Mortgage Rates Weekly Update [December 11 2017]

Mortgage Rates Weekly Update for December 11, 2017

Mortgage Rates Update for December 11, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were able to move lower as mortgage bonds bounce off support to trade higher. If you look at the mortgage bond chart below you can see mortgage bonds have been stuck in a sideways trading pattern alternating between ceiling of resistance and floor of support but has failed to break out of the channel. Mortgage bonds closed Friday just below the ceiling of resistance and failed to break out of the channel higher but settled on a triple layer of support formed by the 50 day moving average, the 200 day moving average and a Fibonacci level. We are recommending carefully FLOATING your mortgage rate to start the week to see if mortgage bonds can rally off support and break through the ceiling of resistance to move mortgage interest rates lower.

In Economic News

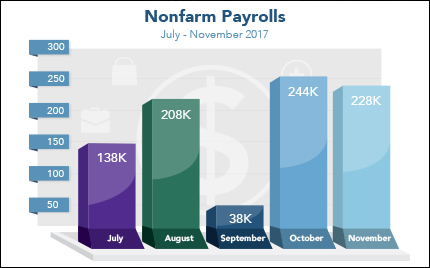

The Jobs Report for November 2017 was released on Friday and showed job growth remained strong with 228,000 jobs created. The Unemployment Rate remained the same at 4.1%, which is considered full employment. The Stock Market rallied on the news of solid jobs report which would normally cause the bond market to sell off but it didn’t. The bond market was able to remain stable in the face of a solid jobs creation and low unemployment because the Average Hourly Earnings disappointed at only 0.2% increase below the 0.3% expected. The year over year Average Hourly Earnings was also disappointing at 2.5% below the 2.7% expected. This means there is no wage growth inflation which is great news for mortgage bonds and which is why we didn’t see mortgage rates jump higher after the Jobs Report.

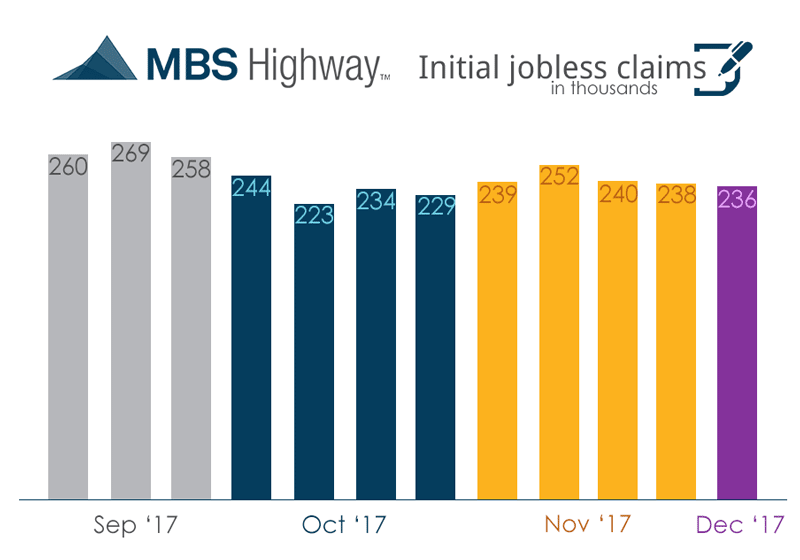

Weekly Initial Jobless Claims were released on Thursday and dropped 2,000 claims from the previous week to 236,000 claims. This was better than expectations of 240,000 claims and shows continued strength in the labor market.

In Housing News

CoreLogic Home Price Index for October 2017 showed home prices surged higher by 7.0% from October 2016 because of three big factors: Lack of inventory of homes for sale, Low home loan mortgage rates, and a strengthening economy. Home Prices were up 0.9% from September 2017. CoreLogic’s forecast for next year is for home prices to increase 4.2% by October 2018.

The Department of Veteran Affairs announced the VA Loan Limits for 2018 effective January 1, 2018. The VA Loan Limit for VA Loans will be raised to $453,100 for 100% financing and up to $679,650 in high cost areas.

The Federal Housing Authority announced the release of FHA Loan Limits for 2018 effective with FHA case numbers assigned on or after January 1, 2018. The new Delaware FHA Loan Limits are as follows:

New Castle County $385,250

Kent County $294,515

Sussex County $316,250

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Saturday December 16, 2017 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday January 10, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages