Mortgage Rates Weekly Update October 10, 2016

Mortgage Rates Weekly Update October 10, 2016

Mortgage Rates weekly update for the Week of October 10, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

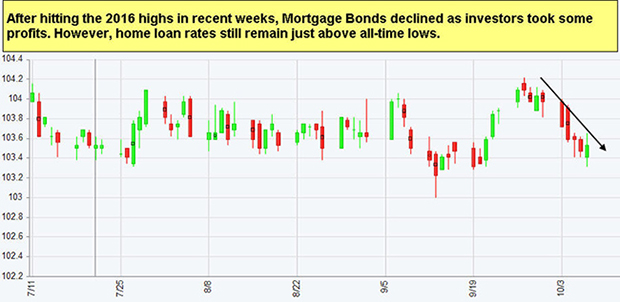

Mortgage Rates moved higher last week as mortgage bonds sold off after being turned lower by resistance. If you look at the mortgage bond chart below you can mortgage bonds sold off last week moving mortgage rates higher until finding a bottom on Friday. Bonds were able to rally off support on Friday with Green Candle so we are recommending FLOATING Your mortgage rate to start the week.

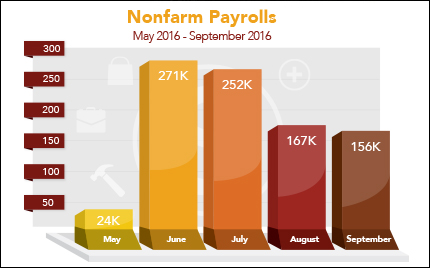

In Economic News, the Labor Department released Jobs Report for September 2016 on Friday which showed 156,000 jobs created for September. This was below the 176,000 expected. Job growth for 2016 has averaged 178,000 jobs per month which is less than the 229,000 jobs per month in 2015 and 251,000 jobs per month in 2014.

The Unemployment Rate ticked up to 5.0% from 4.9% in August and about the same as year ago in September 2015. The average hourly earnings did increase by 2.6 percent.

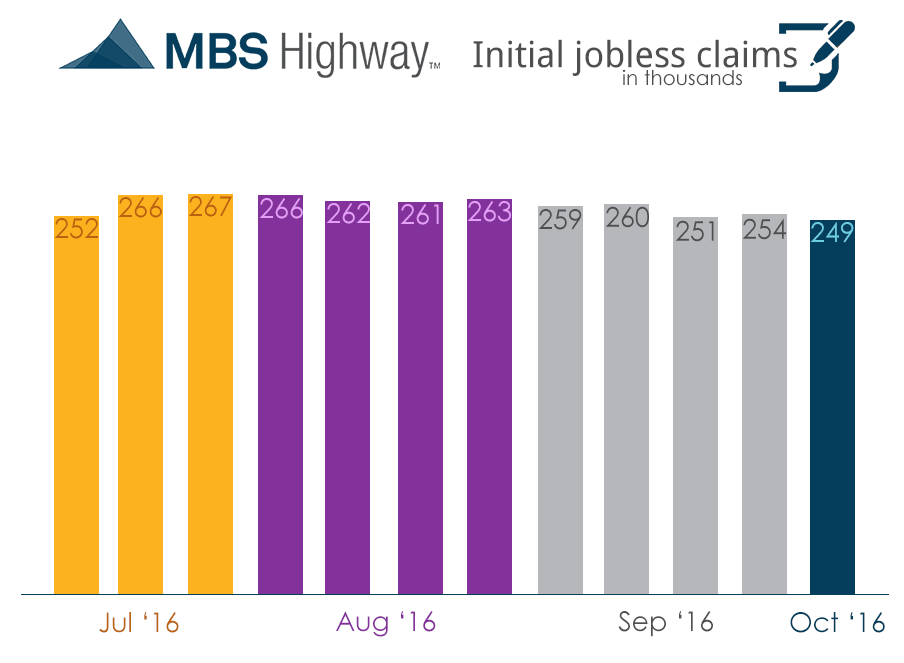

Weekly Initial Jobless Claims were released on Thursday and came out at 249,000 claims for the week which was a drop of 5,000 claims from the previous week and the best reading on weekly claims since Mid-April when it was 248,000 claims. This is the longest streak of claims below 300,000 at 83 consecutive weeks since 1970.

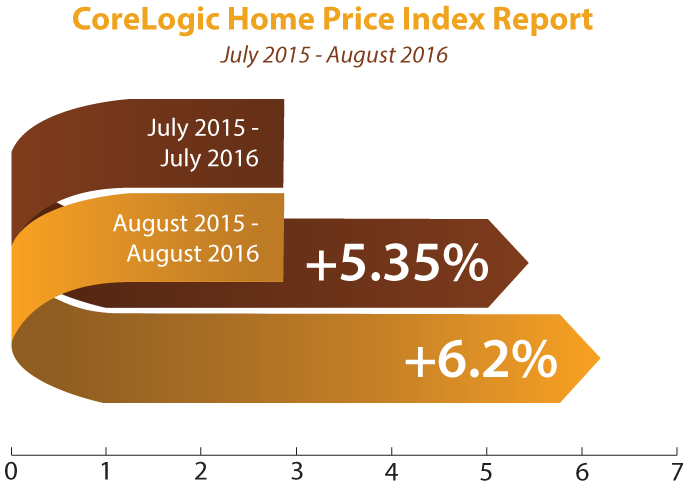

In Housing News, the CoreLogic Home Price Index for August 2016 showed prices appreciated 1.1% from July and were up 6.2% from August 2015. Home Prices are predicted to rise about 5% in the coming year which would bring home prices back to the peak in 2006.

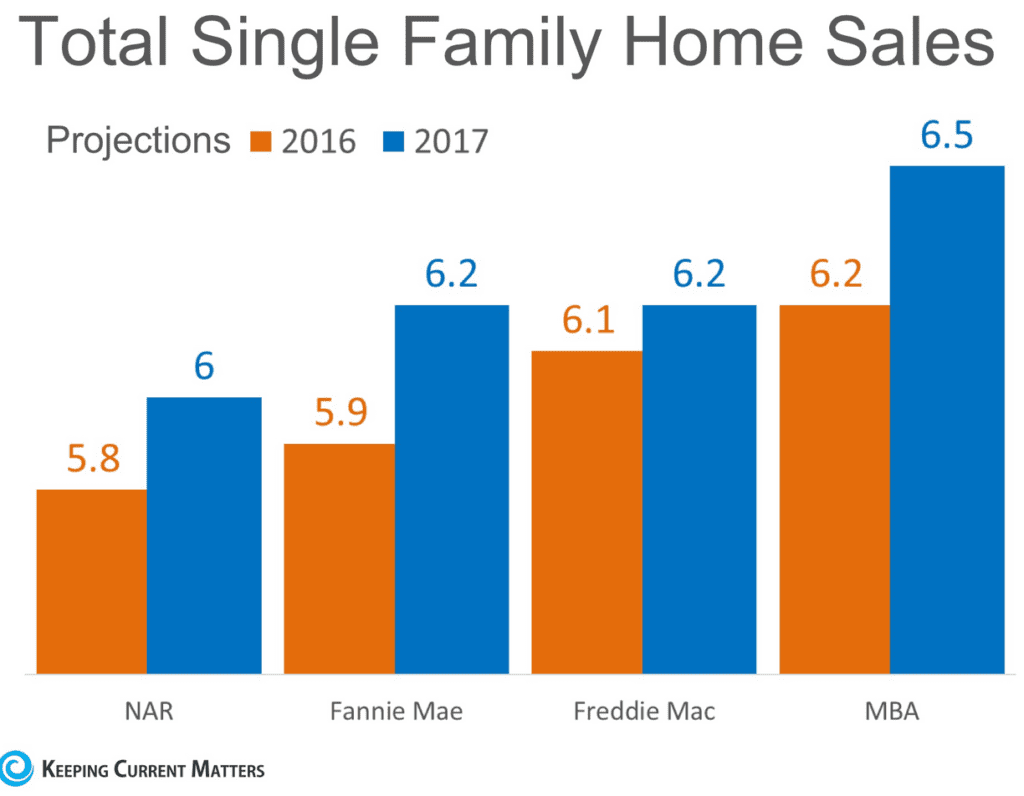

Home Prices Appreciate Projections for 2016 and 2017 from National Association of Realtors (NAR), Fannie Mae, Freddie Mac, and the Mortgage Banker’s Association (MBA) are displayed in the chart below. Looks like no matter who you look at 2016 and 2017 are going to be solid years for home prices to go up. This means that now is the perfect time to purchase a home with mortgage rates at historic lows and home prices predicted to go up between 5-6% each of the next 2 years. The cost of waiting to buy will be drastic as rates are projected to increase over the next 2 years and home prices will continue to go up.

New Castle County Released a new Delaware Down Payment Assistance Program on October 5, 2016 called the NCC ReVaMP Program which provides a forgivable loan of up to $5,000 at 0% interest for purchasing homes in New Castle County, Delaware in designated census tracts. Call 302-703-0727 to get more information or to apply.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday October 29, 2016 in Newark, Delaware.

Next Dover Delaware First Time Home Buyer Seminar is Saturday October 15, 2016 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Mortgage Interest Rates remain near all time record low rates, so it is the perfect time to purchase or refinance a home before rates move higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you.

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate