Mortgage Rates Weekly Update [March 10 2019]

Mortgage Rates Weekly Update for March 10, 2019

Mortgage Rates Update for March 10, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

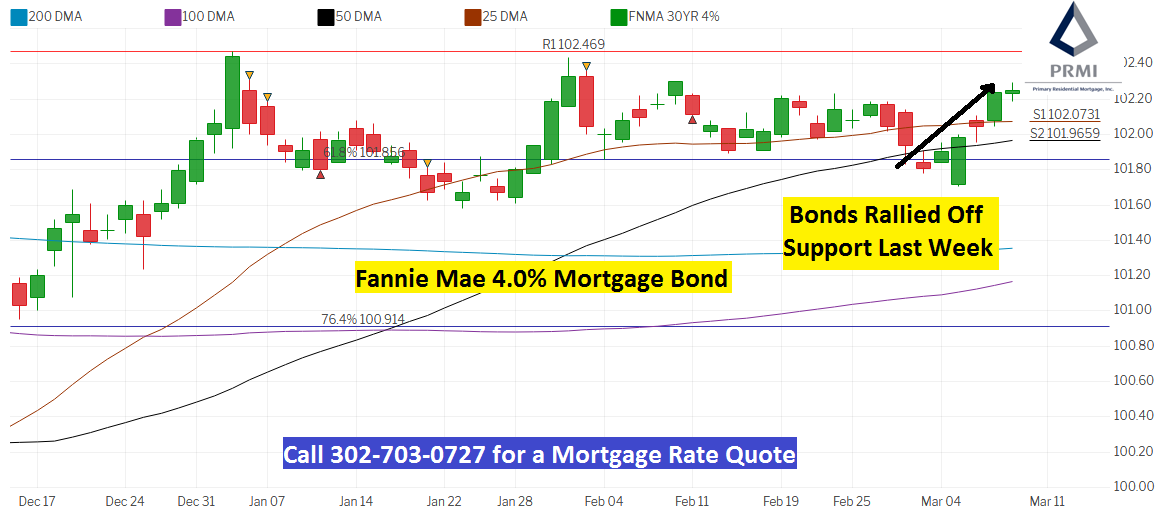

Mortgage Rates moved lower last week after mortgage bonds were able to rally higher. If you look at the mortgage bond chart below, you can see mortgage bonds broke beneath support on Tuesday with the long candle but were able to reverse and rally higher to end the day. Bonds were able to build on this bounce off support and move higher all week to end the week in the middle of a trading channel with room to move higher. We are recommending FLOATING Your mortgage rate to start the week

In Economic News

Jobs Report for February 2019 was released on Friday by the Bureau of Labor Statistics and showed there were only 20,000 jobs created which was well below expectations of 180,000 jobs. This was a very weak jobs report. The Unemployment Rate ticked down from 4.0% to 3.8% which seems to be contradictory to a jobs report of only 20,000 but the reason is because the Jobs Report uses the Business Survey and the Unemployment Rate uses the Household Survey. The Household Survey showed 225,000 jobs created for February and a decrease in the workforce of 25,000 hence why the unemployment rate dropped. The 3.8% unemployment rate is a 50 year low.

The Jobs Report also showed the Average Hourly Earnings rose from 3.2% to 3.4% but the Weekly Earnings fell from 3.5% to 3.1%.

Weekly Initial Jobless Claims were released on Thursday and dropped 3,000 claims to 223,000 claims for the week which was slightly higher than expectations of 220,000. Jobless claims still remain very low and have reversed the trend of moving higher and appear to have stabilized which supports the drop in the unemployment rate.

In Housing News

Housing Starts for January 2019 rose a whopping 18.6% to 1.230 million units on annualized basis, which was much better than the market was expecting and is welcome news for new home construction. Building Permits for January 2019 rose 1.4% to 1.345 million units on annualized basis. These reports support our opinion that housing will continue to improve as we head into the spring buying season.

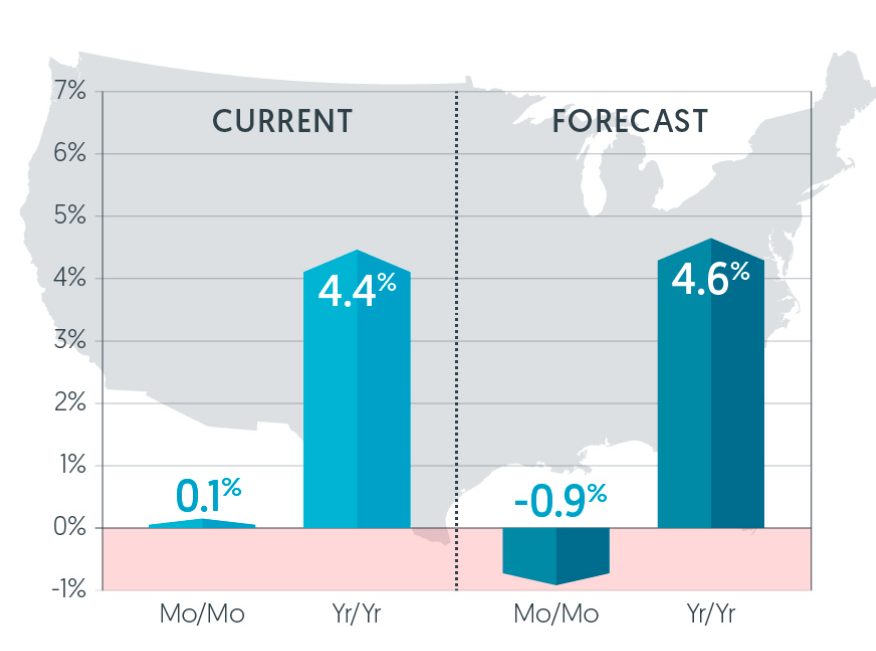

CoreLogic Home Price Index for January 2019 showed home prices were up 0.1% from December and up 4.4% year over year. CoreLogic is predicting a solid year for housing and sees a 4.6% home price appreciation year over year from January 2019 to January 2020.

New Homes Sales for December 2018 were up 3.7% to 621,000 units on annualized basis. The Median Home Price of New Construction Sale was 318,600. This is old data as was delayed by government shut down. The total new home sales for 2018 was up 1.5% from 2017 total new home sales.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday March 16, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday March 20, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday March 30, 2019 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam