Delaware Mortgage Rates Weekly Update for December 2, 2013

Delaware Mortgage Rates weekly mortgage market update for the Week of December 2, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John Thomas is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates moved slightly higher to end the week as mortgage bonds traded lower to end the week. If you look at the mortgage bond chart below you can see bonds traded slightly lower to end the week. Traders left for the Thanksgiving holiday so trading volume was light on Wednesday and Friday. We are recommending FLOATING your Delaware mortgage rate to start the week.

In Economic News, Weekly Initial Jobless Claims came lower by 10,000 claims at 316,000 claims. This was the lowest reading on initial jobless claims since September 28th but numbers are difficult to calculate as seasonal employment for the holidays can skew the number lower.

The Consumer Sentiment Index in late November 2013 rose more than expected to 75.1, above the final reading in October 2013 of 73.2. The rise was due in part to wealthier Americans’ outlook on the economy improved. Within the report, it showed that upper-end consumers are benefiting from rising stock prices and low interest while lower-income households are still concerned about job growth.

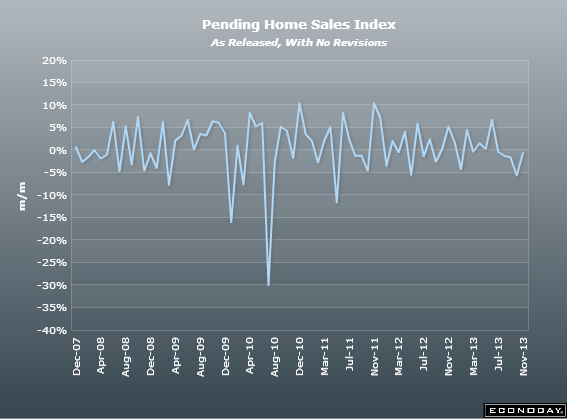

In Housing News, Pending Home Sales for October 2013 were reported down by 0.6% which was below expectations of a gain of 1.1%. Pending Home Sales measures the number of contracts signed in October to purchase existing homes. This was the 5th consecutive month of declines but the good news is the bulk of the decline is from the Western States.

Building Permits for September 2013 & October 2013 were both reported higher than expected. Permits for September were up 5.2% at 974,000 and Permits for October were up 6.2% at 1.034 Million. Building Permits measures how much new home construction there will be in the future so this is very encouraging for home builders. Building Permits are up 13.9% year over year which shows buyers are still in the market for buying a new home.

The Case-Schiller 20 City Home Price Index was up 0.7% for September 2013 from August 2013 and is up 13.3% year over year. This is the largest increase in 7.5 years for home prices. Schiller did state in an interview that he is not worried about a real estate bubble and that the rate of appreciation is slowing.

In Local News, New Castle County VHAP Program is out of funds for the remainder of 2013. A Borrower had to have their application at the county by November 27th to reserve funds for this year. The program should be refunded January 2014. The New Castle County DPS program still has funds available for down payment assistance.

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday, December 14, 2013, in Newark, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

The next Dover Delaware Home Buyer Seminar is Saturday, January 11, 2014, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, December 7, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713