Delaware Mortgage Rates Weekly Update for August 4, 2014

Delaware Mortgage Rates weekly market update for the Week of August 4, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates continued their roller coaster ride last week as mortgage bonds dropped big then tried to recover to end the week. If you look at the mortgage bond chart below you can see mortgage bonds were recovering last week until Wednesday when they dropped BIG as you can see from the BIG RED Candle down. Bonds were able to recover on Thursday and start to move higher on Friday. We are recommending FLOATING your Delaware Mortgage Rate to start the week to see if bonds can continue to climb back higher following through on Friday’s push higher.

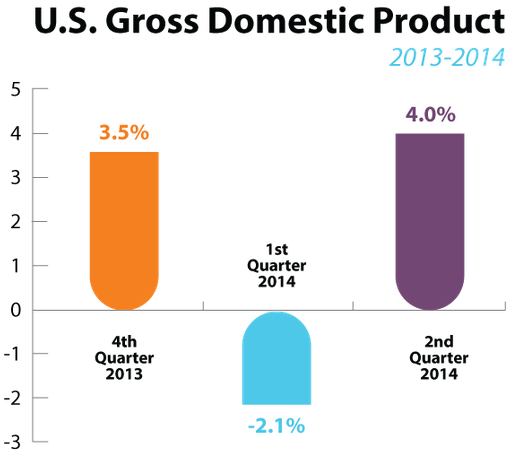

In Economic News, the Gross Domestic Product (GDP) first reading of the second quarter of 2014 was released on Wednesday and it shows a very surprising gain of 4% which was a big turn around from the first quarter which was -2.1%. The big increase appears to be from increased consumer spending and business investment in inventory.

In Economic News, the Gross Domestic Product (GDP) first reading of the second quarter of 2014 was released on Wednesday and it shows a very surprising gain of 4% which was a big turn around from the first quarter which was -2.1%. The big increase appears to be from increased consumer spending and business investment in inventory.

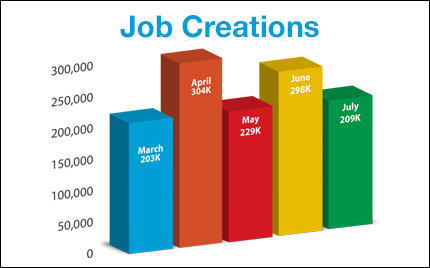

The Jobs Report for July 2014 was released by the Labor Department on Friday and it showed 209,000 jobs were created in July. May and June jobs report were also revised higher by 15,000 jobs. The monthly average for 2014 is at 230,000 jobs which is enough to support economic growth. The Unemployment Rate did tick up slightly from 6.1% to 6.2%. When you dig into the fundamentals of the report, this was a very good jobs report as it showed most of the jobs created were to people with college degrees in full-time employment. Full-time employment was more than 4 to 1 to part-time employment in the jobs report. We also saw the Labor Force Participation Rate increase slightly from 62.8% to 62.9%.

The Jobs Report for July 2014 was released by the Labor Department on Friday and it showed 209,000 jobs were created in July. May and June jobs report were also revised higher by 15,000 jobs. The monthly average for 2014 is at 230,000 jobs which is enough to support economic growth. The Unemployment Rate did tick up slightly from 6.1% to 6.2%. When you dig into the fundamentals of the report, this was a very good jobs report as it showed most of the jobs created were to people with college degrees in full-time employment. Full-time employment was more than 4 to 1 to part-time employment in the jobs report. We also saw the Labor Force Participation Rate increase slightly from 62.8% to 62.9%.

The Federal Reserve announced on Wednesday that it would continue to taper its asset purchase program by cutting another $10 Billion a month in purchases starting August 2014. This means the Feds will only be purchasing $25 Billion a month in bonds and treasuries. The Feds goal is to end the asset purchase program this year.

The Federal Reserve announced on Wednesday that it would continue to taper its asset purchase program by cutting another $10 Billion a month in purchases starting August 2014. This means the Feds will only be purchasing $25 Billion a month in bonds and treasuries. The Feds goal is to end the asset purchase program this year.

The Weekly Initial Jobless Claims came out on Thursday and increased to 302,000 claims up from 279,000 claims last week. The jobless claims have recently dropped to 300,000 which is a good sign for the labor market.

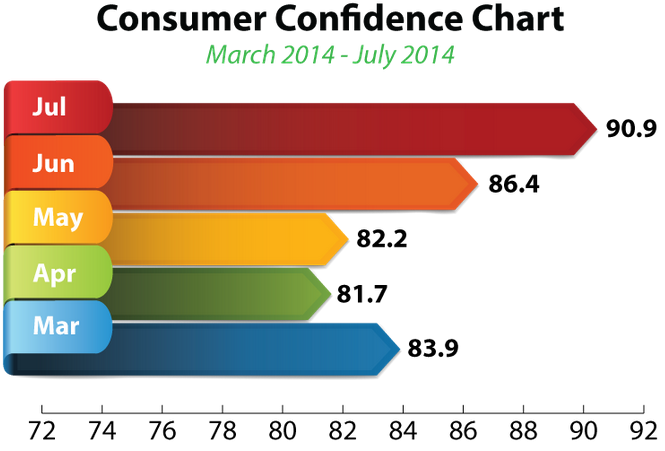

Consumer Confidence Index surged to a 7 year high to 90.9 fro July 2014 up from 86.4 for June 2014. This is the 3rd consecutive month of gains in consumer confidence and is the highest level since October 2007. The gains in the labor market have fueled the increase in consumer confidence.

USDA Rural Housing Update – Rural Development announced last week that Effect October 1, 2014, it is changing its mortgage insurance premiums. Currently, USDA loans charge a 2% upfront guarantee fee and a monthly mortgage insurance premium based on a figure of 0.4%. Effective October 1, 2014, the upfront will remain 2% but the monthly amount is increasing to 0.5%.

USDA Rural Housing Update – Rural Development announced last week that Effect October 1, 2014, it is changing its mortgage insurance premiums. Currently, USDA loans charge a 2% upfront guarantee fee and a monthly mortgage insurance premium based on a figure of 0.4%. Effective October 1, 2014, the upfront will remain 2% but the monthly amount is increasing to 0.5%.

The next Delaware First Time Home Buyer Seminar is Saturday, August 23, 2014, in Newark, Delaware and the next Dover Delaware First Time Home Buyer Seminar is August 16, 2014. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, August 30, 2014Â in Towson, Maryland and Frederick Maryland First Time Home Buyer Seminar on August 9, 2014, in Frederick, Maryland and Laurel Maryland First Time Home Buyer Seminar on August 20, 2014. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713