Mortgage Rates Weekly Update [August 6 2018]

Mortgage Rates Weekly Update for August 6, 2018

Mortgage Rates Update for August 6, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates ended the week slightly lower as mortgage bonds were able to rally to end the week after the July Jobs Report was released on Friday. If you look at the mortgage bond chart below for the Fannie Mae 4.0% Mortgage Bond you can see mortgage bonds were able to bounce higher off a weak floor of support created at the green horizontal line on the chart. Mortgage bonds have a very tough over head ceiling of resistance formed by 4 different resistance levels which are the 25 day moving average, 50 day moving average, 100 day moving average and a technical Fibonacci level at 101.988. There is also 40 basis point to drop before next strong level of resistance so with bonds in the middle of a touch trading range and very tough overhead resistance we are recommending LOCKING your Mortgage Rate to start the week as the risk out weighs the reward.

In Economic News

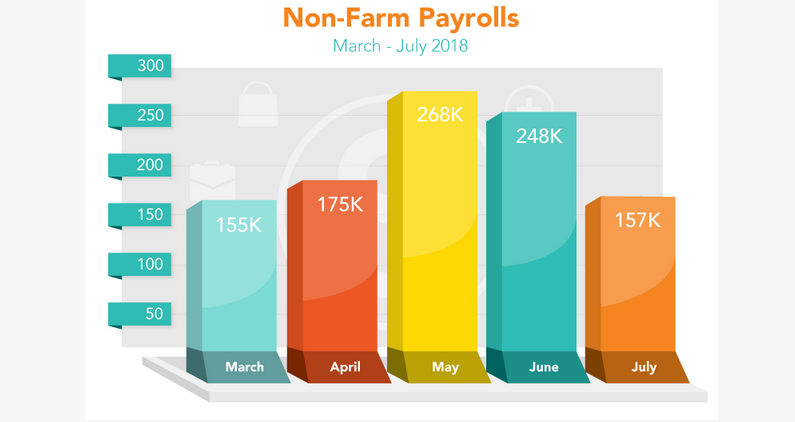

Jobs Report for July 2018 was released on Friday and show 157,000 jobs were created which was below expectations of 190,000 jobs. There was however a net positive revision of 58,000 jobs to the previous two months jobs reports with May revised higher by 24,000 jobs from 244,000 to 268,000 jobs and June was revised higher by 35,000 jobs so went from 213,000 to 258,000 jobs. Hobby and Retail toy employment fell by 32,000 jobs largely from the closing of Toy R Us which dented the headline jobs number for July so this could be a one off month and we could see August numbers bounce back.

The Unemployment Rate dropped from 4.0% to 3.9% which was the lowest reading since May 2018 and also a 18 year low for unemployment rate. The unemployment rate decreased because the household survey used for unemployment showed 389,000 jobs created and only 105,000 new people entered the workforce so we saw a 1% drop in the unemployment rate. The U6 Unemployment number dropped from 7.8% to 7.5% which measures total unemployed and those marginally employed.

Average Hourly Earnings was reported up 0.3% from last month but year over year remained stable at 2.7% which there was no wage inflation in the Jobs Report. Having stable wage inflation is bond friendly news because inflation is the enemy of bonds.

Federal Reserve Open Market Committee met last week and agreed to leave the Fed Funds Rate unchanged as was expected at this meeting. Feds did state they will continue to gradually raise the Fed Funds Rate which is the rate banks use to lend money to each other overnight.

Weekly Initial Jobless Claims were released on Thursday and showed an increase of 1,000 claims to 218,000 claims for the week. The previous week’s claims remained the same at 217,000. Weekly initial jobless claims remain at historically low levels and continue to show a very strong labor market in the United States which is also supported by historically low unemployment rate of 3.9%.

The Week Ahead in Mortgage Rates

For the Week of August 6, 2018 thru August 10, 2018

Producer Price Index (PPI) which is a measure of wholesale inflation

Consumer Price Index (CPI) which is measure of consumer inflation

Weekly initial jobless claims on Thursday

In Housing News

Flood Insurance Bill passed Us Senate last week and gives National Flood Insurance Program (NFIP) and additional 4 months of continued coverage for nearly 5 million homeowners and business owners. The vote was 86-12 in the Senate to pass the bill which had previously passed the House. The reason it was only a temporary measure is because the program needs a major overhaul as the NFIP owes more than $20 billion to the United States Treasury and that is the number after receiving a $16 billion bailout from Congress in 2017 to make sure claims for Hurricane Harvey were paid. This bill extends coverage through November 30, 2018 so this issue will be back in front of Congress very soon.

Flood Insurance Bill passed Us Senate last week and gives National Flood Insurance Program (NFIP) and additional 4 months of continued coverage for nearly 5 million homeowners and business owners. The vote was 86-12 in the Senate to pass the bill which had previously passed the House. The reason it was only a temporary measure is because the program needs a major overhaul as the NFIP owes more than $20 billion to the United States Treasury and that is the number after receiving a $16 billion bailout from Congress in 2017 to make sure claims for Hurricane Harvey were paid. This bill extends coverage through November 30, 2018 so this issue will be back in front of Congress very soon.

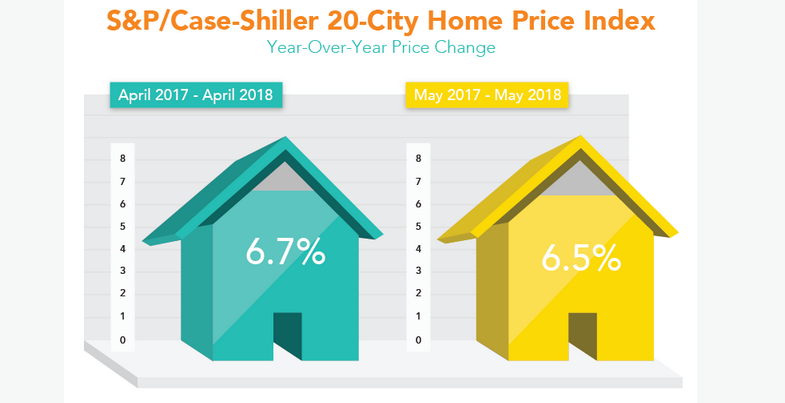

The Case Shiller 20 City Home Price Index for May 2018 showed home prices rose 6.5% from May 2017 thru May 2018. Home prices were up 0.7% from April 2018 to May 2018. Home prices continue to rack up gains that are 2 to 3 times that of the inflation rate and with the rise in mortgage rates are starting to affect the affordability of homes in some parts of the country.

Rental and housing numbers from the Census Bureau: The U.S. Census Bureau reports that over the 10 years from 6/30/07 to 6/30/17, the number of “renter” households in the U.S. increased by 8.4 million to 43.4 million, while the number of “owner” households increased by just 0.9 million to 76.1 million. However, over the latest 12 months from 6/30/17 to 6/30/18, the number of “renter” households in the United States declined by 0.1 million to 43.3 million, while the number of “owner” households increased by 1.8 million to 77.9 million.

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Saturday August 18, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday August 22, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam