Mortgage Rates Weekly Update [December 18 2017]

Mortgage Rates Weekly Update for December 18, 2017

Mortgage Rates Update for December 18, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

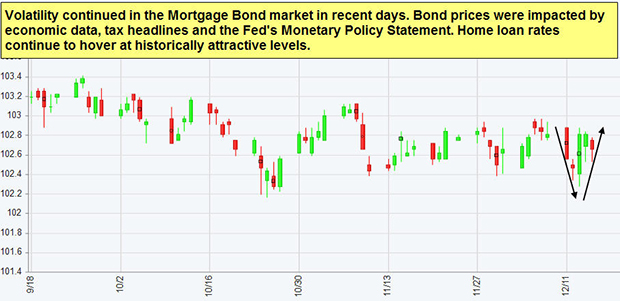

Mortgage Rates ended the week right about where they started after a roller coaster week of moving higher than falling lower to end the week. If you look at the mortgage bond chart below you can see mortgage bonds started the week on Monday slightly higher than they ended the previous week but sold off to end the day on Monday moving mortgage interest rates lower. Mortgage bonds continued to sell of until Wednesday after the Federal Reserve announced they would raise the Fed Funds Rate 0.25%. Mortgage bonds ended the week by closing just below a touch a ceiling of resistance that has persisted October. We are recommending LOCKING your mortgage rate to start the week because mortgage bonds are once again up against a tough a ceiling of resistance with lots of room to sell off to the downside.

In Economic News

The Federal Reserve announced they would be raising the Fed Funds Rate by 0.25% at its December 2017 meeting last week. The Federal Funds Rate will be increasing from 1.25% to 1.50%. This will increase the rates on short term and variable interest rate loan products such as home equity lines of credit but usually has the opposite effect on long term interest rates like mortgage rates because raising the Fed Funds Rate keeps inflation low. The Fed said they expect to hike rates 3 more times in 2018 and they lowered they unemployment forecast from 4% to 3.9%. The GDP forecast for 2018 is 2.5%.

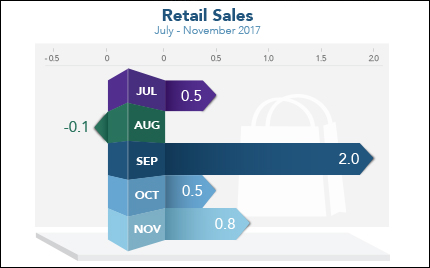

Retail Sales for November 2017 were released by the Commerce Department and Retail Sales jumped 0.8% which was more than double expectations of 0.3% gain. Retail Sales are up 5.8% from November 2016. October Retails Sales were also revised higher from 0.3% to 0.5%. This shows we are having a very strong holiday shopping season which bodes well for the fourth quarter GDP reading.

The Producer Price Index for November 2017 was released last week and rose from 2.8% to 3.1% which is a 6 year high for wholesale inflation. The core PPI which strips out food and energy prices remained stable at 2.4%. Wholesale inflation doesn’t always translate to Consumer inflation so their wasn’t much impact on the markets.

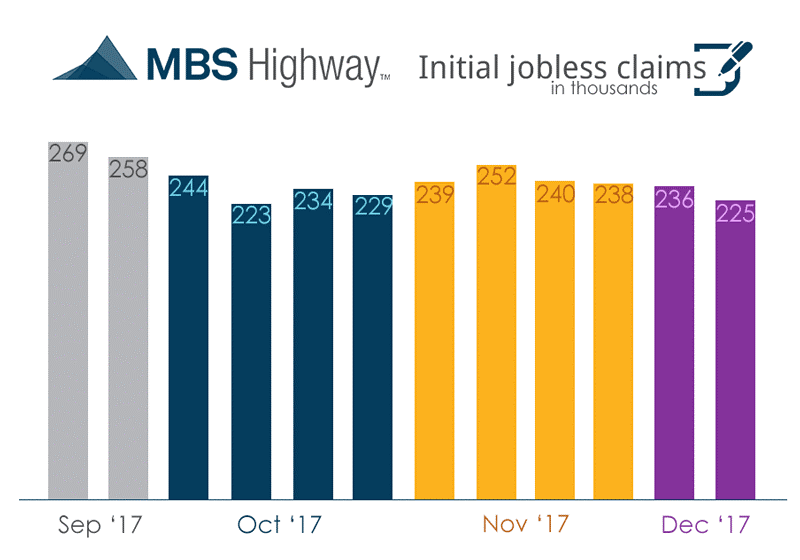

Weekly Initial Jobless Claims dropped 11,000 claims on Thursday to 225,000 jobless claims. This was 14,000 better than expectations of 239,000. This is the lowest reading since October and shows that the labor market is doing very well.

In Housing News

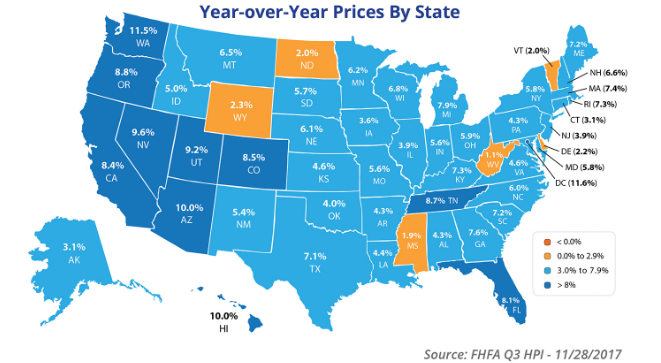

Home price appreciation shown below from the Federal Housing Finance Agency Quarterly Home Price Index Report for Q3 by state for 2017 shows Delaware at 2.2% year over year, Maryland is 5.8%, Pennsylvania is 4.3% and New Jersey is 3.9%. Based on the report, if you are waiting to buy a home it will end up costing your more as home prices continue to rise across the country.

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Saturday January 20, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Saturday January 10, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages