Mortgage Rates Weekly Update [June 18 2018]

Mortgage Rates Weekly Update for June 18, 2018

Mortgage Rates Update for June 18, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were able to move lower last week after mortgage bonds found a floor of support and rallied higher. If you look at the mortgage bond chart below you can see mortgage bonds sold off until finding a floor of support of Wednesday and were able to rebound and rally higher on Thursday and again on Friday. Mortgage bonds were stopped again at the 50 day moving average which they have failed to break through so we are cautious that bonds can break through this ceiling. The Stock market is selling off in the face of trade wars overseas and mortgage bonds are still not able to break above the 50 day moving average so we are recommending to very careful FLOAT your mortgage rate to see if can break above the 50 day moving average but if stocks recover, we would quickly switch to a locking stance.

In Economic News

The Federal Reserve met last week and announced they are raising the Fed Funds Rate 0.25% bringing the new target range from 1.75 to 2.0 percent. The Fed Funds Rate is a short term rate at which banks lend money to each other overnight. The Feds noted in their meeting that the US Economy is doing well and that investors should look for four more increases to the Fed Funds Rate this year, which is up from three previously announced. The Feds raised their inflation forecast for 2018 and 2019 which is not good news for mortgage bonds. Higher inflation leads to higher mortgage interest rates. The Producer Price Index (PPI) for May 2018 supports this view as it came out at 3.1 percent which is the largest increase since January 2012. The PPI measures inflation at the wholesale level.

The Consumer Price Index (CPI) for May 2018 also came out hotter than expected by increasing 0.2% and the Core CPI increased from 2.1% to 2.2% year over year.

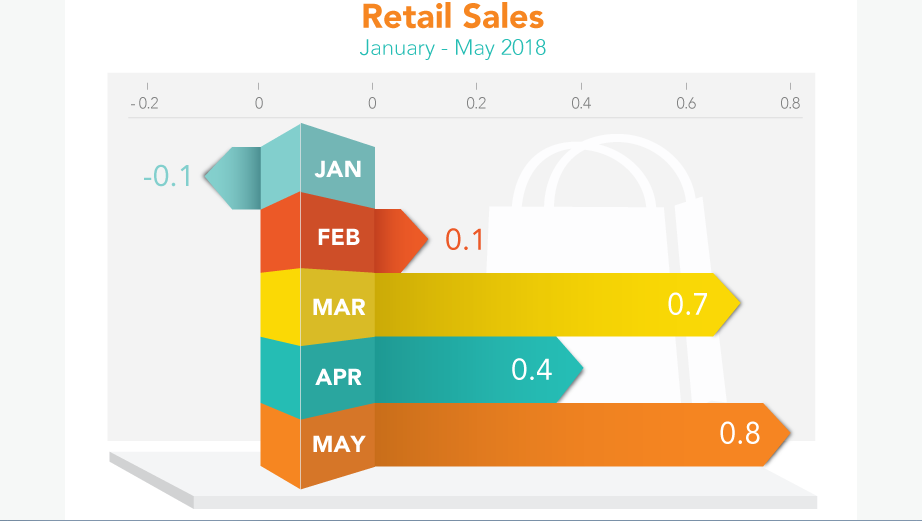

Retail Sales for May 2018 jumped 0.8 percent from April 2018 which was well above the 0.4 percent expected. Retail Sales are up 5.9 percent from May 2017 to May 2018. Retail Sales measures consumer spending and if it keeps growing, the US economy will continue to grow.

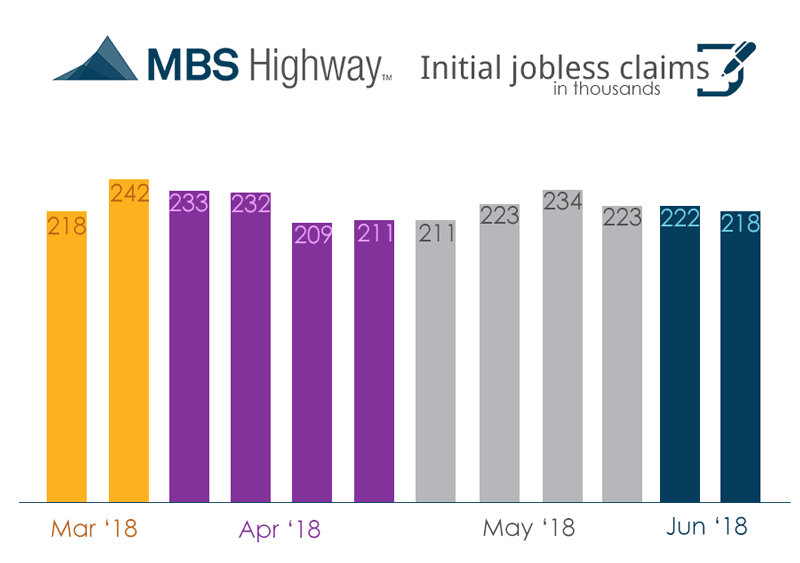

Weekly Initial Jobless Claims were released on Thursday and showed 218,000 claims for the week which was down 4,000 from the previous week. Jobless claims show the labor market is doing very well and remains tight for businesses who are holding onto their workers. Unemployment is at the lowest level in 18 years.

In Housing News

CoreLogic released its Loan Performance Insight for March 2018 which shows that loans 30 days or more past due decreased from 4.4% in March 2017 to 4.3% in March 2018. Seriously delinquent loans which is defined as 90 days or more delinquent, decreased from 2.1% to 1.9% which is the sum of the 90-119 days and 120+ days on the chart below. Equity Growth was up on average $16,300 per home owner from March 2017 to March 2018.

New Castle County Delaware voted 7-5 to Raise Property Taxes effective July 1, 2018 by 15% on the county portion of the property taxes. This comes one month after voting to raise the sewer bills. Read the full story and watch a video to understand how this will impact you at New Castle County Property Tax Increase.

First Time Home Buyer Seminars Coming Up:.

Delaware First Time Home Buyer Seminar is Wednesday June 27, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday July 28, 2018 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages