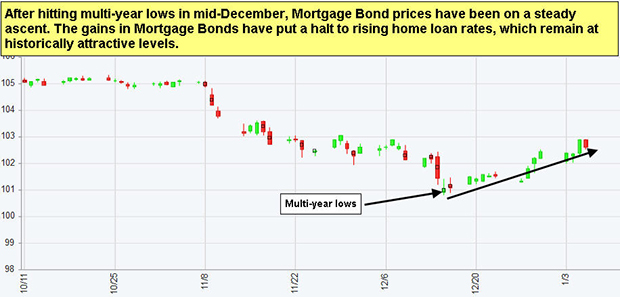

Mortgage Rates moved lower last week as mortgage bonds were able to continue to rally for the second straight week. If you look at the mortgage bond chart below you can see mortgage bonds have been moving up since about December 20, 2016 after hitting the lowest point for bonds in 2 years and the highest point for mortgage interest rates. Bonds found floor of support and were able to rally higher and broke through ceiling of resistance. Mortgage bonds have stopped at ceiling of resistance and were turned lower. We are looking for bonds to make another run at breaking through the ceiling of resistance so we are recommending FLOATING your mortgage rate to start the week.

In Economic News

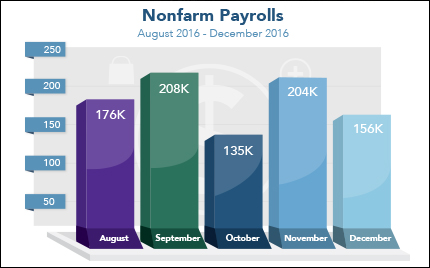

The US Bureau of Labor Statistics released the December 2016 Jobs Report on Friday which showed 156,000 jobs were created in December which was well below the 175,000 expected. In 2016 the total job growth was 2.2 million jobs created which was down from 2.7 million created in 2015. The Unemployment rate ticked higher from 4.6% to 4.7% as more Americans sought out employment in December which added them back into the unemployment calculation.

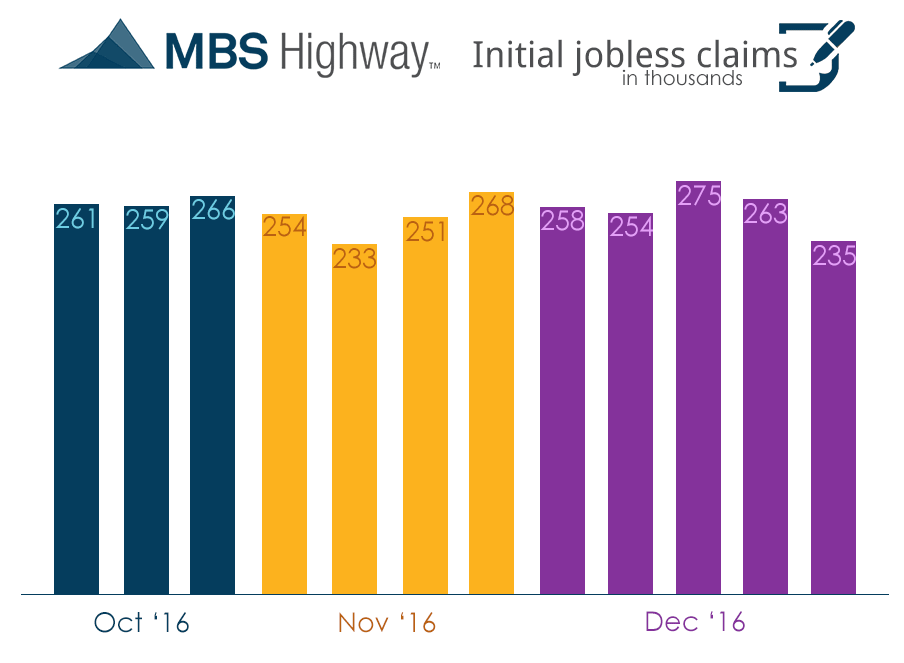

Weekly Initial Jobless Claims were released on Thursday the 5th and showed 235,000 claims filed which was a drop of 28,000 claims which was much better than expectations. This week’s report may not be a true reflection because it was for the Christmas Holiday week which could account for less people filing for unemployment benefits. This week’s report which reports for last week could also be skewed because of the New Year’s Holiday.

In Housing News

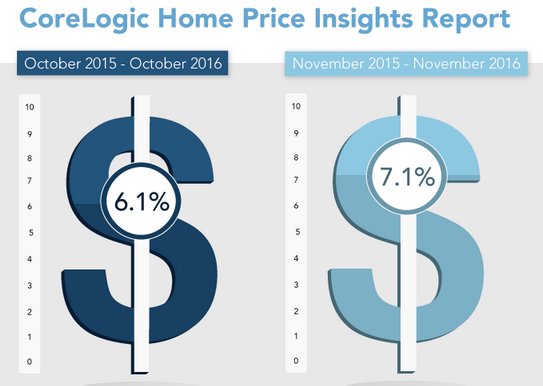

CoreLogic Home Price Index for November 2016 showed that home prices appreciated 7.1% year over year on a national level and were up 1.1% from October 2016. Home Prices continue to gain and CoreLogic is predicting a 4.7% home price appreciation in 2017 on a national basis.

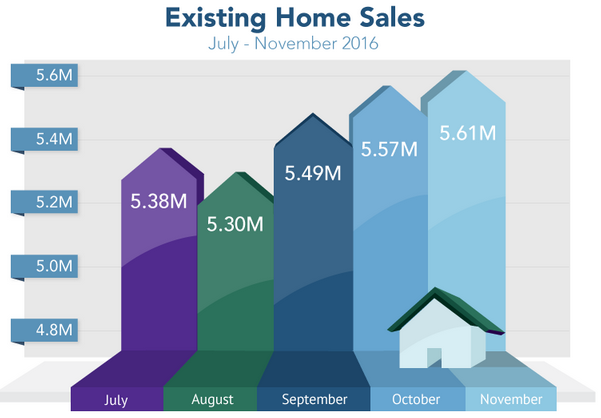

November 2016 Existing Home Sales were at a 9 year High at 5.61 Million units on an annualized basis. Existing home sales were up 15.4 percent from November 2015.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday January 14, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday January 21 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate