Mortgage Rates Weekly Update for January 19, 2015

Mortgage Rates weekly market update for the Week of January 19, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware.

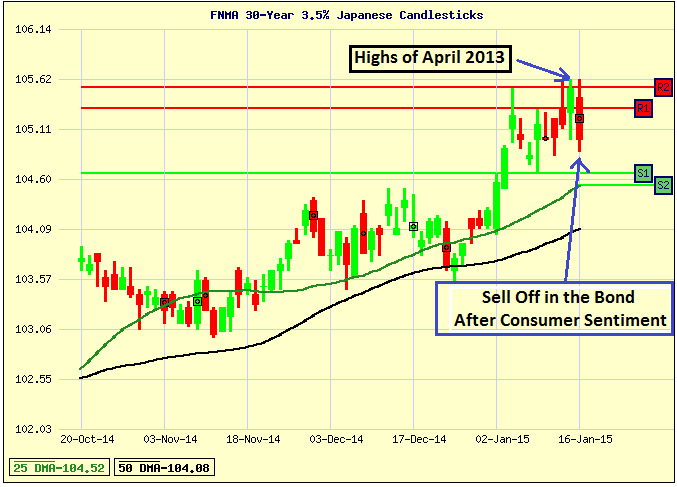

Mortgage Rates spiked higher to end the week on Friday after Consumer Sentiment came out better than it had in 11 years. This sent the stock market rallying higher and pulled money out of the bond market. If you look at the mortgage bond chart below, you can see mortgage bonds hit a record high in almost 2 years on Thursday then sold off sharply on Friday. We are recommending LOCKING your Mortgage Rate to start the week as the short term trend is now for bonds to continue to sell off if stocks continue to rally.

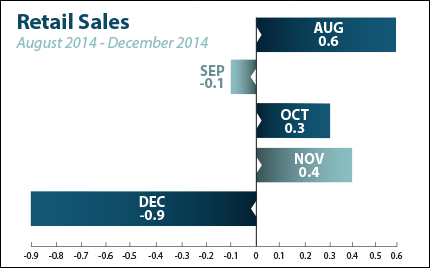

In Economic News, the Consumer Sentiment for December 2014 came in at 98.2 which was far above the 94 expected and the best reading in 11 years! This caused the stock market to reverse course and rally higher, the DOW gained 190.86 points on Friday. Retail Sales for December 2014 were, however, just the opposite and came out very disappointing at -0.9% decrease from November 2014. This was a surprise as most thought the lower price of oil would allow consumers to spend more.

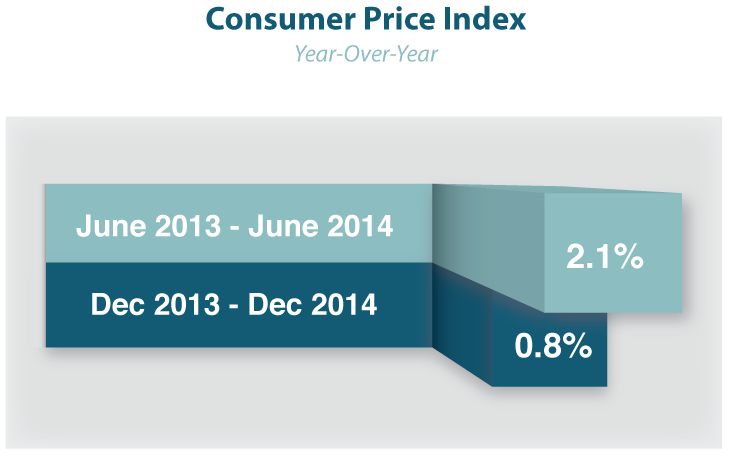

Inflation remained tame at the consumer level with the Consumer Price Index for December 2014 falling by 0.4%. The year over year CPI fell to 0.8% down from 2.1% in May 2014. Inflation was also tame at the wholesale level with the Producer Price Index for December 2014 falling 0.3%.

Weekly Initial Jobless Claims were released on Thursday and surprisingly jumped higher to 316,000 claims which are up 19,000 claims from the previous week. This is only the second time jobless claims have been above 300,000 claims in the last 17 weeks.

2014 Real Estate in Review for the State of Delaware:

New Castle County Delaware experienced a 3.5% increase in the median home price of homes sold in 2014 rising from $198,000 to $205,000. The number of homes sold in New Castle County decreased by 4.6% from 2013 compared to 2014. The number of homes that went under contract in 2014 decreased by 2.6% from the number of homes that went under contract in 2013.

Kent County Delaware experienced a 4.5% increase in the median home price of homes sold in 2014 increasing from 176,950 to $185,000. The number of homes sold in Kent County increased by 8.8% compared to 2013 and the number of homes that went under contract in 2014 increased by 16.2% compared to 2013.

Sussex County Delaware saw a 0.6% decrease in the median home price of homes sold in 2014 decreasing from $246,500 to $245,000. Sussex County experienced a 1.8% decrease in the number of homes sold in 2014 compared to those sold in 2013 and the number of homes that went under contract in 2014 decreased by 2.6% from 2013.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, February 21, 2015, in Newark, Delaware.

There is a Dover Delaware First Time Home Buyer Seminar Saturday, March 7, 2015, in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713