Mortgage Rates Weekly Update for February 2, 2015

Mortgage Rates weekly market update for the Week of February 2, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware.

Mortgage Rates were able to move lower last week as mortgage bonds were able to rebound off support. If you look at the mortgage bond chart below you can see bonds were able to rally higher on Wednesday and follow through Friday back to an all-time record high for the year.

If you look at the mortgage bond chart below, it shows the line of resistance that bonds have failed to close above for 2015. The bond closed right at this line of resistance on Friday so if it doesn’t rally higher, then bonds will probably sell off and move mortgage interest rates higher in the short term. So we are recommending LOCKING your Mortgage Rate if you are closing in the next 30-60 days as these are the best interest rates we have seen in over 2 years. If you are closing in longer than 60 days then you could FLOAT your mortgage interest rate.

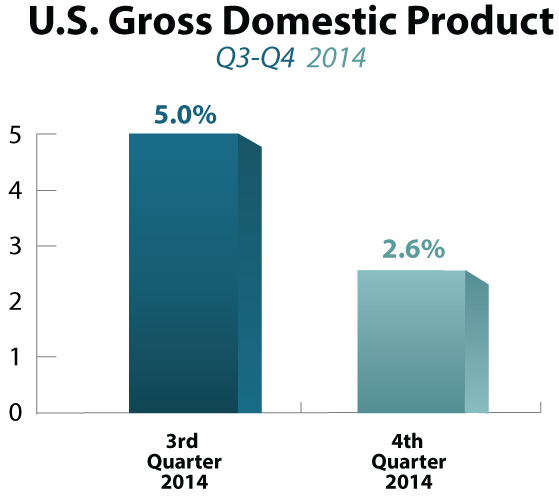

In Economic News, the first reading of the Gross Domestic Product (GDP) for the 4th quarter of 2014 dropped to 2.6% from 5% in the third quarter of 2014. GDP is considered the broadest measure of U.S. economic activity so a strong GDP is a sign of a good economic recovery. The GDP for all of 2014 was 2.4% which is up from 2.2% in 2013. We are looking for a GDP reading of 3% or higher for a sign of a good U.S. economy.

Durable Goods Orders for December 2014 fell by 3.4% which is a big miss. We also saw some big multinational corporations like Microsoft, Proctor & Gamble, and Caterpillar miss earnings report which is being blamed on the Strong U.S. Dollar which makes it more expensive for the sale of exports from the U.S. On a brighter note, Consumer Confidence for December 2014 surged higher to 102.9.

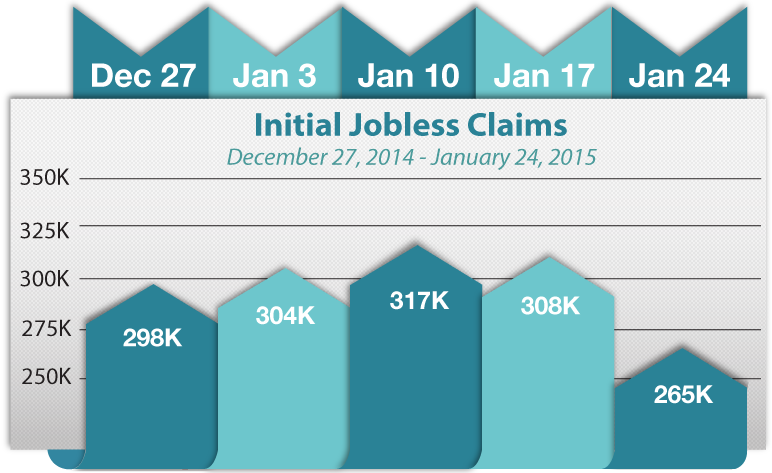

Thursday Weekly Initial Jobless Claims were released by the Labor Department and they fell 43,000 claims to 265,000 claims for the week. This was the lowest level since April 2000 and well below expectations of 301,000. The Martin Luther King Holiday could have contributed to the lower claims level. Initial Jobless Claims measures the number of first-time filers for state unemployment claims.

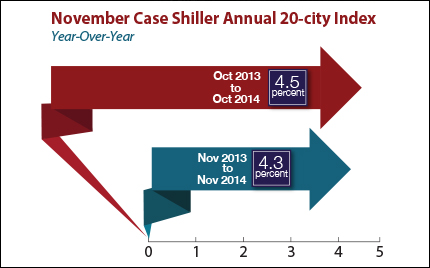

In Housing News, the Case Shiller 20 City Home Price Index for November 2014 showed a 4.3% which was below the 4.5% appreciation seen in October 2014. This is down from the double-digit gains seen in 2013 and the beginning of 2014.

In other housing news, New Home Sales for December 2014 were up 11.6% at 481,000 units. New Home Sales measures the number of contracts signed for new home construction so is a measure of future construction. Median Home Price was up 8.2% to $298,100.

Pending Home Sales for December 2014 were down 3.7% from November to 100.7 Million units but are still up 6.1% year over year so this is still a good report on housing. Pending Home Sales measures the number of contracts signed on existing homes for sale.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, February 21, 2015, in Newark, Delaware.

There is a Dover Delaware First Time Home Buyer Seminar Saturday, March 7, 2015, in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713