FHA Loan Limits 2016

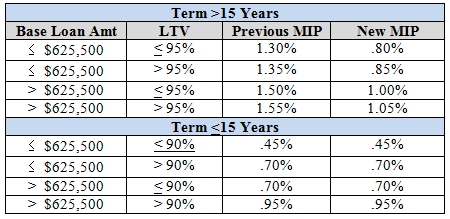

Federal Housing Administration released FHA Loan Limits for 2016 on December 9, 2015 with the release of Mortgagee Letter 2015-30. The minimum maximum FHA Loan limit remained at $271,050 and the maximum FHA Loan limit in high cost area remained at $625,500. The maximum loan limit for a FHA Loan is set by the median house price in the county in which the property is located. The FHA loan limits for 2016 are for FHA Loans with case numbers assigned on or after January 1, 2016.

FHA increased loan limits in 188 counties across the country and didn’t decrease loan limits in any counties. The FHA Loan limits remained the same in Delaware, Maryland, and Pennsylvania. Search the FHA Loan limit in any county in the United States at HUD’s website at FHA Loan Limit Search

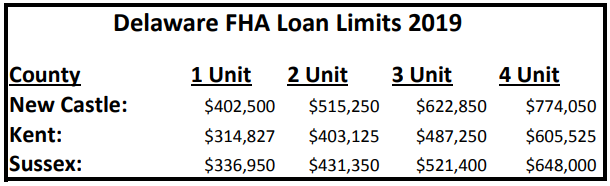

Delaware FHA Loan Limits 2016

New Castle County Delaware – $379,500 (1 Unit Property)

Kent County Delaware – $271,050 (1 Unit Property)

Sussex County Delaware – $316,250 (1 Unit Property)

Maryland FHA Loan Limits 2016

Allegany County Maryland – $271,050 (1 Unit Property)

Anne Arundel County Maryland – $517,500 (1 Unit Property)

Baltimore County Maryland – $517,500 (1 Unit Property)

Baltimore City Maryland – $517,500 (1 Unit Property)

Calvert County Maryland – $625,500 (1 Unit Property)

Caroline County Maryland – $625,500 (1 Unit Property)

Carroll County Maryland – $517,500 (1 Unit Property)

Cecil County Maryland – $379,500 (1 Unit Property)

Charles County Maryland – $625,500 (1 Unit Property)

Dorchester County Maryland – $271,50 (1 Unit Property)

Frederick County Maryland – $625,500 (1 Unit Property)

Garrett County Maryland – $271,50 (1 Unit Property)

Harford County Maryland – $517,500 (1 Unit Property)

Howard County Maryland – $517,500 (1 Unit Property)

Kent County Maryland – $290,950 (1 Unit Property)

Montgomery County Maryland – $625,500 (1 Unit Property)

Prince George’s County Maryland – $625,500 (1 Unit Property)

Queen Anne’s County Maryland – $517,500 (1 Unit Property)

Somerset County Maryland – $316,250 (1 Unit Property)

St. Mary’s County Maryland – $347,300 (1 Unit Property)

Talbot County Maryland – $382,950 (1 Unit Property)

Washington County Maryland – $271,050 (1 Unit Property)

Wicomico County Maryland – $316,250 (1 Unit Property)

Worcester County Maryland – $316,250 (1 Unit Property)

If you have questions about FHA Loans or would like to inquiry about how to qualify for a FHA Loan for the purchase or refinance of a home, please call 302-703-0727 or get APPLY ONLINE