Mortgage Rates Weekly Update [September 17 2018]

Mortgage Rates Weekly Update for September 17, 2018

Mortgage Rates Update for September 17, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved higher last week as mortgage bonds fell following through on a sell off that started with the Jobs Report the previous week. If you look at the Fannie Mae 4.0% mortgage bond chart below you can see mortgage bonds are in a downward trend that started at the end of August. As mortgage bonds sell off and move lower, mortgage interest rates move higher. Bonds ended the week below a layer of support which will now be a resistance, if they break below the next floor which they are sitting on, there is plenty of room to fall before reaching the next floor of support. US Treasuries have moved up and ended the week at 3.0% and will probably move up to 3.1% before finding a ceiling of resistance. With all of this headwind for bonds, we are recommending LOCKING Your mortgage rate to start the week.

In Economic News

In World Economic news, There have been no new developments from the China/U.S.-tariff issues. However, we are seeing signs that China’s economy is slowing, materially, which could help further the negotiations. China’s Stock market, the Shanghai Index, is down 20% in the last year and in bear market territory. This “pain” could be lifted by China striking a deal with the U.S. We shall see.

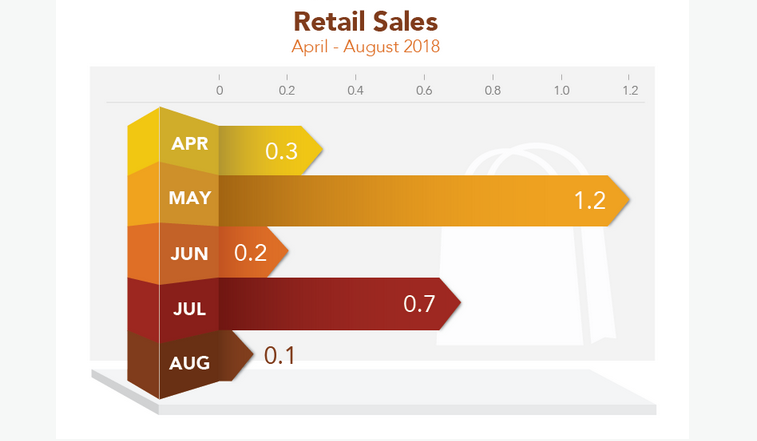

Retail Sales for August 2018 disappointed at only 0.1% increase which was below expectations of 0.4%. However, July Retail Sales was revised higher from 0.5% to 0.7% which shows consumers spent more in July and held back in August. On an annual basis Retail Sales are up 6.6% from August of 2017. The Retail Sales report is a measure of the total receipts of retail stores and is the most timely indicator of broad consumer patterns.

The Consumer Price Index (CPI) for August 2018 rose 0.2% from July and fell year over year from 2.9% to 2.7%. CPI measures inflation at the consumer level so this was a bond friendly report as this was a tame report on inflation. The lower inflation data could mean Feds slow their rate hikes in the future. We also saw lower inflation on the wholesale level as the Producer Price Index (PPI) for August 2018 fell 0.1% from July and the year over year figured dropped from 3.3% to 2.8%.

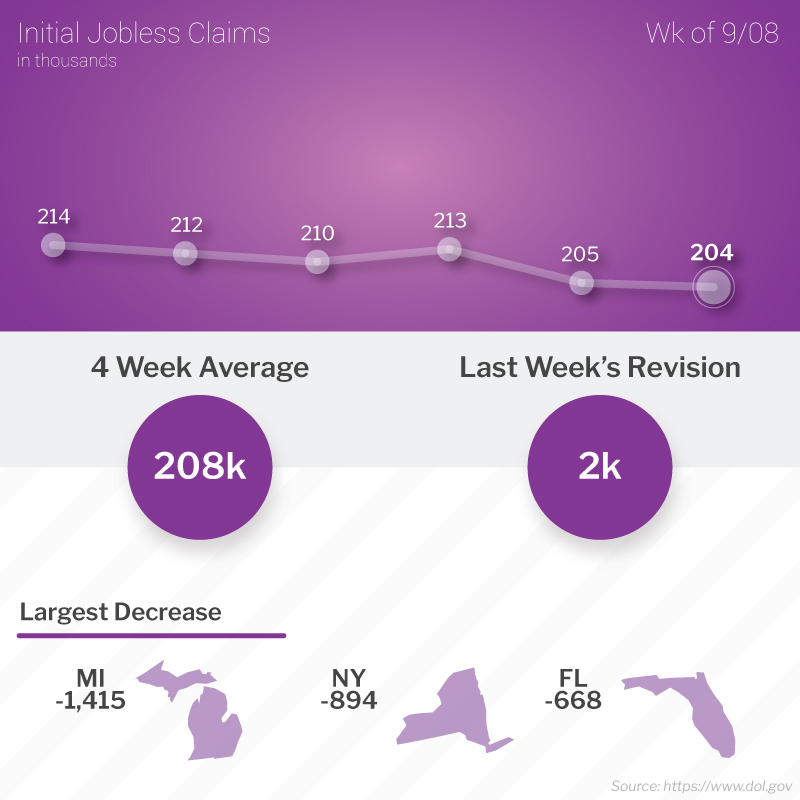

Weekly Initial Jobless Claims were released on Thursday and came out at 204,000 claims for the week. This was a drop of 1,000 claims from the previous week which was revised higher from 203,000 to 205,000. The labor market remains very tight with weekly initial claims at lows not seen since the 1960s.

The Week Ahead in Mortgage Rates

For the Week of September 17, 2018 thru September 21, 2018

Housing Starts & Building Permits on Wednesday

Existing Home Sales on Thursday

Weekly Initial Jobless Claims on Thursday

In Housing News

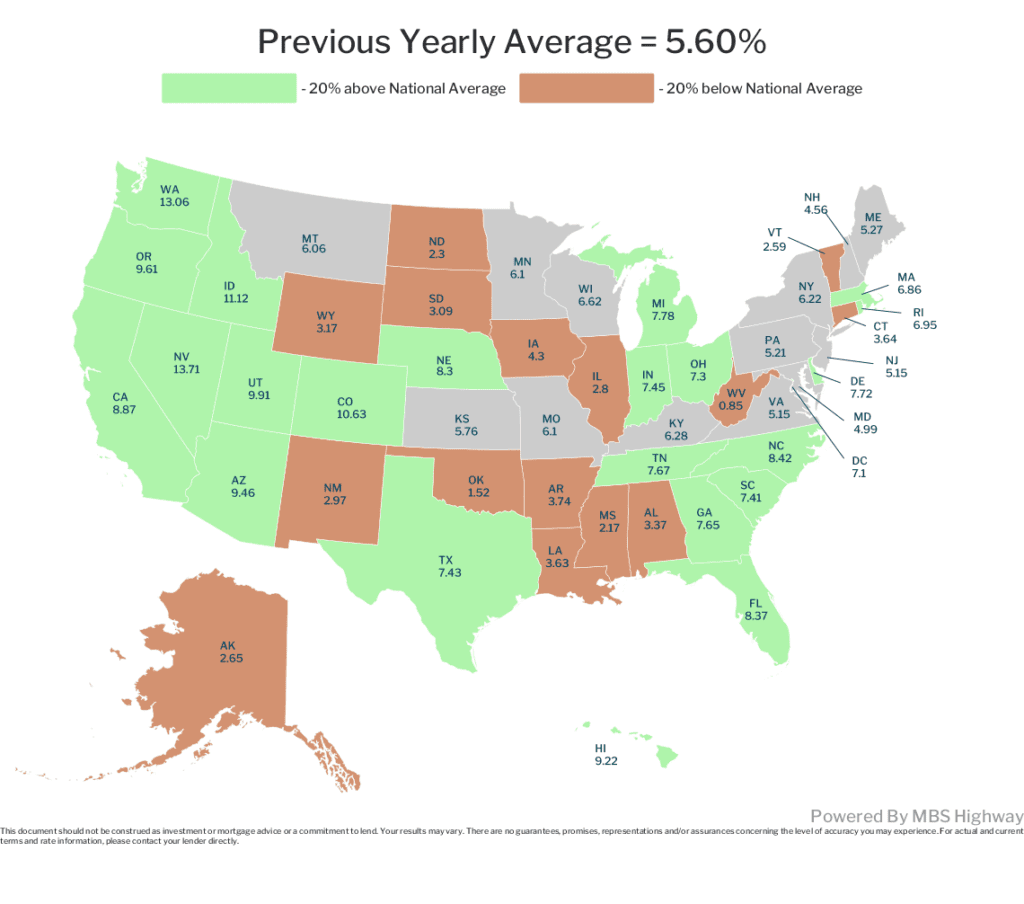

Home Price Index for 1 year through August 2018. Delaware was above the national average at 7.72%, Maryland was 4.99%, Pennsylvania was 5.21% and New Jersey was 5.15%. The National average home price appreciation over the last year was 5.60%. This makes real estate still a great investment.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday September 22, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday September 26, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday September 29, 2018 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday October 27, 2018 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam