Mortgage Rates Weekly Update [June 25 2018]

Mortgage Rates Weekly Update for June 25, 2018

Mortgage Rates Update for June 25, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

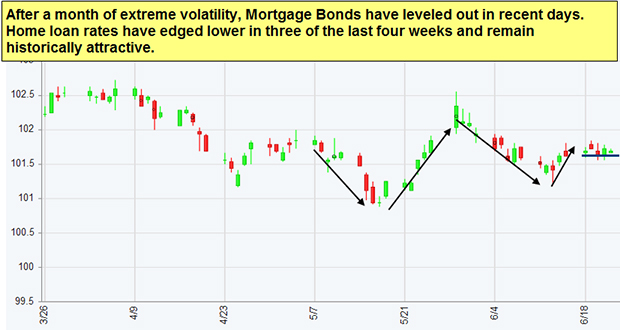

Mortgage Rates were finally able to stabilize last week after a roller coaster ride in the past several weeks. If you look at the mortgage bond chart below you can see mortgage bonds have been sitting just above the 50 day moving average last week. The technical trading signals formed a Pennant Flag formation and we are looking for mortgage bonds to break out either higher or lower. There has not been any clear signal this it is breaking out higher yet but as long as the 50 day moving average holds we are recommending FLOATING your mortgage rate to see if mortgage bonds can break out higher and move mortgage interest rates lower.

In Economic News

Federal Chair, Jerome Powell, stated last week that the US economy is doing very well and that the US labor market is particularly robust. He also stated that inflation has moved up to the Feds target rate of 2%. He finished by saying that with the economy strong and risks to the outlook balanced, the Feds will continue to gradually raise the Fed Funds Rate. This should lead mortgage rates to increase gradually over the next year as inflation continues to increase.

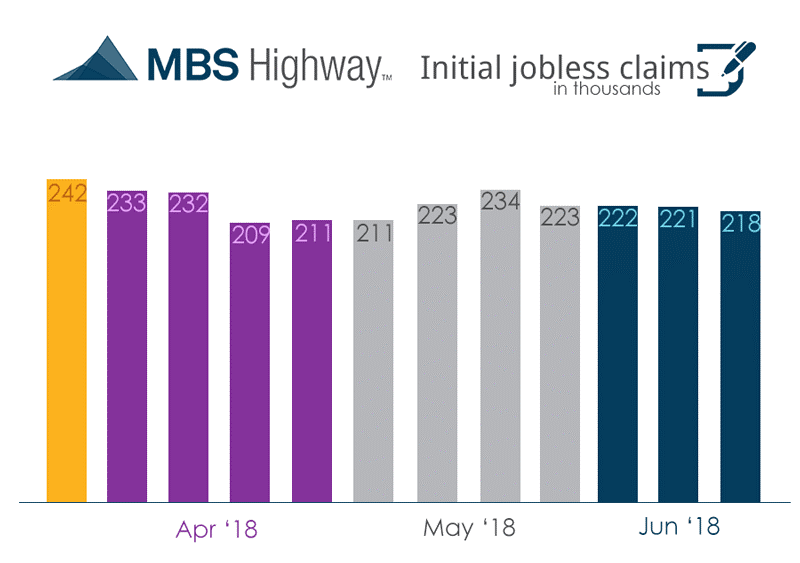

Weekly Initial Jobless Claims were released on Thursday and showed 218,000 claims for the week which was down 3,000 from the previous week which was revised higher to 221,000 claims. This is the sample week that will be used in the June 2018 Jobs Report which points to a very good jobs report based just on initial unemployment claims. The June Jobs Report will be released on Friday July 6, 2018.

In Housing News

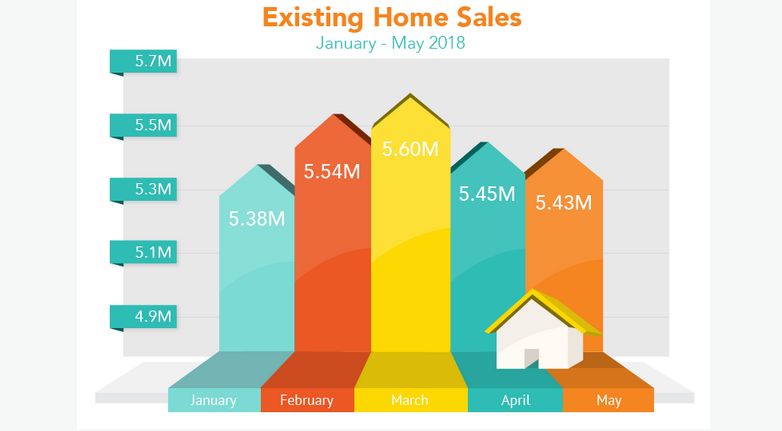

May 2018 Existing Homes Sales were reported down by 0.4 percent from April 2018 to an annualized rate of 5.43 million units. Existing Home Sales were down 3 percent from May 2017 to May 2018. Inventory of homes for sale remain at historic lows at a 4.1 month supply of homes for sale. A normal market is a 6 month inventory of homes for sale. The chief economist for NAR stated that low inventories continues to be the biggest impediment to more sales as the demand is present in the market, just not the supply.

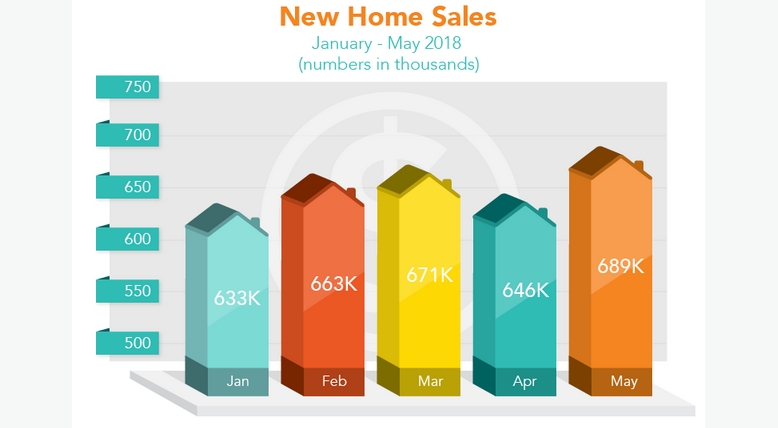

New Home Sales for May 2018 rose 6.7% from April 2018 to 689,000 on an annualized basis. New Home Sales were above the expected 666,000 and the highest reading since November 2017. New Home Sales rose 14.1 percent from May 2017 to May 2018. The median home price of a new home sale was $313,000.

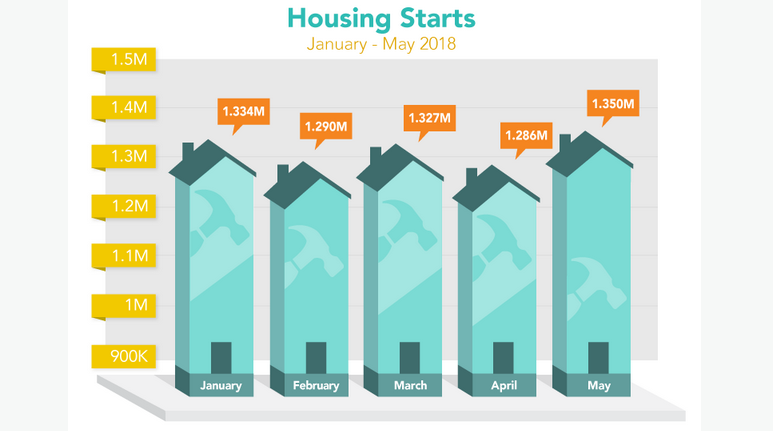

Housing Starts for May 2018 surged higher to almost an 11 year high by moving up 5 percent from April 2018 to 1.350 million units on an annualized basis. Housing Starts jumped 20.3 percent from May 2017 to May 2018. Future home construction could potentially slow as Building Permits for May 2018 dropped by 4.6 percent from April 2018.

USDA Loan Update – Middletown Delaware USDA Loans are no longer eligible for USDA financing effective June 4, 2018 based on new property eligibility guidelines released by Rural Housing Department. USDA also increased the income limits for qualifying for the USDA Loan program effective June 13, 2018.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Wednesday June 27, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday July 28, 2018 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam