Mortgage Rates Weekly Update [March 19 2018]

Mortgage Rates Weekly Update for March 19, 2018

Mortgage Rates Update for March 19, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

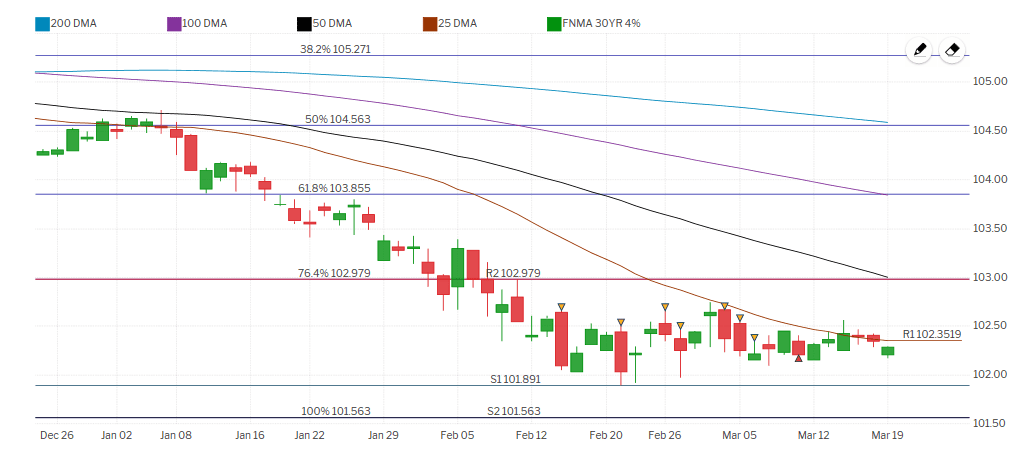

Mortgage Rates ended the week slightly lower than where they started as mortgage bonds moved up to the the 25 moving average. If you look at the mortgage bond chart below you can see mortgage bonds continue to trade in a sideways pattern and ended the day on Friday right at the 25 day moving average. Since bonds have failed to break through the 25 day moving average the last three times they have approached the 25 day moving average, we are going to recommend LOCKING your mortgage interest rate to start the week. Mortgage bonds have a big risk of selling off because they have failed to break through the 25 day moving average so the downside risk is much bigger than any potential gain in the bond market.

In Economic News

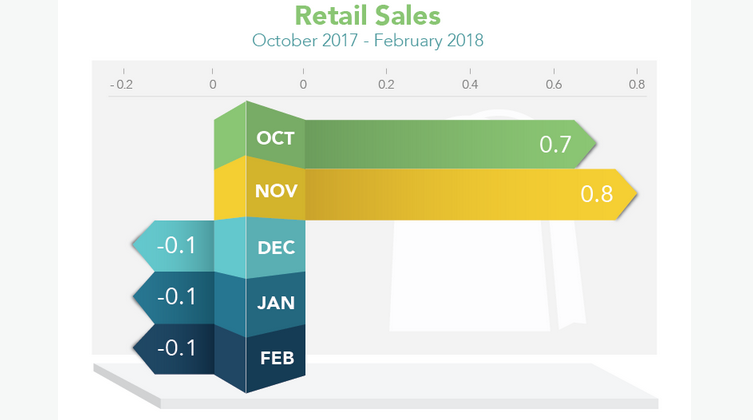

Retail Sales for February 2018 were released by the US Commerce Department last week and fell 0.1% from January 2018 which was below expectations of a 0.3% gain. This is the third month in a row that Retail Sales have declined and is the first time this has happened since April 2012. The big question from this report is, Does this data signal a slowdown in the economy in the first quarter of 2018? Consumer spending makes up two-thirds of the U.S. economy so is crucial to a healthy economy.

Consumer Inflation remained tame as the Consumer Price Index (CPI) for February 2018 came in at 0.2% which was down from 0.5% in January 2018. Lower energy prices were a big factor in the drop in consumer inflation. Wholesale inflation was also tame as we saw the Producer Price Index (PPI) for February 2018 come in at

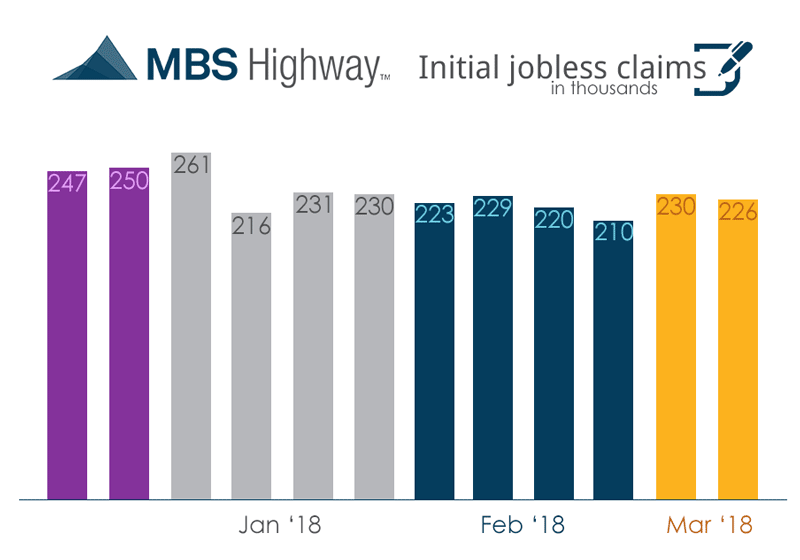

Weekly Initial Jobless Claims dropped 4,000 claims last week to 226,000 claims for the week. The number of firings in the labor market remains historically low as the supply of labor continues to shrink, employers are holding onto good employees.

In Housing News

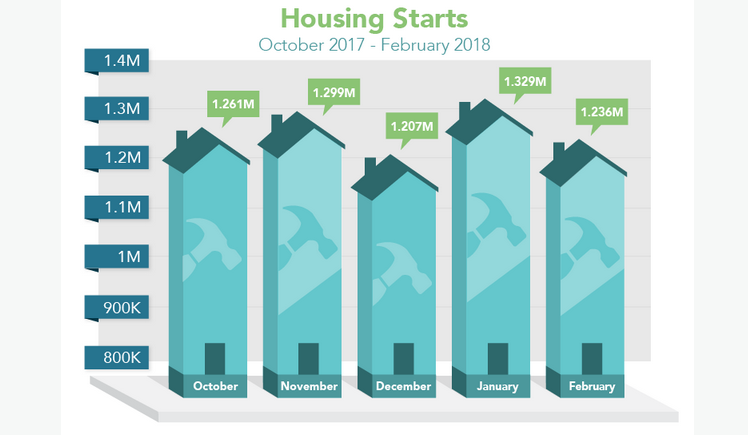

Housing Starts for February 2018 dropped 7 percent from January 2018 to an annual rate of 1.2336 million units. The decline was in multi-family units as single family dwellings actually increased by 2.9%. The news media made the report look bad when in reality it was not. The single family dwelling which makes up the majority of the housing market was actually up so new home construction is still doing very well.

USDA Rural Housing Loans are changing their eligible property maps effective June 4, 2018. The new maps will have the area of Middletown, Delaware no longer eligible for a USDA loan to purchase a home with 100% financing. You must have your commitment by June 4, 2018 or you will not be able to close on a USDA rural housing loan to purchase in Middletown. Call 302-703-0727 to get pre-approved ASAP if looking to use this program in Middletown.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Saturday March 24, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday March 28, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday April 7, 2018 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates