Mortgage Rates Weekly Update [August 27 2018]

Mortgage Rates Weekly Update for August 27, 2018

Mortgage Rates Update for August 27, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

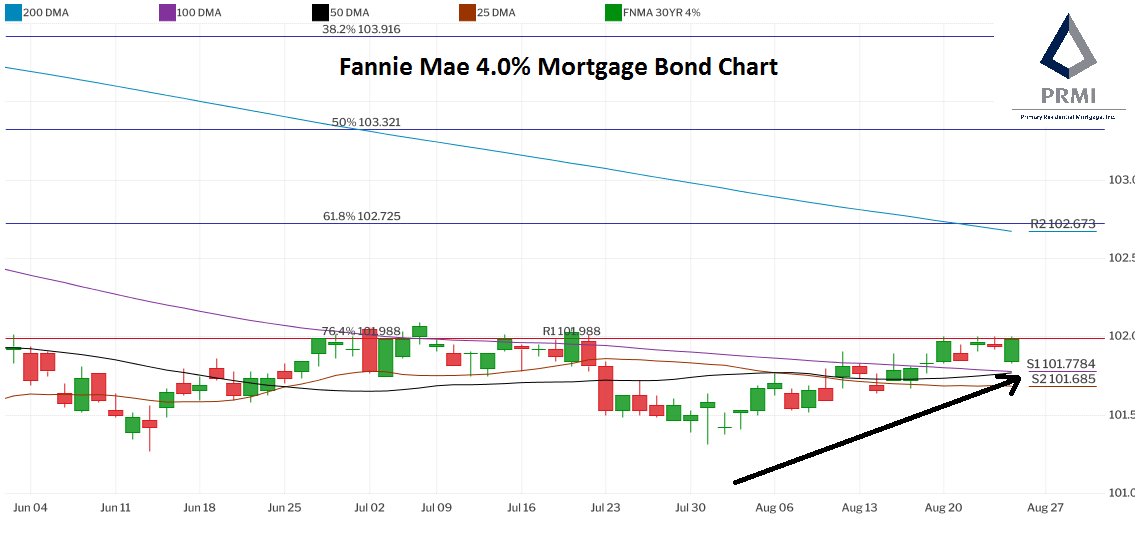

Mortgage Rates ended the week about where they started after failing to break above tough ceiling resistance. If you look at the Fannie Mae 4.0% Mortgage Bond Chart below you can see mortgage bonds have been on an upward trend since bouncing off a floor of support on July 30th. Mortgage bonds has been capped at very strong ceiling of resistance that bonds have not been able to break above since May but have come up against 4 times this week. If mortgage bonds can break above this ceiling of resistance it would be significant and would mean a big potential upside for bonds so we are recommending FLOATING Your mortgage rate to start the week.

In Economic News

Federal Reserve stated the will continue to hike rates while they have a chance and wile the economy can handle it, so that if US Economy does fall into a recession, the Fed has bullets left in their gun to cut rates and stimulate the economy. If the Fed Funds Rate is too low, there is not much they can do in the way of rate cuts to help in a recession. Feds will be hike the Fed Funds Rate next month and will play it by ear for December.

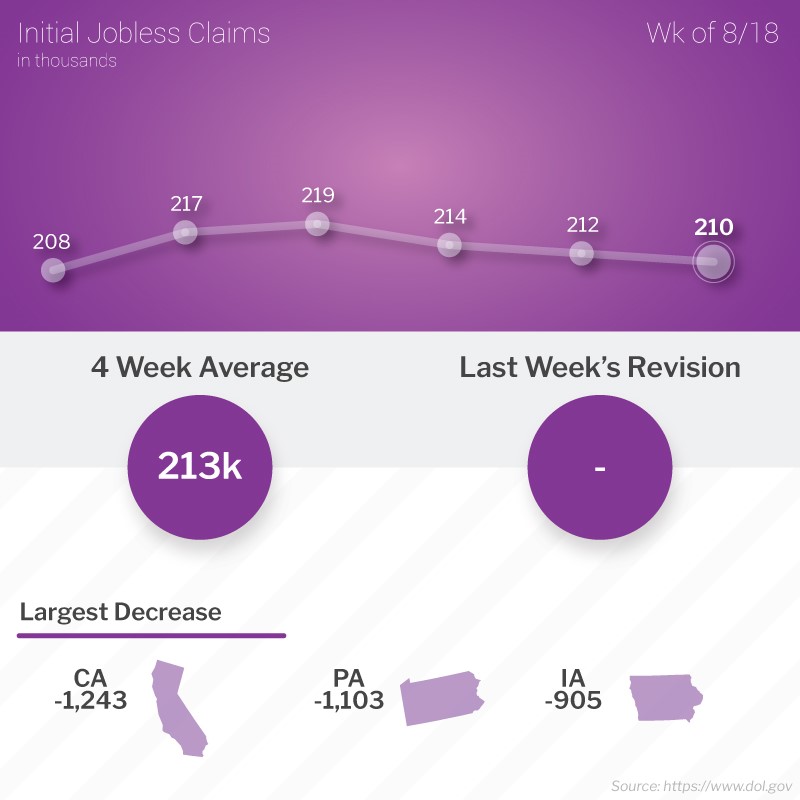

Weekly Initial Jobless Claims were released on Thursday and decreased of 2,000 claims to 210,000 claims for the week. This was the “sample week” to be used in the modeling and estimates of the Bureau of Labor Statistics August Jobs Report. This low claims figure would point to a strong August Jobs Report, which will be released on Friday September 7, 2018.

The Week Ahead in Mortgage Rates

For the Week of August 27, 2018 thru August 31, 2018

S&P/Case Shiller Home Price Index on Tuesday

Consumer Confidence on Tuesday

Gross Domestic Product on Wednesday

Consumer Sentiment Index on Friday

Weekly Initial Jobless Claims on Thursday

PCE Inflation Report on Thursday

In Housing News

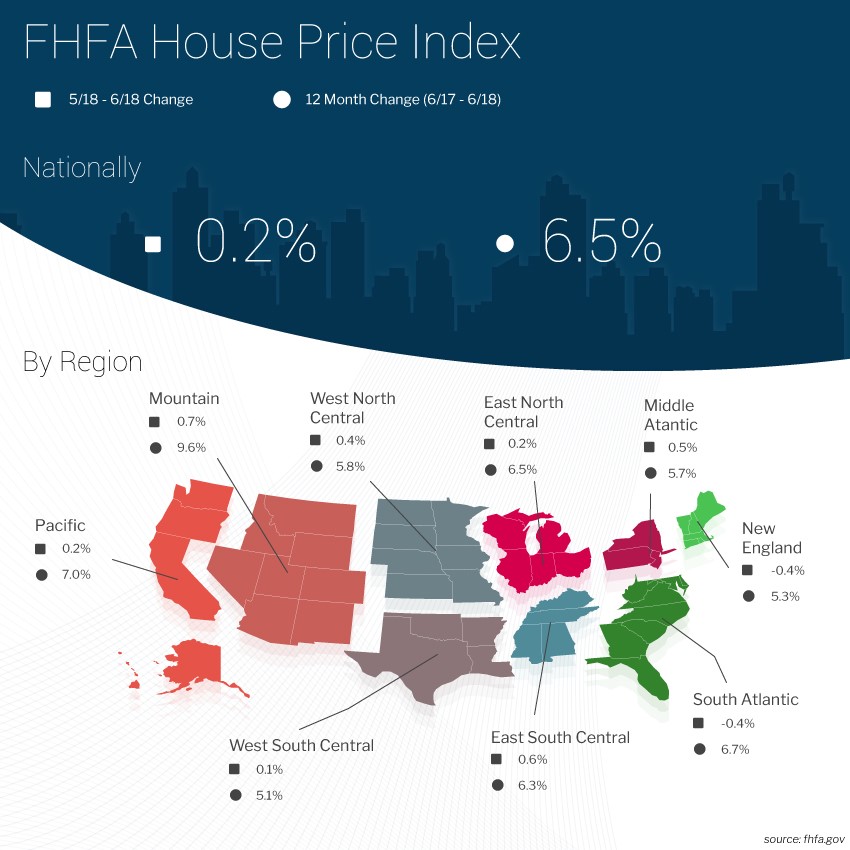

The Federal Housing Finance Agency (FHFA) released their Home Price Index for June 2018 which showed home prices rose 0.2% from May 2018 and year over year are up 6.5% from June 2017. The South Atlantic Regios which includes Delaware and Maryland saw a 0.4% drop in home prices but was up 6.7% from June 2017. The Mid Atlantic Region which includes Pennsylvania and New Jersey was up 0.5% and was up 5.7% from June 2017.

New Home Sales for July 2018 declined by 1.7 percent from June 2018 to an annual rate of 627,000 units which was below expectations of 645,000 units. Even though sales were down month over month, they are up 12.8 percent from July 2017. The median sales price of a new home was $328,700 and the supply of new homes for sale was 5.9 month supply which is near the 6 month levels considered normal. New home construction is doing very well with the 12.8 percent year of year increase in new home sales.

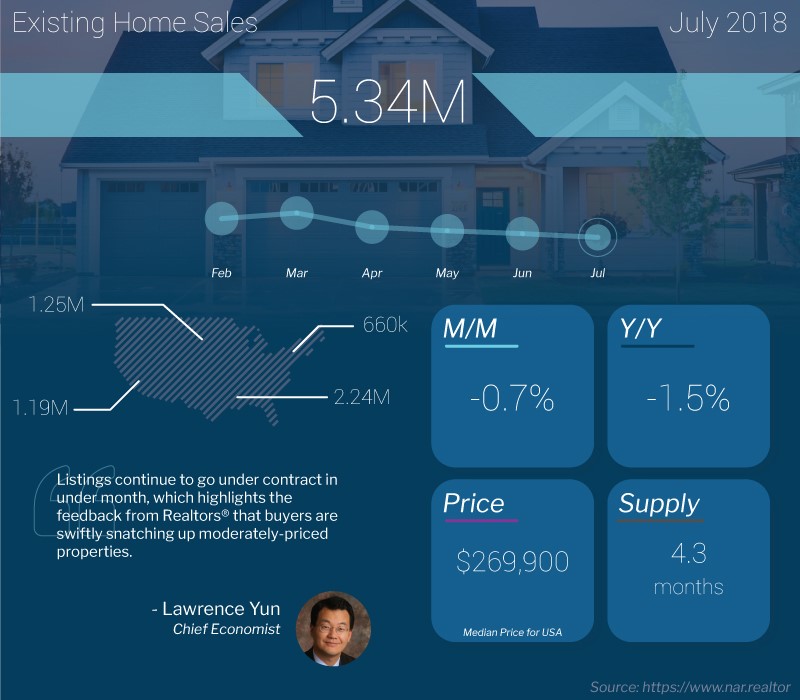

Existing Home Sales for July 2018 fell 0.7 percent from June 2018 to 5.34 million units on annualized basis. This was below expectations of 5.40 million units. This was also the fourth straight month of declines for existing home sales and their slowest pace in more than 2 years. Existing home sales are down 1.5 percent from July 2017. The median home price for an existing home sale was $269,600 which was a decline from $276,900 reported for June 2018. Median home prices are up 4.5% year over year. First Time Home Buyers rose from 31% of sales to 32% of sales in July 2018.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday September 22, 2018 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday September 26, 2018 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday September 15, 2018 in Hyattsville, Maryland

Maryland First Time Home Buyer Seminar is Saturday October 27, 2018 in Hyattsville, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam