Mortgage Rates Weekly Update for February 6, 2017

Mortgage Rates Weekly Update for February 6, 2017

Mortgage Rates Weekly Update for February 6, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were able to end the week slightly lower than where they started the week. If you look at the mortgage bond chart below you can see mortgage bonds have been trading in a tight band between the blue lines for the past several weeks. Mortgage bonds were able to bounce off support from the bottom blue line and move higher as you can see with the green candles at the end of the week. We are going to recommend FLOATING Your Mortgage Rate to start the week to see if bonds can rally higher after bouncing off support.

In Economic News

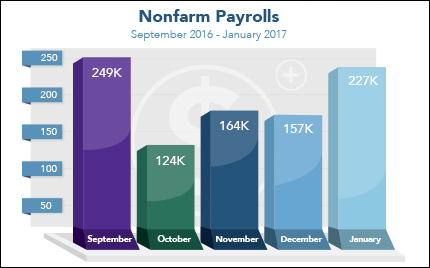

U.S. Labor Department released the January 2017 Jobs Report on Friday which showed 227,000 jobs were created in January which was above expectations of 170,000. But the job creation numbers for December and November were revised lower by a combined 39,000 jobs. The Unemployment Rate ticked up from 4.7% to 4.8% as more people started looking for work again and were added back into the count.

Wage Growth was not very rosy, Average hourly earnings only increased by 0.1% which was below expectations of 0.3% and December average hourly earnings was revised lower from 0.4% to 0.2%.

The Federal Reserve kept the Feds Fund Rate the same at Federal Open Market Committee meeting on January 31st and February 1st. The Feds Funds Rate has only been increased twice in the last decade so the Feds have been really slow in bringing the rate higher.

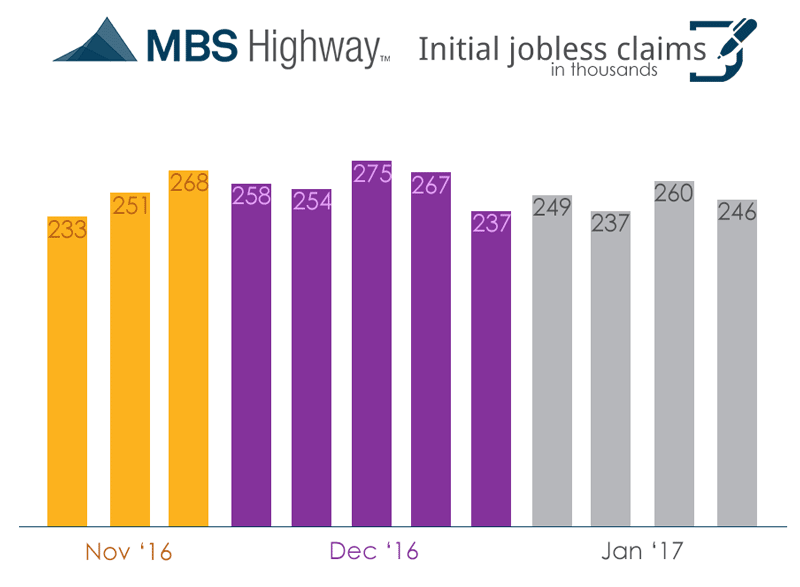

Weekly Initial Jobless Claims were released on Thursday and dropped 16,000 claims to 246,000 claims for the week which supports a strong labor market.

In Housing News

The Case-Shiller Home Price Index for November 2016 showed home prices continue to move upwards as the national home prices were up 5.6% on a year over year basis. The low inventory will support increased home prices in 2017. The national housing market has rebounded well since the 2007-2008 housing recession caused by the mortgage market meltdown. Investing in real estate remains strong going into 2017.

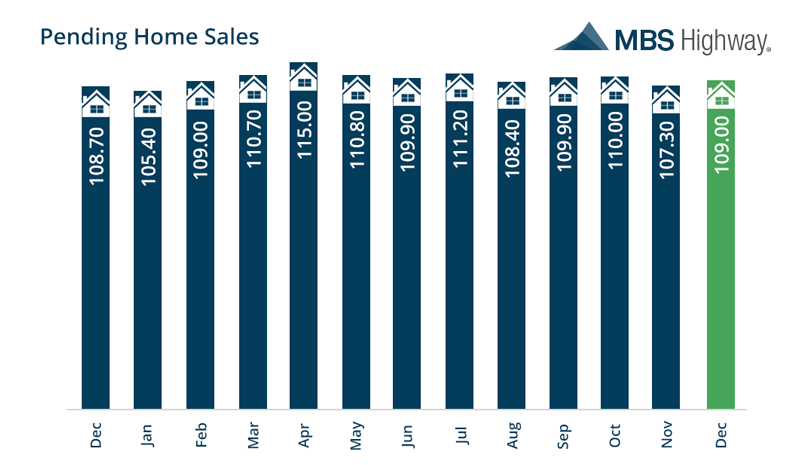

Pending Home Sales for December 2016 were released last week and rose by 1.9% from November 2016. Pending Home Sales measure the number of new contracts signed to purchase existing homes. Pending Home Sales support a strong housing market and upward price pressure on homes.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday February 18, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday March 25 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate