Mortgage Rates Weekly Update for June 5 2017

Mortgage Rates Weekly Update for June 5, 2017

Mortgage Rates Weekly Update for June 5, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved lower last week after disappointing Jobs Report for May 2017 was released. If you look at the mortgage bond chart below you can see mortgage bonds hit the high for 2017 after breaking through a tough ceiling of resistance at 200 day moving average and have hit the high not seen since the November US presidential elections. We are recommending FLOATING Your mortgage rate now that bonds have broken out of tight trading channel. We will be looking for bonds to close above the 200 day moving average on Monday and then this will be a new floor of support. If bonds fall below 200 day moving average then we would recommend locking your mortgage interest rate.

In Economic News

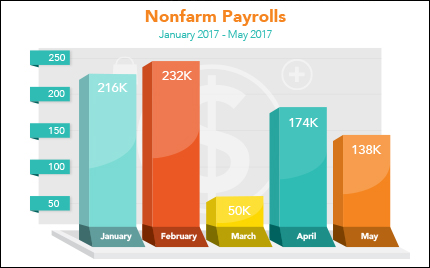

The US Labor Department released the Jobs Report for May 2017 on Friday and it was very disappointing with only 138,000 jobs created in May which was 47,000 less than expectations. March and April were also revised lower by 66,000 jobs. On a positive note, the Unemployed Rate fell from 4.4% to 4.3% which is a 16 year low. The total unemployed measured by the U6 number fell to from 8.6% to 8.4% which is down from 9.4% in May 2016. The Labor Force Participation Rate (LFPR) declined from 62.7% to 62.9%. The LFPR measures the number of people 16 years and older that are actually employed.

A measure of Consumer inflation was released last week with the Core Personal Consumption Expeditures (PCE) for April 2017 was up 0.2% from March and was down to 1.5% year over year from 1.6% April 2016. Part of the reason for the decline in PCE inflation is that oil prices are now being compared to the price of oil a year ago when oil was higher.

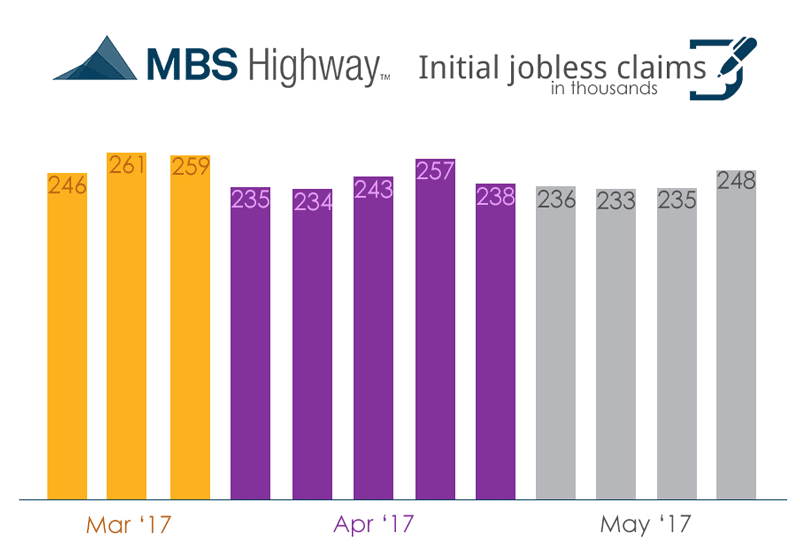

Weekly Initial Jobless Claims were released on Thursday and were up 13,000 claims to 248,000 jobless claims. This was about 10,000 more claims than expected but still a decent number for first time claims. Weekly Initial jobless claims have been below 300,000 claims for a long time now which shows a stable labor market.

In Housing News

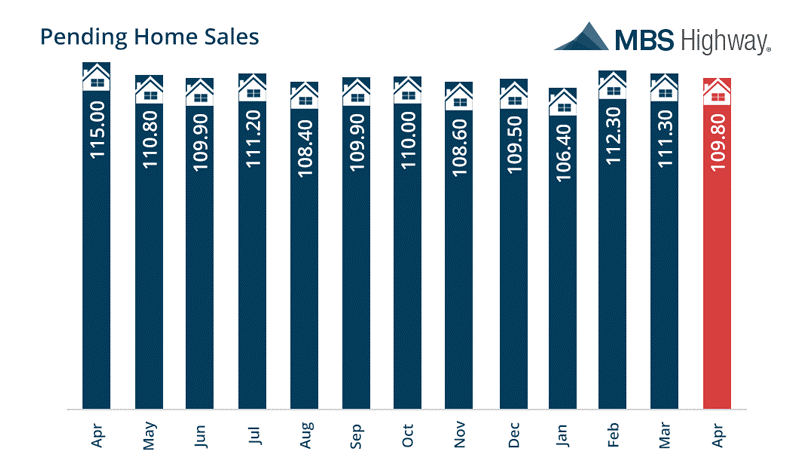

Pending Homes Sales for April 2017 fell by 1.3% from March 2017 and are now down 3.3% from a year ago. The foot traffic is higher than it was a year so the demand for purchasing homes is there. The lack of inventory which is down 9% from last year is causing the foot traffic to NOT translate into home sales. Pending Home Sales measures the number of contracts written on existing homes for sale. This is a future indicator of home sales for existing homes.

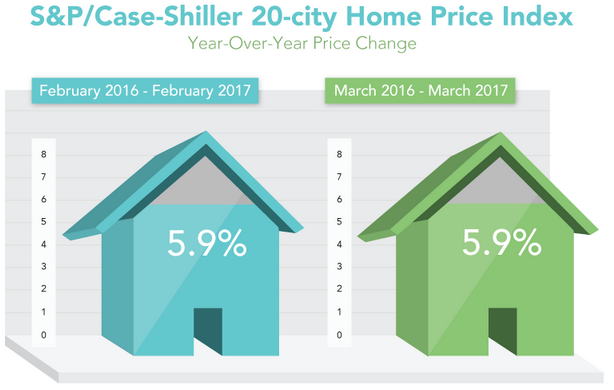

The Case-Shiller 20 City Home Price Index for March 2017 rose 5.9% year over year. The price appreciation gains in March 2017 matched the gains in February 2017 which is the biggest gains since July 2014. Home prices increased 0.9% from February to March 2017. The low supply of homes for sale is the case of the rise in home prices. If we look at the local market, Delaware is predicted to have 3.6% rise in home prices over the next year and the historical price appreciate over the last 5 years in Delaware s 9.68%.

Have questions around seller paid closing costs?

We recommend that you read the article on Understanding Seller Paid Closing Costs that explains the ins and outs of negotiating for the seller to pay money toward your closing costs and pre-paid items at closing. The amount you can ask a seller to pay toward your closing costs depends on the mortgage loan type you are getting as well as if the property is a primary residence or an investment property.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday June 17, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday June 24 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate