Mortgage Rate Weekly Update for February 27 2017

Mortgage Rate Weekly Update for February 27, 2017

Mortgage Rate Weekly Update for February 27, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rate were able to move lower to end the week as mortgage bonds were able to rally higher. If you look at the mortgage bond chart below you can see mortgage bonds were able to rally higher off support and ended the week at a level of resistance. We are recommending LOCKING your mortgage rate to start the week to take advantage of the recent move lower along with mortgage bonds facing a stiff overhead resistance which turned bonds lower the last time they tested this level.

In Economic News

Federal Reserve Meeting Minutes from 2.1.2017 meeting were released last week which showed that Feds said would be appropriate to raise short term rates again fairly soon but did not give any indication that it would be at March’s meeting. The decision will depend on data for jobs and inflation.

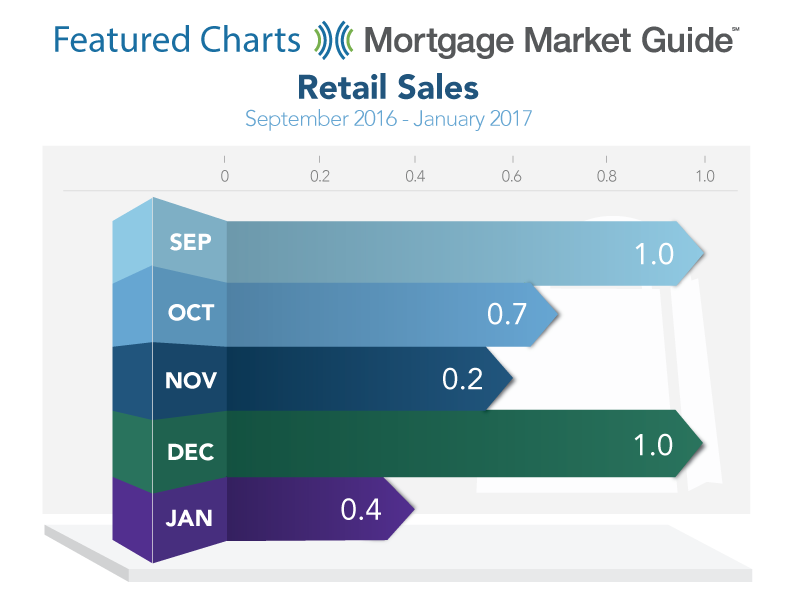

Retail Sales for January 2017 were up 0.4 percent which was a solid number showing consumers are more upbeat about the economy as the labor market improves. Retailers across the board reported positive numbers with the exception of auto dealers. Retail Sales were up 5.6 percent from January 2016.

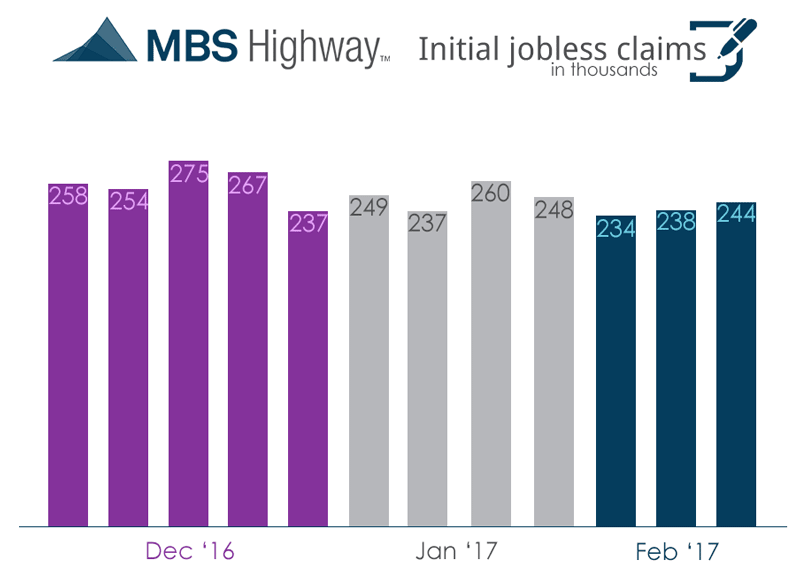

Weekly Initial Jobless Claims were released on Thursday at 244,000 claims for the week. This is the sample week that will be used for the February Jobs Report. The four week moving average jobless claims moved down 4,000 to 241,000 which is the lowest level since 1973.

In Housing News

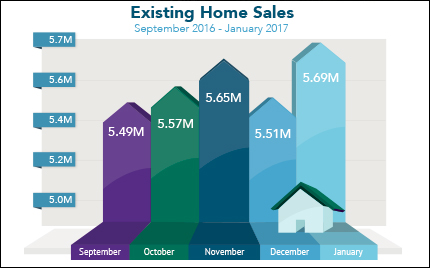

Existing Home Sales for January 2017 were released last week and jumped higher 3.3 percent to 5.69 million units on an annualized basis which was a 10-year high. Housing Demand remains strong as home buyers are shrugging off increasing home prices and higher mortgage interest rates. The median existing home price rose 7.1 percent from January 2016.

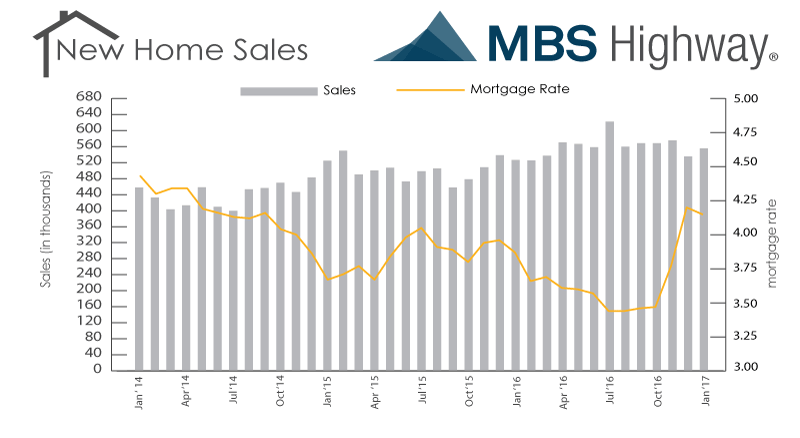

New Home Sales for January 2017 rebounded by rising 3.7 percent from December to 555,000 units and up 5.5 percent from January 2016. The median sale price of a new home is up 7.7 percent from a year ago to $312,900.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday March 18, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday March 25 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate