Mortgage Rates Weekly Update [January 15 2018]

Mortgage Rates Weekly Update for January 15, 2018

Mortgage Rates Update for January 15, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved higher last week as mortgage bonds broke through support and the stock market rallied to new record highs. If you look at the mortgage bond chart below you can see mortgage bonds broke below support on Tuesday with the giant red candle. Bonds were able to find a floor of support on Wednesday and tested the floor again on Friday before recovering. We are recommending FLOATING Your mortgage rate to start the week to see if bonds can rally off the floor of support and move mortgage interest rates lower but if bonds fall below the floor of support, we will quickly switch to a locking stance as mortgage bonds would have a long way to run down before next floor of support.

In Economic News

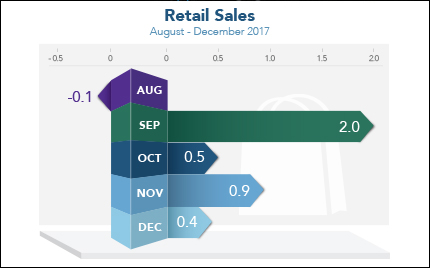

Retail Sales for December 2017 rose 0.4% and November’s reading was revised higher to 0.9%. Retail Sales were up 4.2% in 2017 as compared to only 3.2% in 2016. Retail Sales is a measure of consumer spending which makes up two thirds of the US economy.

The Consumer Price Index for December 2017 which measures inflation at the consumer level showed the headline CPI drop from 2.2% to 2.1% but this drop was expected. The Core CPI which strips out food and energy prices increased from 1.7% to 1.8% unexpectedly. The surprise jump in Core CPI caused mortgage bonds to sell off on Friday which moved mortgage rates higher.

The Producer Price Index for December 2017 which measures inflation at the wholesale level dropped from 3.1% to 2.6%. The Core PPI which strips out food and energy prices dropped from 2.4% to 2.3%. The dropped was unexpected but didn’t have much effect on mortgage bonds because bonds care about consumer inflation much more than wholesale inflation.

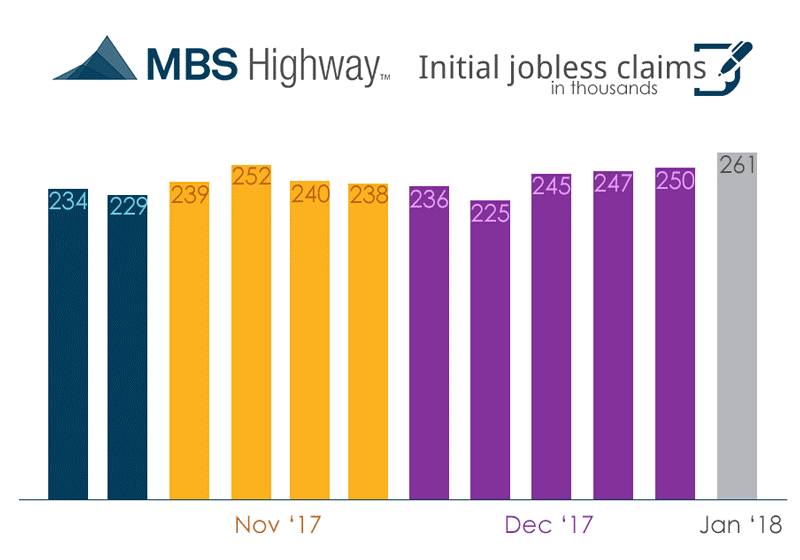

Weekly Initial Jobless Claims rose 11,000 to 261,000 claims for the week. Weekly initial jobless claims measures the number of people filing for unemployment benefits for the first time. This was the fourth consecutive week that jobless claims have risen and is the highest number in 3 months.

In Housing News

Mortgage Credit Certificate Programs were saved in the New Tax Bill that passed effective January 1, 2018. The Delaware Mortgage Credit Certificate program was in jeopardy of being eliminated along with all the other MCC programs as the house version of the tax bill was set to eliminate MCCs. The final bill that was signed into law did not include the House provision to remove the first time home buyer tax credit programs called mortgage credit certificates (MCC).

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Saturday January 20, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday February 10, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday February 21, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#MortgageRates