Mortgage Rates Weekly Update for February 9, 2015

Mortgage Rates weekly market update for the Week of February 9, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

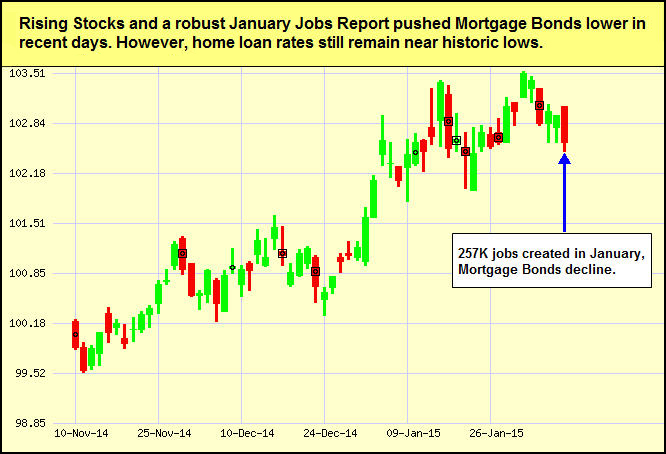

Mortgage Rates Spiked Higher on Friday to end the week after January Jobs Report Released. If you look at the mortgage bond chart below you can see mortgage bonds hit the ceiling of resistance on Monday and closed lower. Tuesday followed through with a sell-off as seen by a red candle. Then Friday mortgage bonds sold off again after January Jobs Report was released. The bond closed on Friday below the 25 Day Moving average and the next level of support is the 50-day moving average which is about 38 basis points below where the bond closed on Friday so we are recommending LOCKING your Mortgage Rate to start the week.

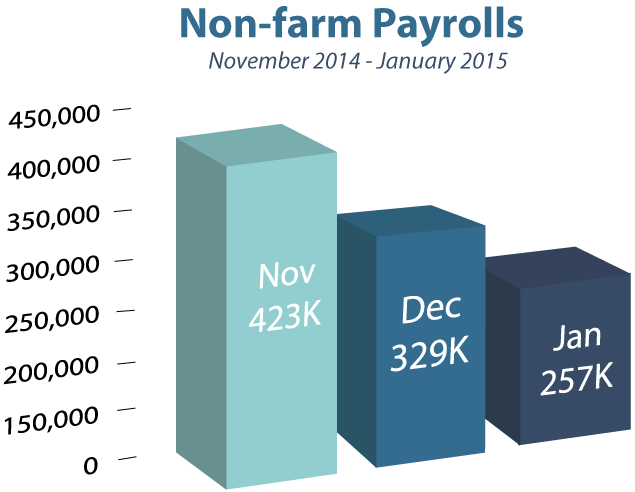

In Economic News, the Labor Department released the January 2015 Jobs Report on Friday which showed 257,000 Jobs were created in January which was above the 235,000 expected. The report also revised November and December sharply higher by 147,000 jobs. The last three months have averaged 336,000 jobs created which is the best 3 month period in 17 years!

The Jobs Report showed the Unemployment Rate ticked up from 5.6% to 5.7% which would be expected if more people are coming back looking for work and as holiday jobs are terminated. The Labor Force Participation Rate ticked up slightly to 62.9% which is still hovering around 40-year lows.

The Biggest concern in the Jobs Report is that the Energy Sector Job loss is not showing up in the Jobs Report yet. There were about 70,000 jobs lost in January from Oil Rigs alone as rig counts dropped by 10.5%. These lost jobs will show up soon and will bring the jobs number down and the unemployment rate up. This will cause a drag on the labor recovery.

Thursday saw the release of the Weekly Initial Jobless Claims which edged higher by 11,000 claims to 278,000 claims. This report is puzzling because as mentioned, there has been a significant cut back in the Energy Sector but it isn’t showing up yet in the weekly initial jobless claims. We do expect these job cuts to start to show up soon which will raise the weekly initial jobless claims.

The Personal Consumption Expenditures (PCE) was released last week which is the Fed’s favorite measure of inflation and it dropped -0.2% in January from December. The year over year measure of inflation for the headline PCE dropped from 1.2% to 0.7%. This shows that inflation is very tepid and almost non-existent.

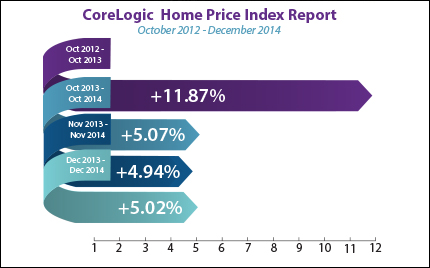

In Housing News, CoreLogic released their Home Price Index Report for December 2014 which showed home prices rose by 5.02% year over year. This shows that home price appreciation has stabilized at the 5% range which is the historical average. December marked the 34th consecutive month of home price appreciation nationally. It is still a great time to buy as home prices are still 13.4 percent below the peak in 2006.

USDA Rural Housing Loan Underwriting Turn Times at Rural Development for files in Delaware as of 2/8/2015 they are working on reviewing files that have been submitted on 1/23/2015 so they are taking about 15 days to review files currently so plan your closing dates accordingly.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, February 21, 2015, n Newark, Delaware.

There is a Dover Delaware First Time Home Buyer Seminar Saturday, March 7, 2015, in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713