Mortgage Rates Weekly Update [June 12 2017]

Mortgage Rates Weekly Update for June 12, 2017

Mortgage Rates Weekly Update for June 12, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates drifted higher as mortgage bonds were turned lower from tough ceiling of resistance. If you look at the mortgage bond chart below you can see mortgage bonds are trading in a tight pattern since rallying higher at the beginning of May 2017. Mortgage bonds have been fighting to stay above the 200 day moving average and have drifted lower since hitting the highs of the year. We are recommending LOCKING your Mortgage Rate to start the week to take advantage of the best rates of the year as mortgage bonds have failed to rally higher and closed on the 200 day moving average on Friday as well as US Treasury closed above the key 2.18% yield mark. Treasuries moving higher could force the bond market to sell off which would move mortgage interest rates higher.

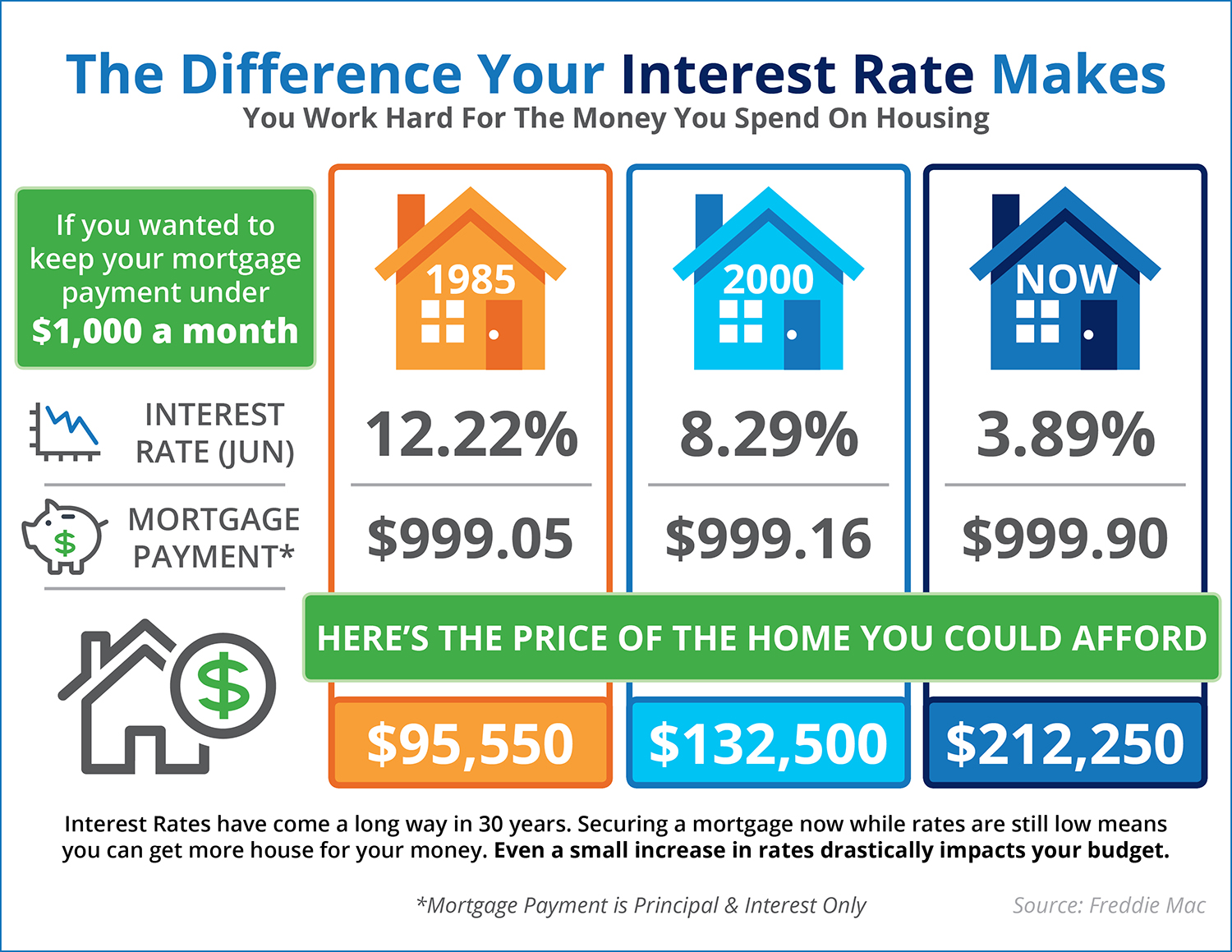

Difference mortgage rates can make on buying power

The mortgage rate you secure on the purchase or refinance of your home can have a big impact on your buying power. Below is infographic illustrating the buying power comparison over the years as mortgage interest rates have come down since the 1980s.

In Economic News

The big news last week were two big headline events. The first was former FBI director James Comey testified before the Senate Intelligence Committee but nothing was revealed that moved the markets one way or the other and the second was the United Kingdom‘s residents went to the polls in snap general election as the U.K. unravels its relationship with the European Union. This UK election event also did not have a impact on world markets so we did not see any effect on mortgage rates.

The House of Representatives passed the Financial Choice Act which would replace the Dodd-Frank Bill. The bill must still go through the Senate then to the President before it can become law. The bill’s intention is to change the law in Dodd-Frank that has proven to hurt the consumers. I encourage people to read the actual bill and not just read other people’s summary which may or may not be factual. Here is link to PDF of the legislative text – H.R. 10 – Financial Choice Act. For those of you who don’t want to read all 569 pages you can read the Comprehensive Summary which is only 147 pages or the Executive Summary which is only 4 pages.

China announced it is prepared to start investing in US Treasuries and increase its current holdings under the right circumstances. Chinese officials have said that US Treasuries are becoming more attractive than other sovereign debt as the Chinese currency the Yuan becomes more stable. If China starts to invest in US Treasuries it will move the price of Treasuries and bonds higher and the yields lower so this would benefit mortgage rates.

The Federal Reserve has it June meeting next week on Tuesday and Wednesday where it is expected that it will raise the Fed Funds Rate by 0.25% bringing the Fed Funds Rate to 1.25%. This will bring the Prime Rate to 4.25% as Prime is the Fed Funds Rate plus 3% so 1.25% plus 3% = 4.25%. This will directly affect the rate on Home Equity Lines of Credit (HELOC) so you will see an increase on your HELOC after the Fed Meeting next week.

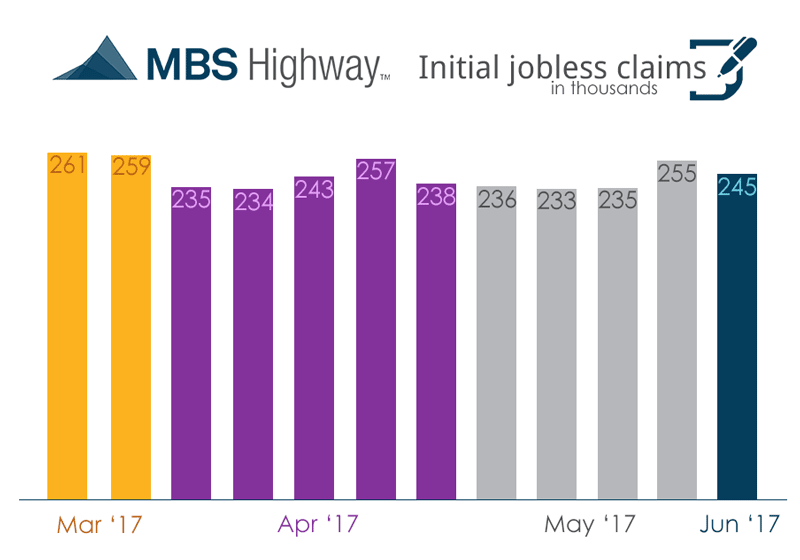

Weekly Initial Jobless Claims were released on Thursday and showed 245,000 jobless claims for first time filers which was a drop of 10,000 claims from the previous week’s reading of 255,000 claims. Jobless Claims continue to show a strong labor market as claims remain below 300,000.

In Housing News

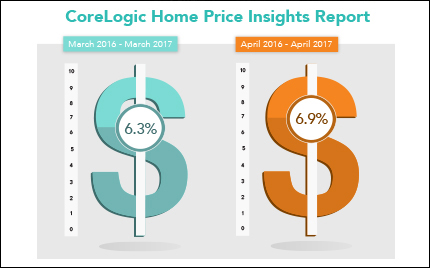

Home Prices continued to surge in April 2017, CoreLogic Home Price Index for April 2017 showed home prices were up 6.9% year over year and the prediction for this year is for home prices to be up 5.1% which is up from previous prediction of 4.9%. Home Prices in April 2017 were up 1.6% from March 2017. Loan mortgage rates and a shortage of inventory have caused “bidding wars” in metro markets as multiple contracts are placed on the same home.

Core Logic released their Equity Report for the first quarter of 2017 which showed 91,000 residential properties regained equity and only 6.1% of all homes with mortgages have negative equity. If home prices appreciate another 5% then another 600,000 homes will regain equity and with a predicted 5.1% gain in home prices for the next year, we could see a lot more homes come on the market with a 5% gain in homes prices as more sellers who have been waiting will be able to sell.

USDA Rural Housing Loan Update

USDA Rural Development has made huge updates to their property and appraisal requirements for their Rural Loan Program, some of the big highlights are as follows:

- USDA is now allowing escrow repairs as long as the home is habitable

- USDA has extended the age of acceptable appraisals to 150 days (previously 120 days)

- USDA has extended the age of acceptable water test results to 150 days (previously 120 days)

- USDA is now allowing cisterns as acceptable water sources for a home

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday June 17, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday June 24 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate