Mortgage Rates Weekly Update for January 26, 2015

Mortgage Rates weekly market update for the Week of January 26, 2015 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware.

Mortgage Rates moved higher last week after the stock market rallied. If you look at the mortgage bond chart below you can see mortgage bonds had a big sell-off on Monday to start the week but were able to find a bottom on Thursday and bounce off support and follow through on Friday as Stocks turned negative on Friday. We recommend FLOATING your Mortgage Rate to start the week to see if the bond can follow through on their bounce off support last week.

In Economic News, The European Central Bank (ECB) announced they would begin a massive Quantitative Easing (QE) Program or asset purchase program that would begin purchasing 60 Billion Euros a month of government bonds to fight off deflation and boost the European economy. This new QE program will run till September 2016. This sent the Euro to an 11 year low against the dollar.

In other Economic News, we saw China report its GDP for 2014 at 7.4% which was the lowest GDP reading for China since 1990. The GDP is a reading of economic growth so this shows that China’s growth is definitely slowing.

The price of crude oil continued to move lower to $45.41 per barrel. The U.S. Department of Energy reported that the U.S. supply of crude oil is quickly building and is at a 14 year high. Oil refineries are operating at 85% capacity which is the lowest output level since 2003. If Oil prices remain low for a prolonged period of time, it will have a negative effect on housing in states like Texas that rely heavily on the Energy sector for jobs.

Thursday saw the release of Weekly Initial Jobless Claims came in at 307,000 claims which were down 10,000 claims from the previous week. This is the 2nd-week jobless claims were above 300,000 claims. This is showing a weaker trend in the labor market as jobless claims continue to remain above 300,000 claims.

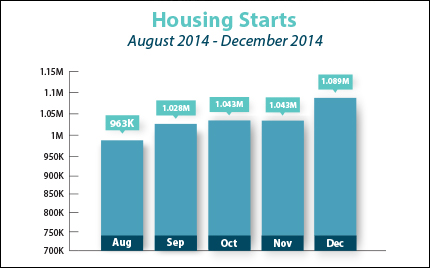

In Housing News, December 2014 Housing Starts were up 4.4% from November 2014 to 1.09 Million units which were the strongest pace in single-family construction in almost 8 years. Housing Starts is a measure of how many new homes builders have started building in the current month. Housing Starts were up 8.8% in 2014 over 2013 at 1.01 Million units which is the highest level since 2007. Building Permits for December 2014 dropped by 2% to 1.03 Million units. This is not a big drop and typically the winter months see lower building permits so this is not of concern to New Home Construction.

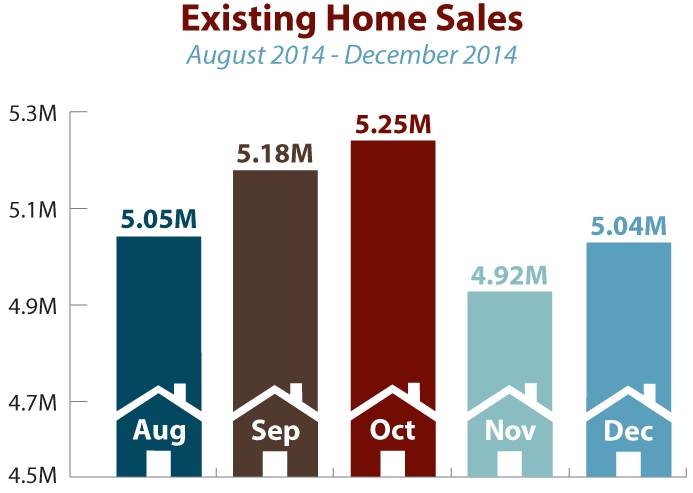

Existing Home Sales for December 2014 were released on Friday which increased 2.4% from November 2014 up to 5.04 Million units. Inventory levels for December dropped 11.1% to 1.85 million units which represent a 4.4 month supply of homes. First Time Home Buyers represented 29% of sales in December which is down from 31% in November but up from 27% in December 2013. The median home price of existing home sales increased 6% from $197,700 to $209,500.

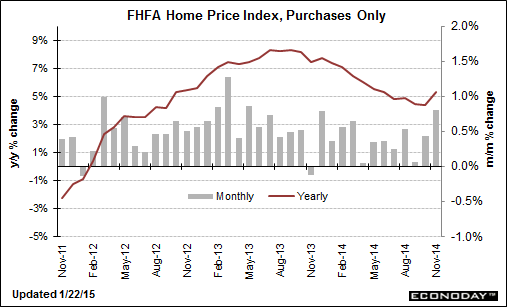

The Federal Housing Finance Agency (FHFA) released their Home Price Index for November 2014 which showed home prices were up 0.8% from October 2014. This was much stronger than the expected 0.3% increase. The year over year home price appreciation went up from 4.5% to 5.3%

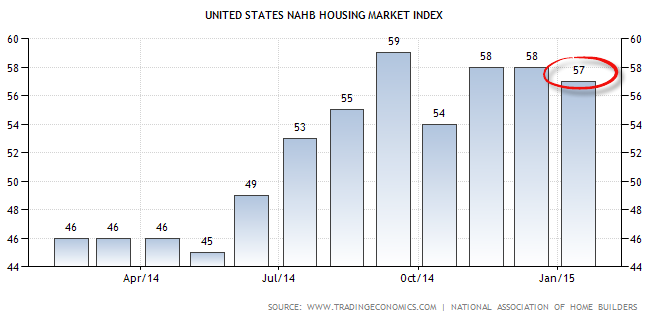

The National Association of Home Builders (NAHB) released their Housing Market Index for January 2015 which came out at 57 which was down from expectations of 58. Anything above 50 is a sign of expansion in the new home construction market. This report is a real-time gauge of market activity for new home builders. The report overall was a very good report. The only downside to the report was a drop in buyer foot traffic.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, February 21, 2015, in Newark, Delaware.

There is a Dover Delaware First Time Home Buyer Seminar Saturday, March 7, 2015, in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713