Delaware Mortgage Rates Weekly Mortgage Market Update for January 27, 2014

Delaware Mortgage Rates weekly mortgage rate update for the Week of January 27, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates were able to move lower last week as mortgage bonds were able to continue to rally. If you look at the mortgage bond chart below you can see the short term trend is for mortgage bonds to move higher and move Delaware mortgage rates lower. Mortgage bonds have rallied since the December Jobs Report came out worse than expected and recently we have seen a flight to quality from international investors who are moving money into U.S. Bonds and Treasuries as a potential currency devaluation occurs in emerging markets. We are recommending FLOATING your Delaware Mortgage Rate to start the week to see if bonds can build on the momentum we had last week. Mortgage bonds have broken through a ceiling of resistance which is a good short term sign for home loan rates.

What is happening in the World Markets to cause a flight to U.S. Bonds & Treasuries? Investors looking for better returns have invested in emerging markets such as Argentina. For Example, if you are an investor who is only looking at a 2% return in the US Market but could get a 10% return in the Argentina market you would investor there for the higher return. This seems to make sense unless the currency in Argentina gets devalued like it just did. So say you want to invest $100,000 in Argentina, you first need to convert your dollars to pesos. The exchange rate lets say is 5 Peso to 1 Dollar. So your $100,000 is converted to $500,000 peso then invested. Let’s say it earns the 10% return which is 50,000 Peso. You now have 550,000 Peso. You convert it back to Dollars but since we now have a currency devaluation the exchange is 8 Peso to 1 Dollar so you only get $69,000. So even though you earned a 10% return in Argentina, you have a net loss of 31% when you convert it back to Dollars. Now that there is fear of more currency devaluation to come in Emerging Markets, investors are moving back to the safe trade which is the US Bond market. So this is why we have seen a rally building in the mortgage bond market.

In Economic News, the Weekly Initial Jobless Claims came out on Thursday at 326,000 claims which are about the same as last week. Weekly claims are continuing to settle in at the about 320k range.

In Housing News, Existing Home Sales for December 2013 rose by 1 percent from November 2013 on an annualized basis coming in at 4.87 Million Homes sold year over year. This shows the housing market does continue to recover. The annual appreciation rate from December 2012 to December 2013 was 9.9% and the median home price in the U.S. is 198k. The market is being limited by a lack of homes for sale so as we move into the spring buying season this will put pressure on home prices to continue to rise.

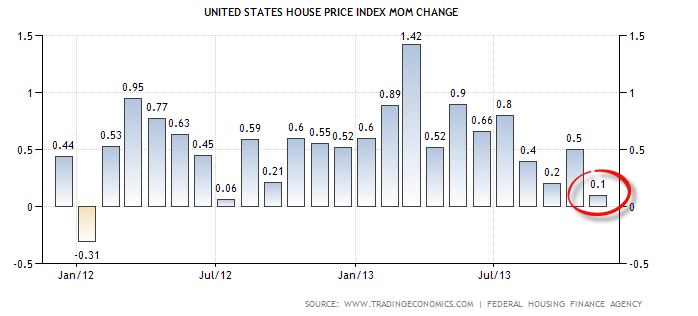

The FHFA released its home price index for November 2013 and it was disappointing in that home prices only rose 0.1% from October which was lower than the 0.4% expected.

USDA announced changes to its USDA Rural Housing Loan Program, it would begin using the 2010 Census Data to determine property eligibility beginning October 1, 2014. The current property eligible areas are determined based on 2000 Census Data. The new eligible areas will eliminate the towns of Middletown and Smyrna from being eligible. Get more information on new maps at USDA Rural Housing Loans Property Eligibility Change October 1, 2014

USDA announced changes to its USDA Rural Housing Loan Program, it would begin using the 2010 Census Data to determine property eligibility beginning October 1, 2014. The current property eligible areas are determined based on 2000 Census Data. The new eligible areas will eliminate the towns of Middletown and Smyrna from being eligible. Get more information on new maps at USDA Rural Housing Loans Property Eligibility Change October 1, 2014

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware home owners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday, February 15, 2014, in Newark, Delaware. Register by calling 302-703-0727 or Dover Delaware First Time Home Buyer Seminar February 8, 2014, Register online at http://www.delawarehomebuyerseminar.com/ . Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar Saturday, February 8, 2014, in Rockville, Maryland or Maryland First Time Home Buyer Seminar is Saturday, February 22, 2014, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713