Mortgage Rates Weekly Update [July 9 2018]

Mortgage Rates Weekly Update for July 9, 2018

Mortgage Rates Update for July 9, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were on a roller coaster ride last week due mostly to global trade issues with countries considering back and forth trade tariffs. If you look at the mortgage bond chart below you can see mortgage bonds hit resistance last week at the 100 day moving average and were turned lower in a sell off on Monday with the red candle. Bonds found floor of support on Tuesday at the 25 day moving average and rallied back higher into the fourth of July holiday. Mortgage Bonds followed through and rallied higher up to the 100 day moving average on Thursday ahead of the Jobs Report. After the Jobs report on Friday, bonds were able to finally break above a dual ceiling of resistance they have been battling for weeks which was formed by the 100 day moving average and a technical Fibonacci level. This is a good sign so we are recommending FLOATING your mortgage rate to start the week to see if bonds can stay above this dual layer and rally higher which would move mortgage interest rates lower.

In Economic News

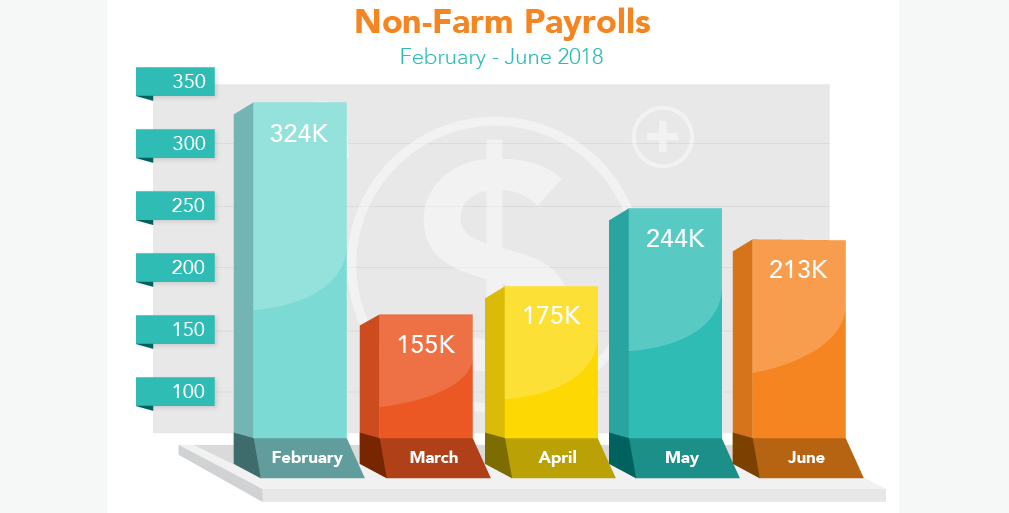

The Jobs Report for June 2018 was released on Friday and showed 213,000 jobs were created which was above expectations of 190,000 jobs. The two previous months of April and May were also revised higher by a combined amount of 37,000 jobs. There are actually two different surveys within the Jobs Report – The Business Survey which is the headline jobs figure and the Household Survey which is used for the Unemployment Rate. The Household survey showed that were 102,000 jobs created and at the same time the labor force increased by 601,000 so this caused the Unemployment Rate to move up from 3.8% to 4.0%. The Labor Force increased in part because the Labor Force Participation Rate (LFPR) increased from 62.7% to 62.9%. The U6 Unemployment Rate which includes the total unemployed plus all people marginally attached to the labor force plus the total part time employees increased from 7.6% to 7.8% and again the increase was attributed to an increase in the labor force. There wasn’t much wage inflation in the report as Average Hourly Earnings was up only 0.2% versus expectations of 0.3% and year over year remained stable at 2.7%. This was bond friendly news as inflation is the enemy of mortgage bonds.

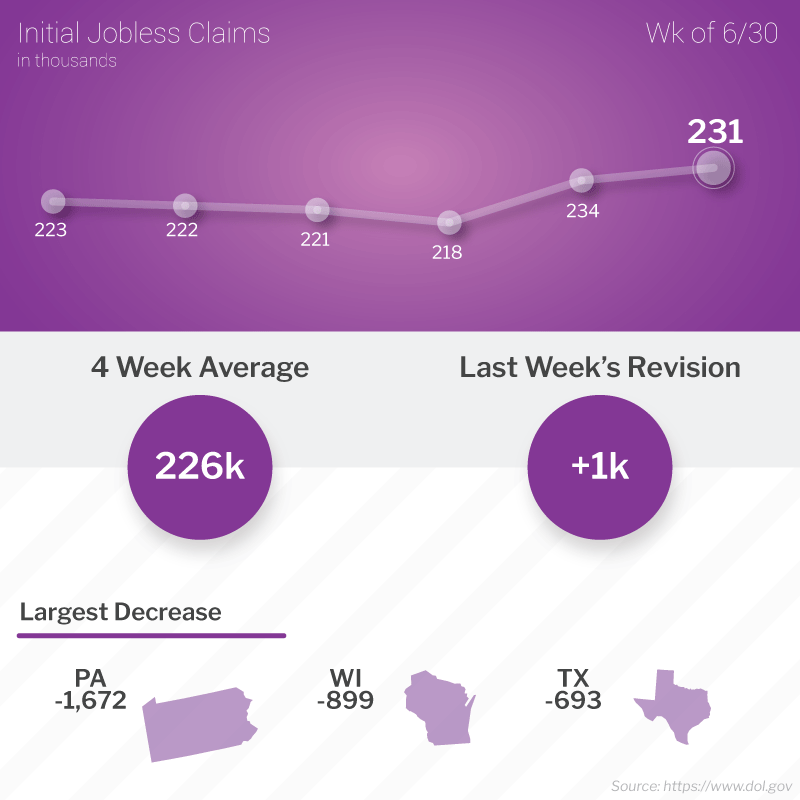

Weekly Initial Jobless Claims were released on Thursday and showed an increase of 3,000 claims to 231,000 claims for the week. Even though we have seen a gradual increase in initial jobless claims, the pace of firings remains extremely low and well below the 300,000 mark which signals a bad turn in the labor market.

In Housing News

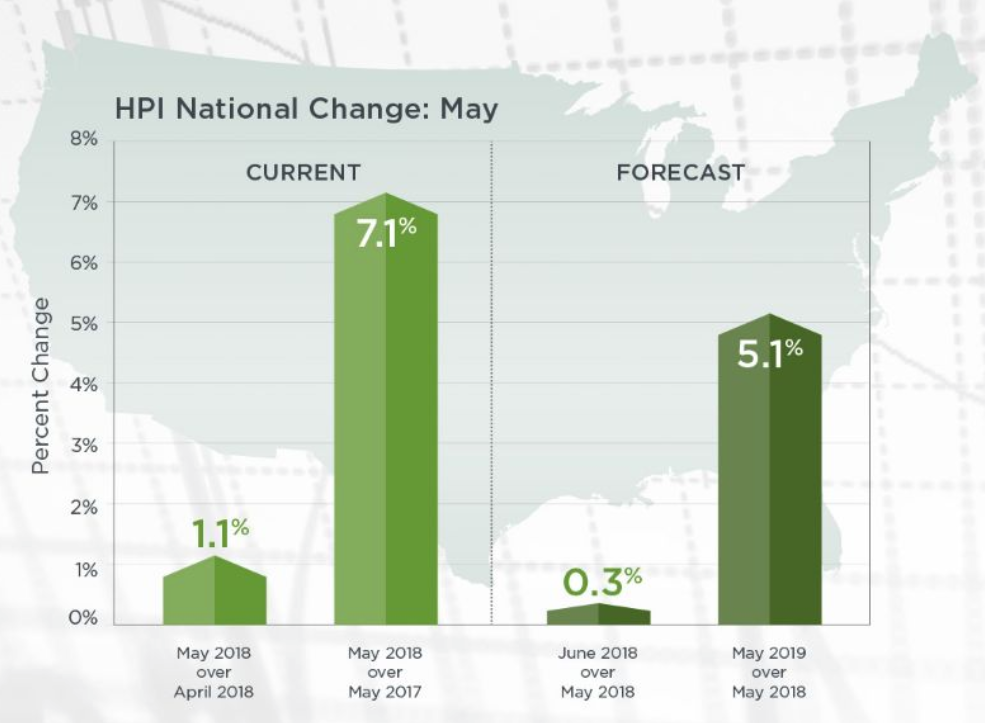

CoreLogic Home Price Index for May 2018 showed home prices rose 1.1% from April and are up a 7.1% year over year. The May 7.1% appreciation is stronger than April’s 6.9% and is the strongest figure in 4 years. CoreLogic is predicting a 5.1% increase in home prices from May 2018 to May 2019 on a national level. The big driver for home prices is the shortage of inventory and the fact that despite high home prices, renters still want to get out of their rental property and purchase a home according to Chief Economist at CoreLogic, Frank Nothaft. CoreLogic found that four times as many renters were looking to buy a home than homeowners willing to sell. This fact will likely exacerbate the supply issue and continue to support rising home prices.

In the Local Real Estate Market, We have the Real Estate Report Card for New Castle County Delaware, Kent County Delaware and Sussex County Delaware.

