Delaware Mortgage Rates Weekly Market Update for August 18, 2014

Delaware Mortgage Rates weekly mortgage market update for the Week of August 18, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Newark, Delaware Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware Mortgage Rates were able to move lower last week as mortgage bonds rallied all week. If you look at the mortgage bond chart below you can see mortgage bonds found a bottom on Monday and were able to rally higher all week after weaker than expected economic news and geopolitical events continuing to dominate headlines. We are recommending FLOATING your Delaware Mortgage Rate to start the week as the short term trend is for mortgage bonds to continue to rally higher which will move mortgage interest rates lower.

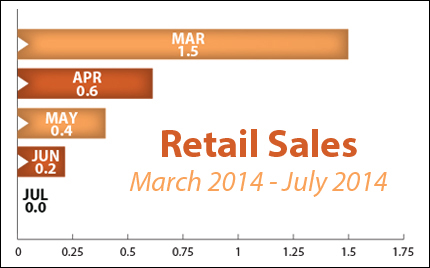

In Economic News, Retail Sales for July 2014 came out unchanged from June 2014 which kicks off the third quarter with a down note as consumer spending slows. This was the lowest reading in 6 months and showed consumer spending slowed in almost all areas. This was a bad report and is not in line with an economy growing at 4% as reported in first reading on 2nd quarter GDP.

Last week brought a bond-friendly report on inflation from the Producer Price Index (PPI). PPI measures inflation at the wholesale level which is the and it came out very tame and only increased 0.1% for July 2014 and dropped from 1.9% to 1.7% for the year which is bell the Feds target of 2%.

Last week brought a bond-friendly report on inflation from the Producer Price Index (PPI). PPI measures inflation at the wholesale level which is the and it came out very tame and only increased 0.1% for July 2014 and dropped from 1.9% to 1.7% for the year which is bell the Feds target of 2%.

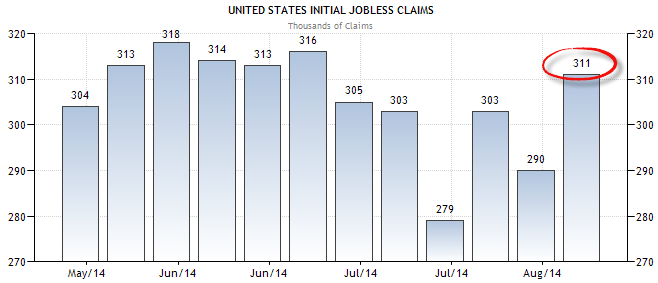

Thursday saw the release of the Weekly Initial Jobless Claims which jumped up to 311,000 claims from a revised 290,000 claims the previous week. Even though this is above the 300s or below it has been this is still a good report as it is in the low 300s. The 4-week average did move higher from 293k to 295k but it is still at an 8 year low.

In Housing News, RealtyTrak reported that foreclosures activity across the nation increased for the first time in four weeks moving up 2% from June 2014 to July 2014. Even with the increase from June to July, Foreclosure activity is still down 16 percent from a year ago and July 2014 marks the 46th consecutive month of foreclosure activity declining on an annual basis.

In Housing News, RealtyTrak reported that foreclosures activity across the nation increased for the first time in four weeks moving up 2% from June 2014 to July 2014. Even with the increase from June to July, Foreclosure activity is still down 16 percent from a year ago and July 2014 marks the 46th consecutive month of foreclosure activity declining on an annual basis.

The next Delaware First Time Home Buyer Seminar is Saturday, August 23, 2014, n Newark, Delaware. Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Then next Maryland First Time Home Buyer Seminar is Saturday, August 30, 2014, in Towson, Maryland and Frederick Maryland First Time Home Buyer Seminar on September 13, 2014, in Frederick, Maryland and Laurel Maryland First Time Home Buyer Seminar on August 20, 2014. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com.

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713