Mortgage Rates Weekly Update [July 2 2018]

Mortgage Rates Weekly Update for July 2, 2018

Mortgage Rates Update for July 2, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were able to move slightly lower last week as mortgage bonds were able to rally off floor of support. If you look at the mortgage bond chart below you can see that after the red candle on Monday, mortgage bonds rallied higher all week with the green candles. Mortgage bonds ended the week by breaking through the 50 day moving average and are just beneath a ceiling of resistance at the 100 day moving average. We are recommending FLOATING Your mortgage rate into July 4th to see if mortgage bonds can break through and continue higher which would move mortgage interest rates lower.

In Economic News

The Feds favorite measure of inflation was released on Friday which was the Personal Consumption Expenditures (PCE) report for June 2018 which showed inflation was up from 2% to 2.3%. This was higher than expectations of 2.2% and was the highest level for the PCE in over 6 years. The report also showed that there was significant wage inflation as private sector wages increased by 4.9% year over year while overall income growth was up 4%. Now that the Feds target of 2% has been reached, it gives them the green light for more interest rate hikes to the Fed Funds Rate and to continue their Fed balance sheet reduction plan.

The final reading of Gross Domestic Product for first quarter of 2018 came in at 2.0 percent which was below the second reading of 2.2 percent. GDP is a measure of the monetary value of all finished goods and services that are produced within our borders in a specific time period. GDP is considered to be the broadest measure of economic activity for a country. GDP readings between 2.5% and 3.0% are considered healthy for an economy.

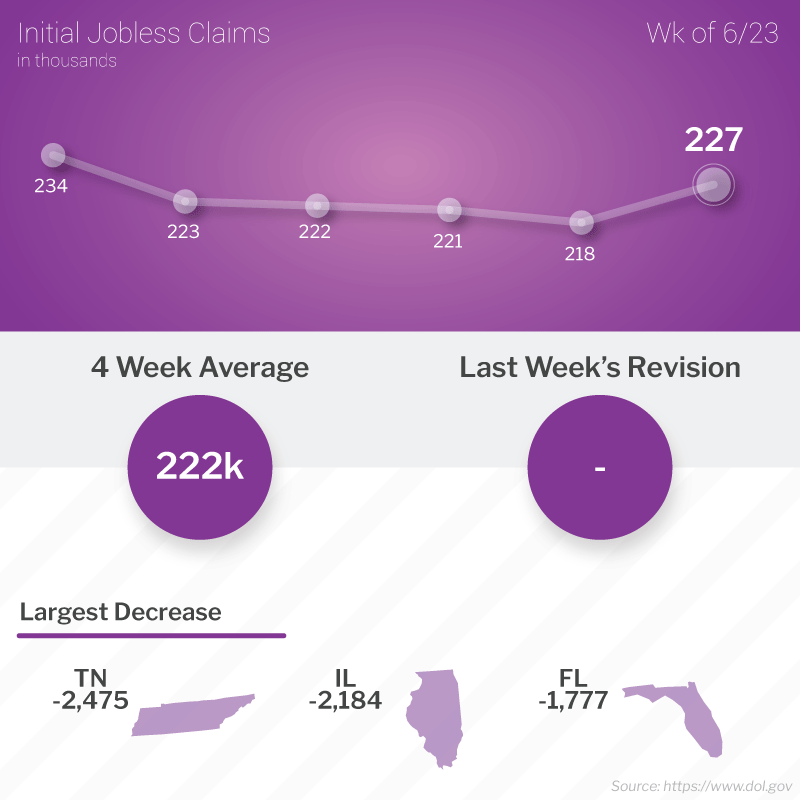

Weekly Initial Jobless Claims were released on Thursday and showed an increase of 9,000 claims to 227,000 claims for the week. The prior week of 218,000 is the sample week to be used in the BLS Jobs Report for June 2018 which will be released on Friday July 6th. This does point to a strong jobs report but the recent tariffs could have a negative effect on the jobs report.

In Housing News

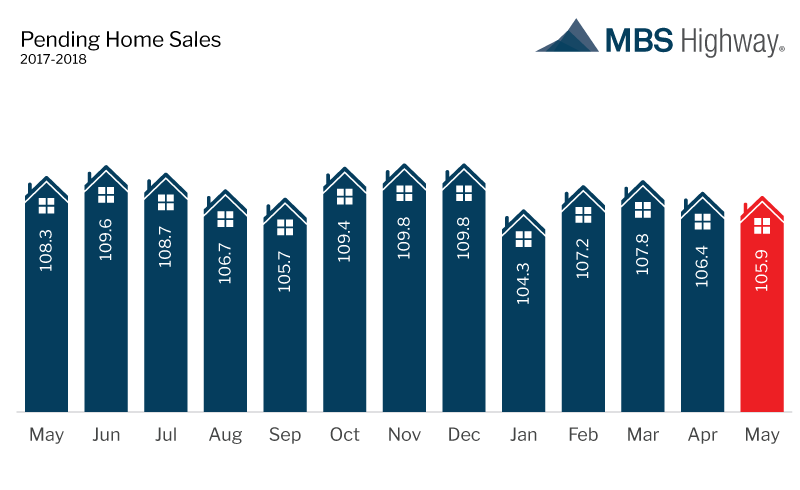

Pending Home Sales for May 2018 were down 0.5% from April to 105.9 on the index. This was lower than the 0.4% gain expected in Pending Home Sales which measures the number of signed contracts on existing homes for sale. Pending home sales are down 2.2% year over year from May of 2017. This drop is because of record low inventories of homes for sale and is not because their is a drop in demand for buying homes. This continues to put upward price pressure on home prices nationwide.

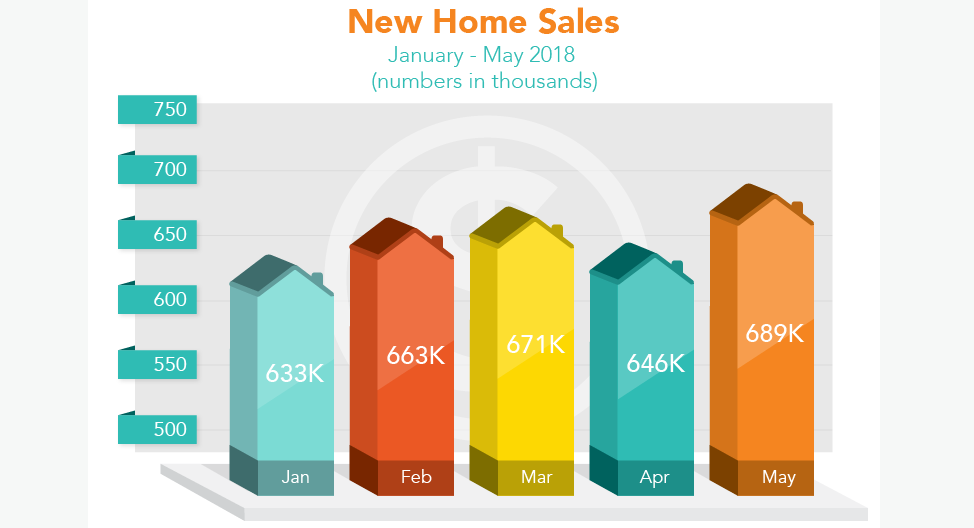

New Home Sales for May 2018 rose 6.7 percent from April 2018 to am annualized basis to 689,000 units. This was above expectations of only 666,000 units and is also the highest reading for new home sales since November 2017. New home sales were up 14.1 percent from May 2017 to May 2018. The median home price of a new home was $313,000 in May 2018.

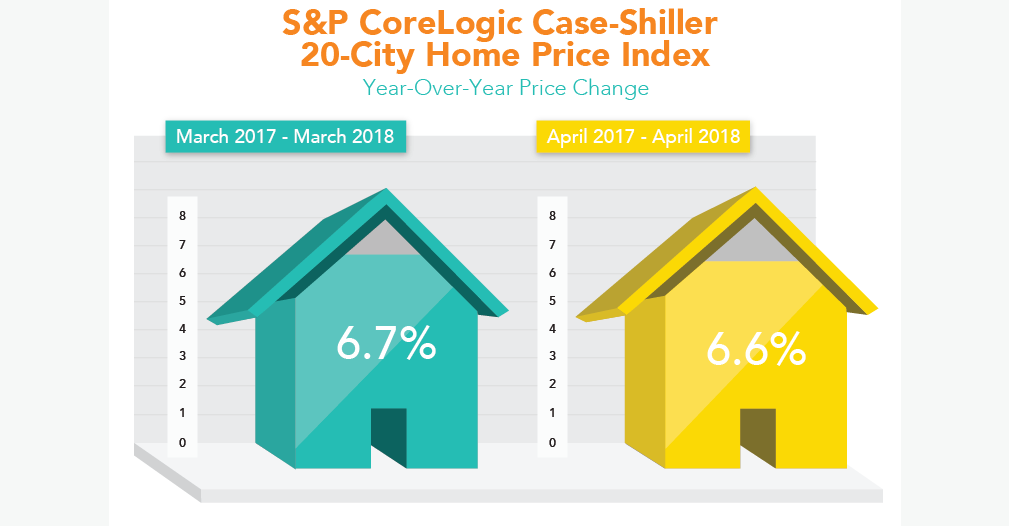

CoreLogic Case-Shiller 20 City Home Price Index for April 2018 was up 6.6% from April 2017. Home prices are continuing to be pushed upward by the continued low supply of homes for sale which is currently at a 4.3 month supply on average. This is up from earlier this year but still very low. A 6 month supply of homes for sale is a considered a healthy number of homes for sale.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Wednesday June 27, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday July 28, 2018 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam