Delaware Mortgage Rates Weekly Rate Update for August 11, 2014

Delaware Mortgage Rates weekly mortgage market update for the Week of August 11, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

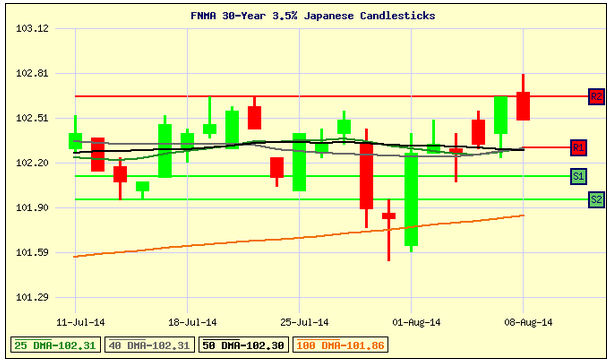

Delaware Mortgage Rates ended the week near the lows for the year but mortgage bonds were turned lower on Friday as the market rallied. Geo-Political News dominated headlines last week and sent the market on a wild ride. The tensions in Ukraine, the War in Gaza, and the war in Iraq have caused the markets to have extreme volatility this past week. If you look at the mortgage bond chart below you can see the green and red candles going back and forth each day and finally ending down on Friday trading below the line of resistance R2 on the chart. We are recommending LOCKING Your Delaware Mortgage Rate to start the week as Friday’s technical signal is for bonds to continue to sell off.

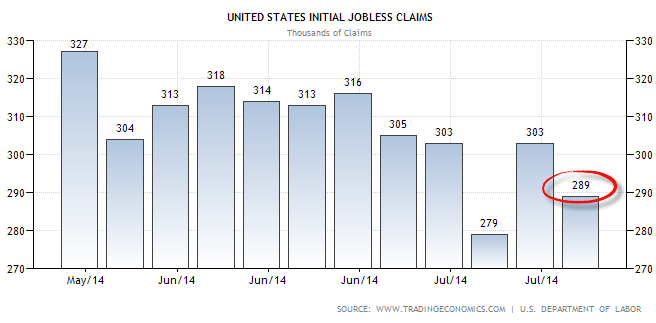

In Economic News, Weekly Initial Jobless Claims fell by 14,000 claims to 289,000 claims for the week. Jobless claims are now at an eight-year low as the labor market improves and the 4-week average has dropped to 293,000 claims. Jobless Claims are a leading indicator of the labor market so we should see better job growth for August Jobs Report.

In Economic News, Weekly Initial Jobless Claims fell by 14,000 claims to 289,000 claims for the week. Jobless claims are now at an eight-year low as the labor market improves and the 4-week average has dropped to 293,000 claims. Jobless Claims are a leading indicator of the labor market so we should see better job growth for August Jobs Report.

Inflation fears were eased as reports on inflation showed it still in the Federal Reserve’s target range. This gives the Feds Reason to keep the short term interest rates low throughout 2015. The Fed’s favorite measure of inflation, PCE, showed that inflation actually moderated on a year over year basis and still remains below the Fed Target of 2%.

Inflation fears were eased as reports on inflation showed it still in the Federal Reserve’s target range. This gives the Feds Reason to keep the short term interest rates low throughout 2015. The Fed’s favorite measure of inflation, PCE, showed that inflation actually moderated on a year over year basis and still remains below the Fed Target of 2%.

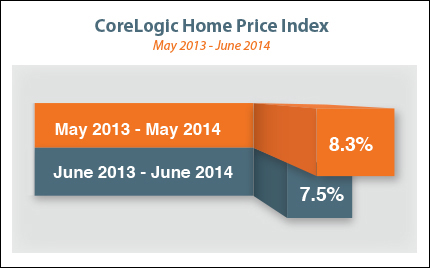

In Housing News, CoreLogic Reported that home prices increased 7.5% from June 2013 to June 2014 which is down from 8.3% from May 2013 to May 2014. The National Market is cooling off as inventories are rising and demand for homes is waning. CoreLogic predicted home prices to rise 5.7% from June 2014 to June 2015 which shows a continuing of the cooling in the housing market.

In Housing News, CoreLogic Reported that home prices increased 7.5% from June 2013 to June 2014 which is down from 8.3% from May 2013 to May 2014. The National Market is cooling off as inventories are rising and demand for homes is waning. CoreLogic predicted home prices to rise 5.7% from June 2014 to June 2015 which shows a continuing of the cooling in the housing market.

The next Delaware First Time Home Buyer Seminar is Saturday, August 23, 2014, n Newark, Delaware and the next Dover Delaware First Time Home Buyer Seminar is August 16, 2014. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, August 30, 2014, in Towson, Maryland and Frederick Maryland First Time Home Buyer Seminar on September 13, 2014, in Frederick, Maryland and Laurel Maryland First Time Home Buyer Seminar on August 20, 2014. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713