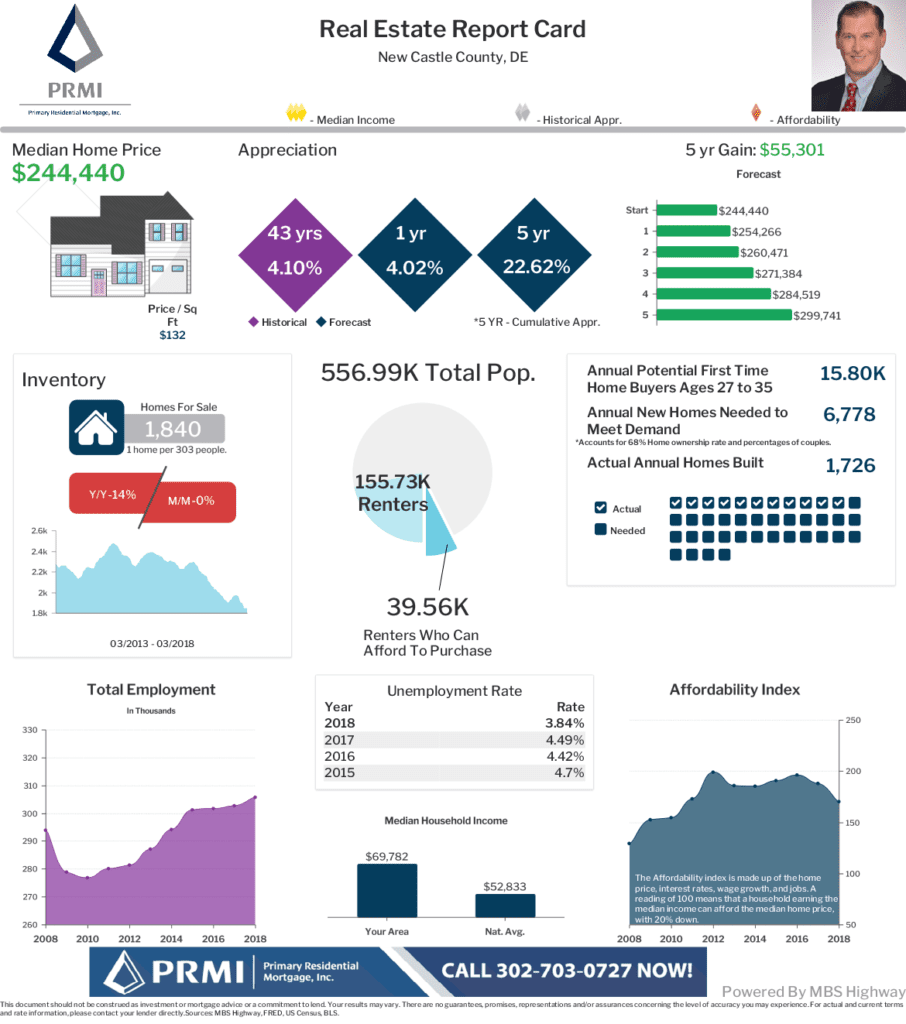

New Castle County Delaware Real Estate Report Card Through June 2018:

Median Home Price – $244,440

Appreciation Rate – 1 year = 4.02% / 5 Year = 22.62% / 43 Year = 4.10%

Forecast of Appreciation = $55,300 on Median Home Price over the next 5 years

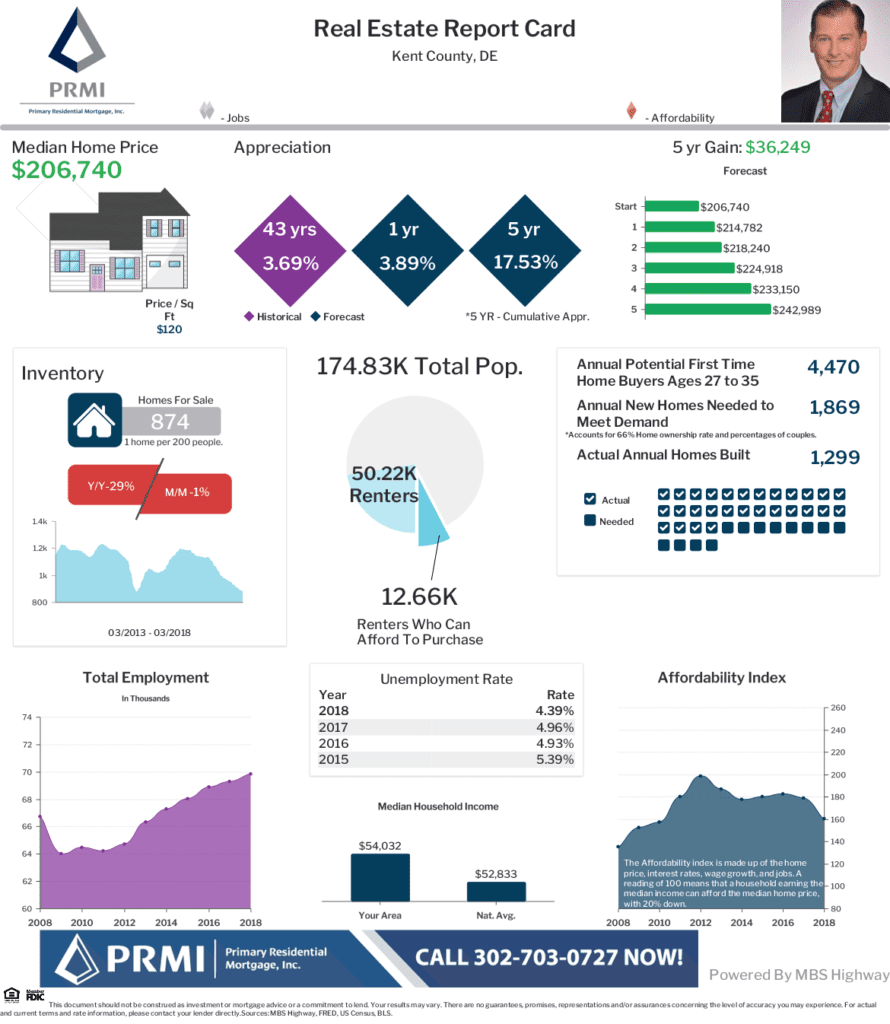

Kent County Delaware Real Estate Report Card Through June 2018:

Median Home Price – $206,740

Appreciation Rate – 1 year = 3.89% / 5 Year = 17.53% / 43 Year = 3.69%

Forecast of Appreciation = $36,240 on Median Home Price over the next 5 years

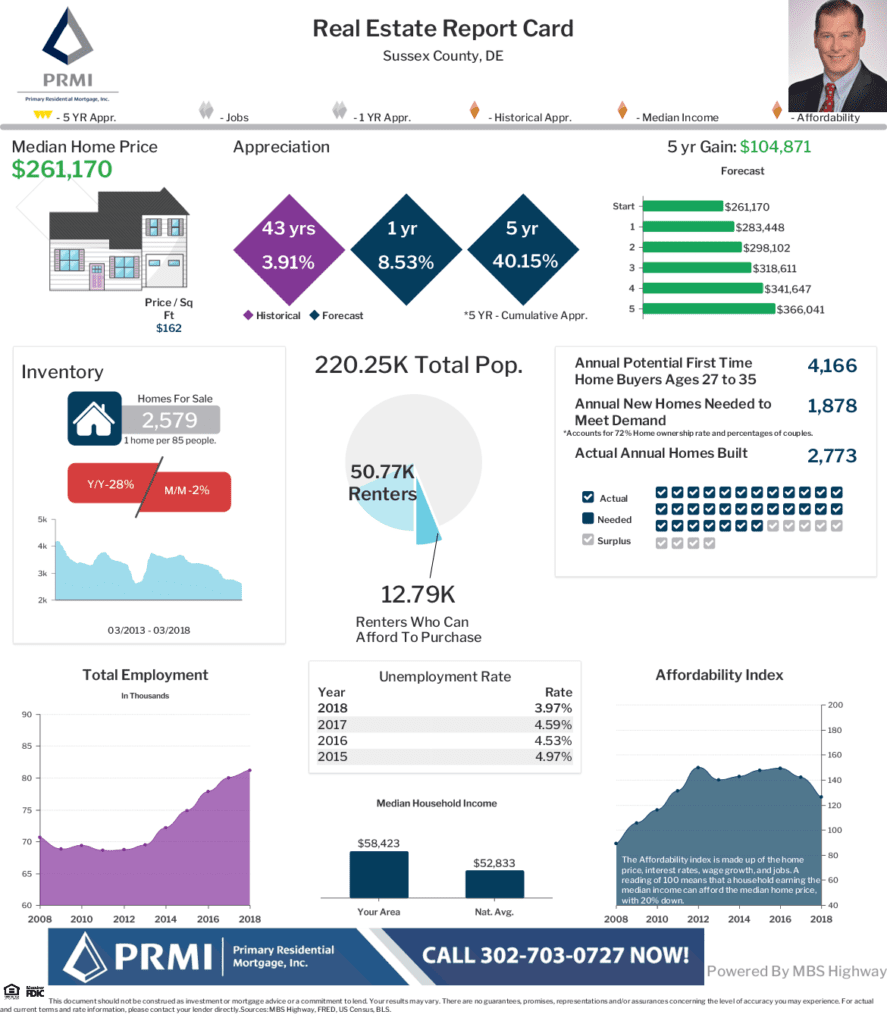

Sussex County Delaware Real Estate Report Card Through June 2018:

Median Home Price – $261,170

Appreciation Rate – 1 year = 8.53% / 5 Year = 40.15% / 43 Year = 3.91%

Forecast of Appreciation = $104,870 on Median Home Price over the next 5 years

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Wednesday July 18, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday July 28, 2018 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam