Mortgage Rates Weekly Update [August 20 2018]

Mortgage Rates Weekly Update for August 20, 2018

Mortgage Rates Update for August 20, 2018 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates were able to end the week slightly lower and closed above the 100 day moving average on Friday which has been a very tough ceiling of resistance for several months. IF you look at the mortgage bond chart below you can see mortgage bonds are now in a short term upward trend which means mortgage rates are moving lower. If mortgage bonds can close above the 100 day moving average on Monday that would be a very good sign so we are recommending FLOATING Your mortgage rate to start the week to see if mortgage bonds can remain above the 100 day moving average. If bonds fall back below the 100 day moving average we would switch to a locking stance.

In Economic News

US Stocks were able to rebound to end the week after it was announced President Trump of the US and the Chinese lead Xi Jinping hope to discuss trade in November. There will be preliminary talks between the US and China leading up to the November meeting to hopefully work out a trade deal.

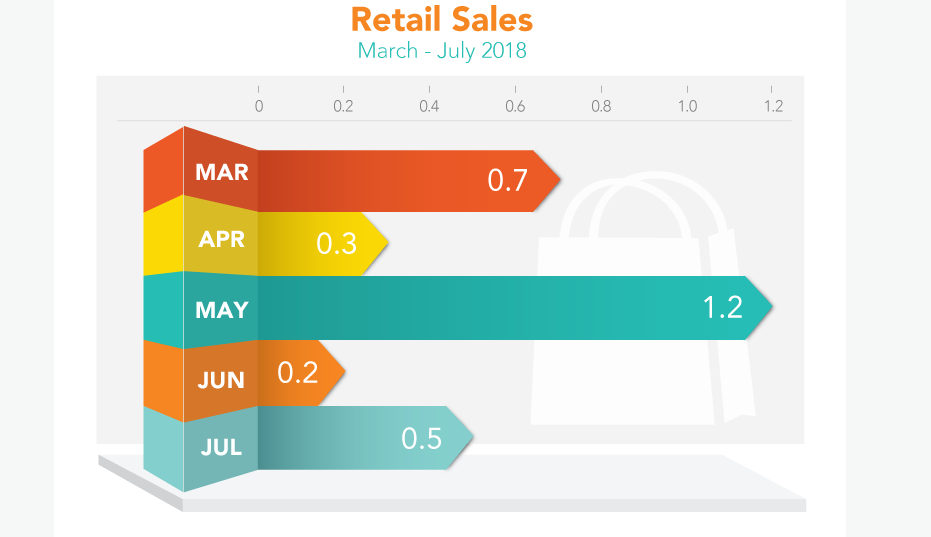

Retail Sales for July 2018 rose 0.5 percent from June 2018 which was a very good number and showed that consumers were splurging in July. This solid retail sales number signals that the U.S. economy is doing very well as consumer spending makes up the bulk of the US economy. Retail Sales were up 6.4 percent from July 2017. Retail Sales should continue to do good with the back to school season upon us now, Halloween and holiday shopping season down the road.

Weekly Initial Jobless Claims were released on Thursday and showed a decrease of 2,000 claims to 212,000 claims for the week. The previous week’s claims were revised higher by 1,000 claims to 214,000. Weekly initial jobless claims remain at historically low levels and continue to show a very strong labor market in the United States which is also supported by historically low unemployment rate of 3.9%. If this continues, it will only be a matter of time before wage pressure inflation starts to show up.

The Week Ahead in Mortgage Rates

For the Week of August 20, 2018 thru August 24, 2018

Existing Home Sales will be released on Wednesday

New Home Sales will be released on Thursday

Weekly Initial Jobless Claims on Thursday

Durable Goods Orders on Friday

In Housing News

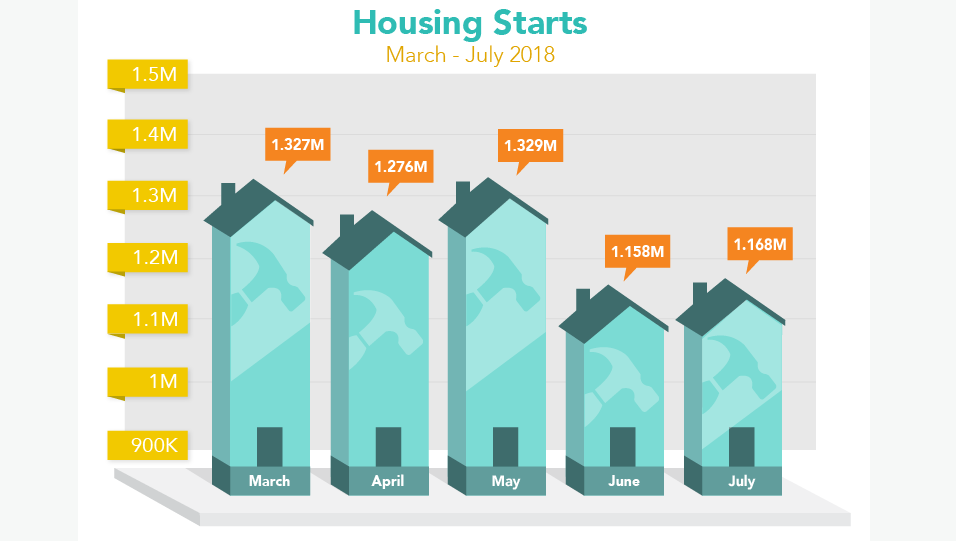

Housing Starts for July 2018 rebounded from a steep decrease seen in June 2018 by increasing 0.9% from June to 1.168 million units on annualized basis. Housing starts measure the number of new homes builders stared construction on in that month. Housing starts are down 1.4 percent from July 2017 mainly because of higher construction costs and land & labor shortages.

Building Permits for July 2018 increased 1.5 percent from June 2018 and are up 4.2 percent from July 2017 which is a very positive report for New home construction. Increase in building permits is a good sign for future construction and means we could see a boost coming in housing starts.

CoreLogic released its Loan Performance Insights for May 2018 showing that loans 30 days or more past due remained stable at 4.2% of all mortgage loans. Seriously delinquent loans which is defined as 90 days or more past due, decreased from 1.9% to only 1.8% of all mortgage loans. Seriously delinquent homes in foreclosure also decreased from 0.6% to only 0.5% of all mortgage loans. The housing market continues to do well in terms of price appreciation and performing mortgage loans.

First Time Home Buyer Seminars Coming Up:

Delaware First Time Home Buyer Seminar is Wednesday August 22, 2018 in Wilmington, Delaware.

Delaware First Time Home Buyer Seminar is Saturday September 22, 2018 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam