Delaware Mortgage Rates Weekly Update for August 26, 2013

Delaware Mortgage Rates weekly market update for the week of August 26, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John Thomas is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

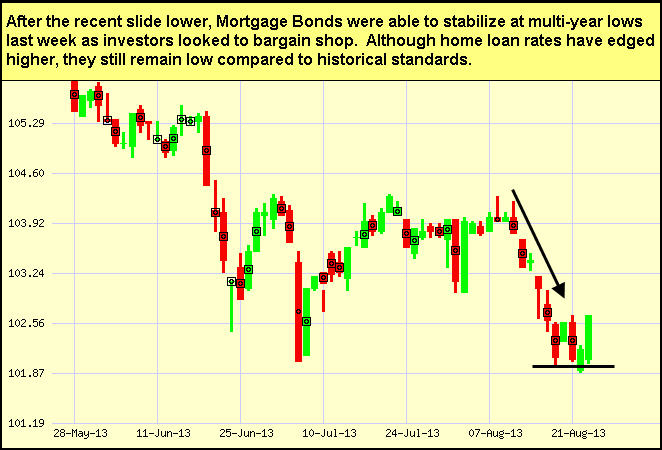

Delaware mortgage rates ended the week about where they ended the previous week after a roller coaster ride. If you look at the Mortgage Bond Chart below you can see mortgage bonds sold off on Monday to start the week which caused home loan rates to jump higher. The bond recovered on Tuesday but then sold off again on Wednesday after the Federal Reserve Minutes were released. Opened again lower on Thursday but was able to recover some after Weekly Initial Jobless Claims were released on Thursday which showed a 13,000 increase in Jobless Claims to 336,000 claims. The mortgage bond followed through on Friday with a Big Rally to end the week back where we ended the previous week. We are recommending FLOATING your Delaware Mortgage Rate to start the week to see if mortgage bond can build on the momentum from Friday’s rally.

In Housing News, Existing Home Sales increased by 6.5% in July 2013 from June 2013 to 5.39 Million units sold. This is a 17.2% increase from July 2012 to July 2013. The FHFA (Federal Housing Finance Agency) reported last week that Home Prices rose by 7.7% from June 2012 to June 2013. The FHFA also reported Home Prices increased by 0.7% from May 2013 to June 2013.

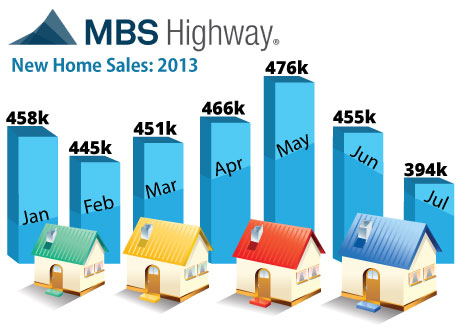

New Home Sales declined by nearly 14% from June to July to the lowest level in nine months. New Home Sales fell to 394,000 units annualized and below the 485,000 that was expected. In addition, June was revised lower to 455,000 from the 497,000 that was first reported. The rise in home loan rates predicted a drop in Home Sales in July as people jumped on the lower rates in May and June. This was all predictable if you saw the drop in mortgage applications and new construction starts that happened in July. August is looking to rebound and good evidence for this as mortgage applications have rebounded from being down in July.

In Economic News, the Federal Reserve released their minutes on Wednesday and threw the market in a tizzy as bonds, stocks, and commodities all sold off because the Feds didn’t mention whether they would or would not start tapering the bond buying program (QE) at the September 18th meeting. We are predicting that the Feds will begin tapering the Asset purchase program (QE) at the September meeting but don’t see a huge negative impact on mortgage rates because the Feds will most likely start tapering the purchase of treasuries and not mortgage bonds. They will also continue to re-invest the interest and payoffs of the bonds already on the books. We also will see less supply coming to market as the Feds pull back because of the drop in mortgage refinances.

FHA Update – HUD released new FHA Back to Work Program effective August 15, 2013, which drastically reduces wait periods for borrowers that experienced Short-Sale, Foreclosure, or Bankruptcy if were the result of extenuating circumstance. Read the full story at Delaware FHA Back to Work Program

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday, September 14, 2013, in Newark, Delaware and First Time Home Buyer Seminar on Saturday, September 28, 2013, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

Then next Maryland First Time Home Buyer Seminar is Saturday, September 14, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713