Mortgage Rates Weekly Update for February 23, 2015

Mortgage Rates weekly market update for the Week of February 23, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved lower again last week as mortgage bonds continue to sell off. If you look at the mortgage bond chart below you can see mortgage bonds sold off on Monday to move rates higher to start the week. Bonds have found a floor of support but have not been able to rally above a tough ceiling of resistance which is the blue line on the chart below. If mortgage bonds can’t break above this line, then rates will not move lower. We are recommending FLOATING your Mortgage Rate to start the week to see if bonds can rally through resistance but would quickly switch to locking if bonds begin to sell off again.

In Economic News, Inflation continues to drop at the wholesale level as the Producer Price Index (PPI) dropped 0.8% from January 2015 to February 2015. Inflation is the enemy of mortgage bonds so low inflation is a catalyst for mortgage rates to stay low.

The Weekly Initial Jobless Claims came out on Thursday and they dropped 21,000 claims to 283,000 claims. This number is still no reflecting all the jobs being lost in the Energy Sector so we think the weekly claims numbers will be going up in the near future which will make the jobs report numbers worse very soon. This would be bond friendly news and could help mortgage rates move lower long term.

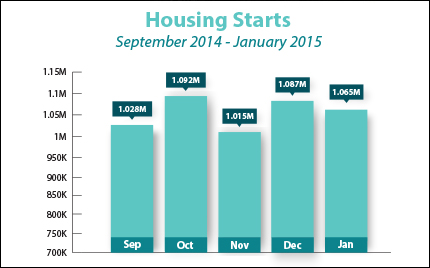

In Housing News, January 2015 Housing Starts fell by 2 percent to 1.065 Million Units. The weaker housing starts were due to impart to a big decline in starts on single-family homes because of factors keeping first time home buyers from purchasing such as student loan debt rising prices. On a positive note, Housing Starts are up 19 Percent from January 2014.

Building Permits for January 2015 came in below expectations at 1.056 Million units. Building Permits is a sign of future construction so if building permits continue to decline that could signal a slowing in housing. The Home Builders Housing Market Index also dropped 2 points to 55 which is a measure of builder sentiment on the market.

Title Insurance Rates Going Up! – Effective March 1, 2015, title insurance rates in Delaware will increase by approximately 18% and the cost of closing protection letters will increase from $75 to $125. These rates have been approved by the Delaware Insurance Commissioner’s Office and will be the same for all Delaware transactions and for all attorneys. Please talk with your manager to discuss how these changes affect the good faith estimates you have provided to borrowers for loans closing after March 1, 2015. If you need revised figures, contact the paralegal for the file and they will be quickly provided.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 2/23/2015 they are working on reviewing files that have been submitted on 2/13/2015 so they are taking about 15 days to review files currently so plan your closing dates accordingly.

First Time Home Buyer Seminars Coming Up:

There is a Dover Delaware First Time Home Buyer Seminar Saturday, March 7, 2015, in Dover, Delaware.

The next Delaware First Time Home Buyer Seminar is Saturday, March 28, 2015, in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713