Delaware Mortgage Rates Weekly Mortgage Market Update for December 23, 2013

Delaware Mortgage Rates weekly mortgage market update for the Week of December 23, 2013, by John R. Thomas with Primary Residential Mortgage in Newark, Delaware. John Thomas is the Newark, Delaware Mortgage Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates spiked higher last week when the Federal Reserve Committee announced that it would begin tapering its asset purchase program. Mortgage rates moved higher as the mortgage bond sold off. If you look at the mortgage bond chart below you can see a Big Red Candle on Wednesday after the news was released. Mortgages bonded continued to move lower on Thursday but then were able to bounce higher to stabilize the bond. Mortgage rates surged higher to end the week about where they were at the end of September. We are looking for mortgage interest rates to move into the 5s for 2014 as the economy improves and the Feds start to taper their asset purchase program called QE3. We are recommending starting the week FLOATING your Delaware Mortgage Rate because bonds were able to rally back on Friday so we want to see if can build on this momentum.

The Federal Reserve released the meeting minutes on Wednesday which surprisingly announced a taper to the Asset purchase program starting in January 2014 to the tune of $10 Billion. Currently, the Feds are purchasing $85 Billion a month in U.S. Treasuries and mortgage bonds but January they are reducing the monthly purchase to $75 Billion a month. This news rocked the mortgage bond market and caused a big sell-off on Wednesday but bonds were able to find a bottom and rally off it on Friday. Long Term outlook for rates is for mortgage interest rates to rise as Feds continue to taper the asset purchase program called QE3 because 90% of mortgage-backed securities being currently bought are being bought by the Feds!

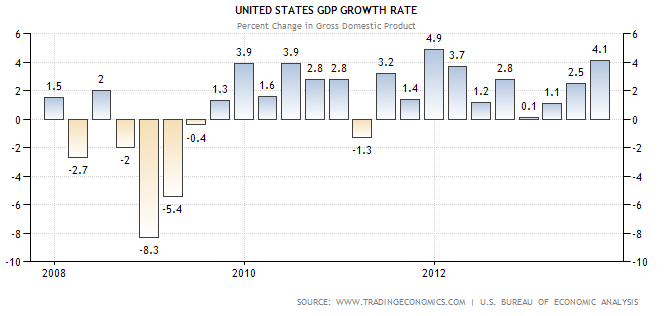

In Economic News, the Final Reading of the Gross Domestic Product (GDP) for 3rd Quarter of 2013 was reported at 4.1% above expectations of 3.6% and was also the highest since the 4th Quarter GDP of 2011. The rise in GDP was from a couple of factors which include:

- Increase in Consumer Spending from 1.4% to 2%

- The buildup in Business Inventories

- Business Spending in Software

We will need to watch the GDP readings to see if continues this high because two of the factors will not keep contributing to GDP. Business Inventories once build up will be done and will no longer contribute to the GDP and Business spending on Software will no longer contribute to GDP once businesses have upgraded.

Weekly Initial Jobless Claims continue to spike higher as Thursday jobless claims were reported higher by 10k claims at 379,000 claims. This was well above expectations of 333k claims and is now the highest reading since March 2013. This doesn’t support a recovering job market so we will need to watch this trend as it could negatively impact the unemployment number and the economic recovery.

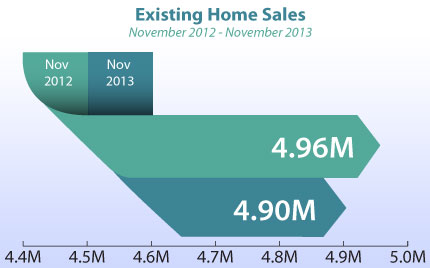

In Housing News, Housing Starts for November 2013 surged higher by 22.7% to 1.09 Million units above expectations for 950k units. This was the largest percent increase since January 1990 and the biggest rate in five years. Building Permits for November 2013 declined by 3.1% to 1.007 million units which were above the 950k estimated for permits. The market for New Construction is continuing to improve and builder confidence is still running high so 2014 looks to be a good year for home builders. In the resale market, Existing Home Sales for November 2013 fell 4.9% for the first time in 29 months to 4.90 Million units down from 4.96 million units in November 2012

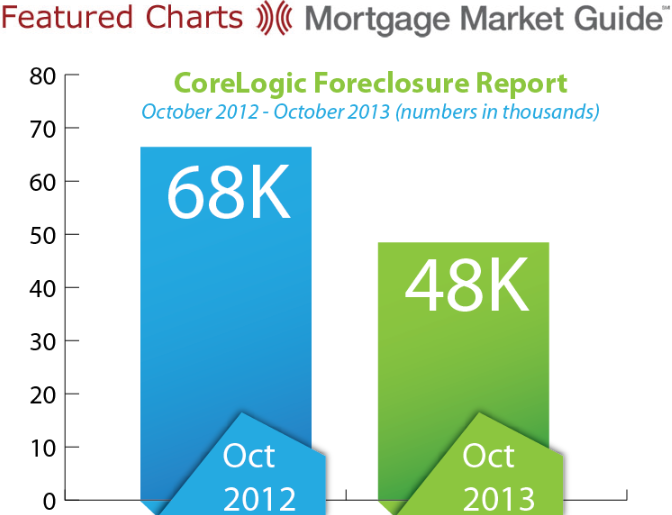

CoreLogic reported that 791,000 more residential properties returned to positive equity in the 3rd Quarter of 2013 but there are still nearly 6.4 Million residential properties still under water with “negative” equity. There were 48,000 foreclosures completed in October 2013 which is a 30% decline from October 2012.

In the week ahead we are looking at the following reports:

- Personal Income & Spending on Monday

- Personal Consumption Expenditure on Monday (Measure of Inflation)

- Consumer Sentiment on Monday

- New Home Sales on Tuesday

- Weekly Initial Jobless Claims on Thursday

Call 302-703-0727 to schedule a mortgage consultation to get pre-approved for a mortgage to purchase a home or to refinance your existing mortgage to lower your rate and save thousands of dollars in interest. There are several special governments refinance programs to help underwater Delaware homeowners refinance. There is the FHA Streamline Refinance Program, the VA IRRRL Streamline Refinance Program, and there is the HARP 1.0 and HARP 2.0 refinance programs. Call us or e-mail us now to get more information or you can APPLY ONLINE.

The next Delaware First Time Home Buyer Seminar is Saturday January 18, 2013, in Newark, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/ The next Dover Delaware Home Buyer Seminar is Saturday, January 11, 2014, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, January 25, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713