Mortgage Rates Weekly Update [March 12 2018]

Mortgage Rates Weekly Update for March 12, 2018

Mortgage Rates Update for March 12, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

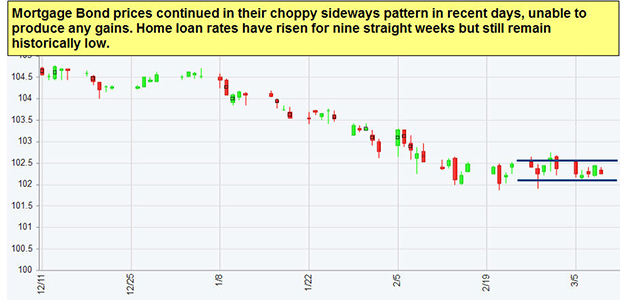

Mortgage Rates ended the week slightly higher than where they started as mortgage bonds were turned lower after failing to break through the 25 moving average. If you look at the mortgage bond chart below you can see mortgage bonds continue to trade in a sideways pattern and ended the day on Friday near the bottom of the channel. US Treasuries ended the day at 2.90% just beneath resistance at 2.908%. If yields move above this level it will cause mortgage bonds to continue to sell off and move mortgage interest rates even higher; therefore, we are recommending LOCKING Your mortgage interest rate to start the week.

In Economic News

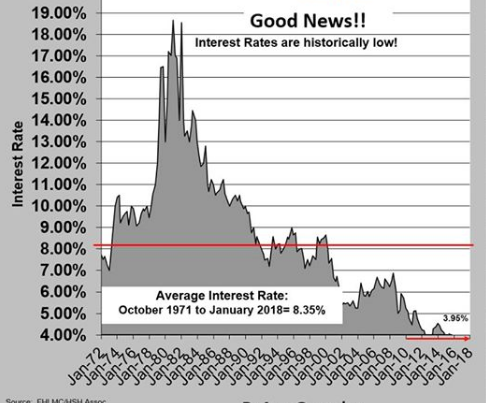

Mortgage Rates are still near historically low rates even as mortgage rates approach 6% on a 30 year fixed rate mortgage. Mortgage Interest Rates are still well below the historical average of the last 47 years of 8.35% from October 1971 to January 2018. It is still a great time to purchase a home or refinance a higher interest rate loan or cashout for debt consolidation or home improvement.

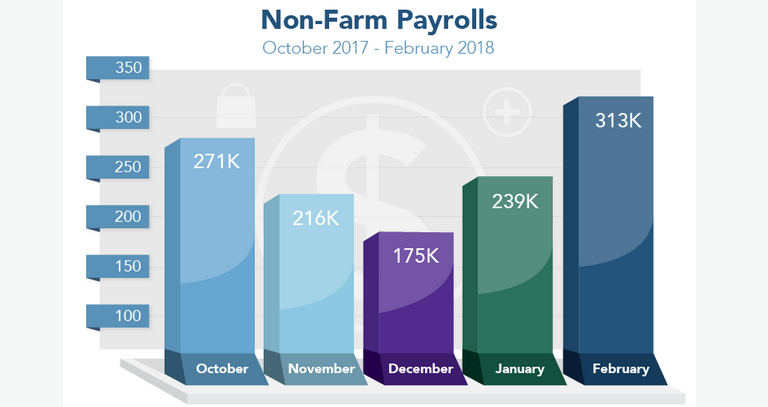

The Jobs Report for February 2018 was released on Friday and it was blockbuster with 310,000 jobs created which was well above the 210,000 expected number of jobs created. The jobs reported for December and January were also revised higher by a total of 54,000 jobs. This brings the 3 month average of jobs created to 242,000 jobs per month! US Stock markets rallied on the news and bonds did sell off but not as much as you would expect because the wage pressure inflation seen in previous reports has cooled. The year over year figure for wage growth fell from 2.9% to 2.6%. The unemployment rate remained the same at 4.1%. Overall this was a very strong jobs report.

In Housing News

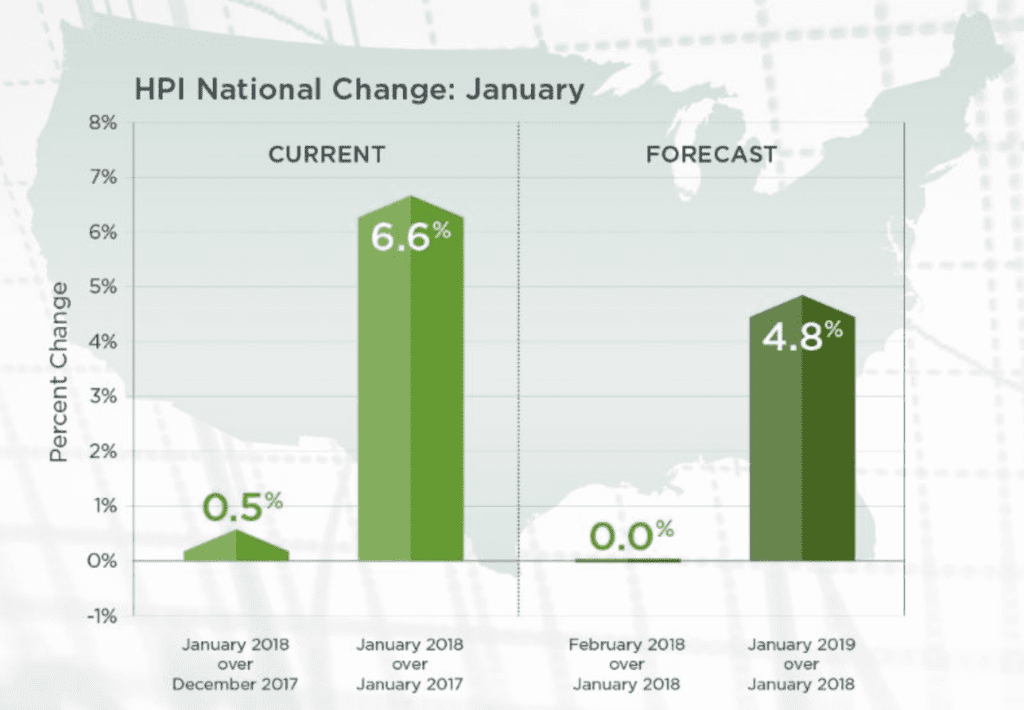

CoreLogic released its Home Price Index report for January 2018 which showed home prices moved up 0.5% from December 2017 to January 2018 and were up 6.6% year over year. The prediction for home prices from January 2018 to February 2018 is to stay flat at 0% and year over year to be 4.8%.

USDA Rural Housing Loans now available for Manufactured Homes. You can now get 100% financing with no down payment to purchase a manufactured home. The highlights are as follows:

- No Down Payment Required

- FICO Scores as low as 620

- Allows for newly constructed propeties

USDA mortgages, combined with a manufactured home, provide low-income families an exceptional way to purchase a home with no down payment and simple qualification guidelines. This program makes becoming a homeowner much easier than any other program available.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Saturday March 24, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday March 28, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday April 7, 2018 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates