Delaware VA Loan Limits 2026

Delaware VA Loan Limits 2026

Important Information for Veterans and Active-Duty Military

Delaware VA loan limits in 2026 only apply to veterans with partial entitlement. With full VA entitlement, there is no loan limit in Delaware and eligible borrowers can finance 100% of the purchase price. Veterans using partial entitlement are subject to a statewide limit of $832,570 across all three Delaware counties, with a required 25% down payment on any amount above their remaining entitlement.

If you’re looking into VA loans in Delaware for 2026 here’s what you need to know. Loan limits in the state only affect veterans who have partial VA entitlement. If you have a full VA entitlement, you won’t face any loan limit. This lets you fund 100% of the home’s purchase price, no matter the cost.

For those with partial entitlement, the limit across all three counties in Delaware is $832,570. If the house price is higher than what your remaining entitlement covers, you’ll need to make a 25% down payment on the amount that exceeds it. Get Started Today, Call VA Loan Officer John Thomas at 302-703-0727 or APPLY ONLINE.

Delaware VA Loan Limits 2026 — Easy-To-Understand Guideline

People often get confused about VA loan limits in specific areas. Here is how VA loans work in Delaware during 2026:

- Full VA Entitlement (100%) ? There are no VA loan limits in Delaware

- Partial VA Entitlement ? Delaware has a VA loan limit

This rule is the same throughout the state and is decided by federal VA rules instead of what individual lenders choose.

How Much Is the Delaware VA Loan Limit in 2026?

If a veteran uses partial entitlement, VA lenders have to follow the 2026 FHFA conforming loan limit in Delaware.

Delaware VA Loan Limit (Applies for Partial Entitlement)

- $832,570 — applies across all three counties in Delaware

The Federal Housing Finance Agency (FHFA) decided this limit, which is relevant if a veteran’s full entitlement hasn’t been restored.

Delaware VA Loan Limits by County (2026)

Delaware has one consistent VA loan cap for partial entitlement throughout the entire state:

- New Castle County: $832,570

- Kent County: $832,570

- Sussex County: $832,570

Delaware counties do not qualify for high-cost adjustments on VA loans in 2026.

Full VA Entitlement in Delaware: No Loan Limits

If you hold full VA entitlement, there is no limit on the loan amount in Delaware.

Example:

- Home price: $1,200,000

- VA entitlement: 100%

- Down payment needed: $0

- VA loan base amount: $1,200,000

The VA does not limit the loan size as long as your income, credit, and the VA appraisal justify the loan.

How Down Payment Works with Partial VA Entitlement in Delaware

When you have partial entitlement, your VA lender calculates your available entitlement left. This calculation shows how much you can borrow with no down payment.

Example of Partial Entitlement in Delaware

- The maximum financing you can get: $500,000

- Home purchase price: $550,000

- Price difference: $50,000

- Down payment needed: 25% of $50,000 = $12,500

Here’s the breakdown:

- You’ll need a down payment of: $12,500

- VA loan base amount: $537,500

This calculation is a mandatory VA guideline, not something decided by the lender.

Reasons Some Veterans in Delaware Might Have Partial Entitlement

You could have partial entitlement if:

- You have a home purchased with a VA loan.

- You paid off a previous VA loan but did not restore your entitlement.

- You switched to a non-VA loan without reclaiming your entitlement.

- You faced a foreclosure or short sale that involved a VA loan.

It is necessary to review entitlement status to determine your exact eligibility.

VA loan eligibility requirements in Delaware

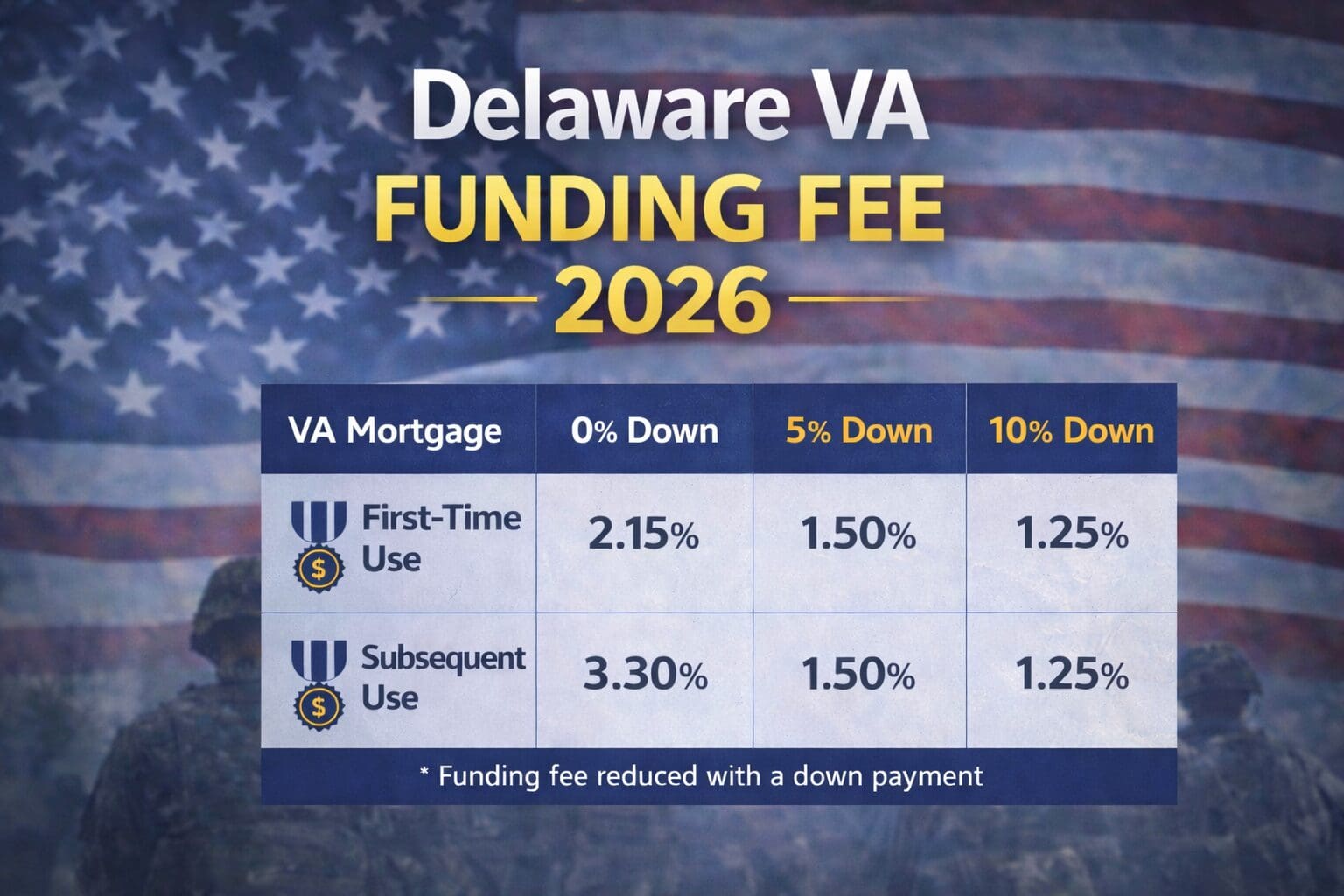

VA Funding Fee and Loan Total (Delaware)

The VA funding fee can be included in your total loan amount. This impacts the final VA loan total.

Who Does Not Have to Pay the VA Funding Fee

- Veterans who get VA disability benefits

- Eligible spouses of deceased veterans

If you are exempt, your base loan amount will match your total loan amount.

Funding Fee Details for Non-Exempt Borrowers (2026)

- First-time buyers with no down payment: 2.15%

- Repeat buyers with no down payment: 3.30%

- You can lower the funding fee by making a down payment.

The funding fee can be added to the loan.

? VA funding fee explained

Misunderstandings About Delaware VA Loan Limits

- Misunderstanding: Delaware VA loans have a limit of $832,570

- Correction: This applies when partial entitlement is in use.

- Misunderstanding: You need a down payment for jumbo VA loans in Delaware

- Correction: With full entitlement, no down payment is needed.

- Misunderstanding: Every veteran must pay the VA funding fee

- Correction: Veterans with VA disability do not have to pay it.

Why Veterans in Delaware Pick John Thomas for VA Loans

VA loans need accurate entitlement calculations and local know-how. John Thomas, a dependable VA loan officer in Delaware, assists veterans with these tasks:

- Checking if entitlement is full or partial

- Calculating exact remaining entitlement

- Setting up VA jumbo loans

- Avoiding last-minute problems in underwriting

No guessing. No unexpected issues. Call 302-703-0727 to Speak to VA Loan Officer John Thomas-NMLS38783

Apply for a VA loan in Delaware

Asked Questions (FAQ)

What is the 2026 VA loan limit in Delaware?

It is $832,570 for veterans who have partial entitlement. No loan limits in Delaware with Full Entitlement.

Are there limits on VA loans in Delaware for full entitlement?

No. With full entitlement, there are no loan limits.

Do VA loan limits differ between Delaware counties?

No. The limit is the same across all three counties.

Can I use a VA loan to buy a home in Delaware that costs over $1 million?

Yes, you can as long as you have full entitlement and meet the qualifications.

How can I find out if I have full or partial entitlement?

You need to complete a VA entitlement review to find out.