Mortgage Rates Update for May 29, 2017

Mortgage Rates Update May 29, 2017

Mortgage Rates Update May 29, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

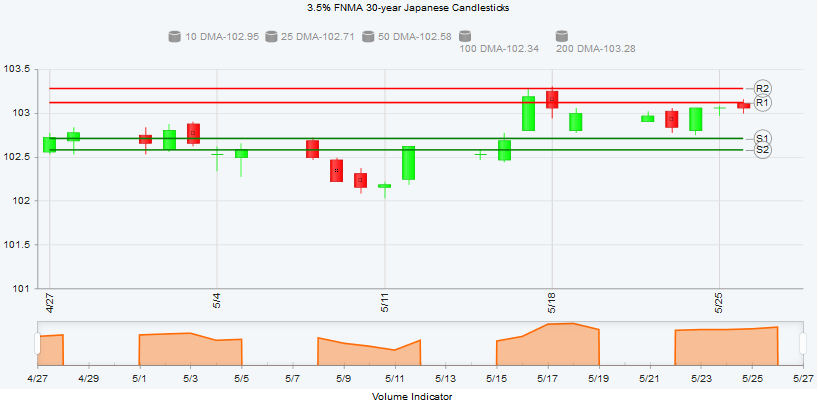

Mortgage Rates ended the week about where they started as mortgage bonds have been trading in a tight range. Looking at the mortgage bond chart below you can see mortgage bonds have been hovering near the highs for the year as bonds have been trading between a tight ceiling of resistance and floor support. With mortgage bonds trading near the highs of 2017, we are recommending LOCKING Your mortgage rate to start the week to take advantage of the lowest interest rates of the year so far.

In Economic News

The Federal Reserve will be meeting in June and there is a 87% chance that they will raise their Fed Funds Rate again. The last time turned out to be good for mortgage bonds so we will have to see how this plays out in June.

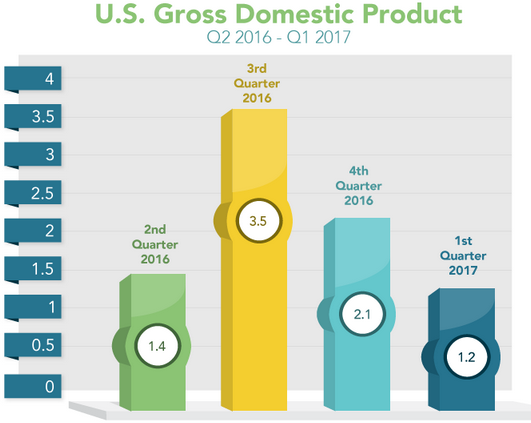

The second reading of Gross Domestic Product (GDP) for the first quarter of 2017 was released last week and was almost twice as strong as the first reading showing the economy grew at 1.2% which was up from the first reading of 0.7% and above expectations of 0.8%. The Federal Reserve is predicting a 4.1% GDP for the 2nd quarter of 2017 which is a very bold prediction so we will definitely need to watch how this plays out.

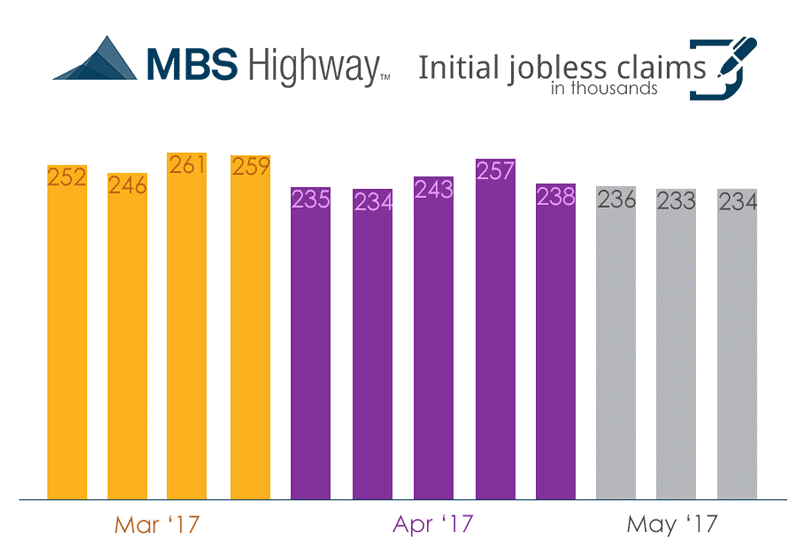

Weekly Initial Jobless Claims were released on Thursday and remain at multi-year lows coming in at 234,000 for the week. The very low weekly initial jobless claims over the last several weeks is one indicator pointing to a strong May 2017 Jobs Report which will be released on June 1st.

In Housing News

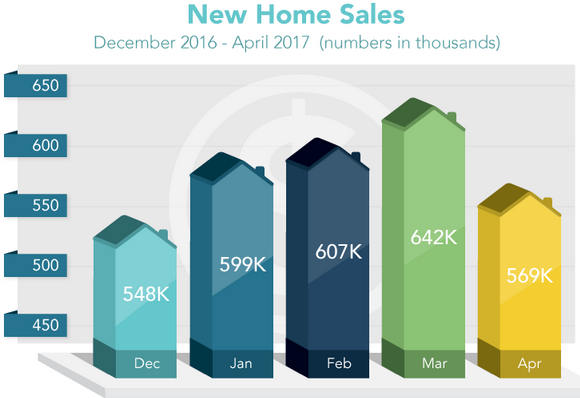

New Home Sales for April 2017 were down 11.4% from March 2017 to 569,000 units on an annualized basis. March New Home Sales was revised even higher to 642,000 from 621,000 originally reported. New Home Sales measures the number of contracts signed by home buyers to purchase new construction homes from home builders. Even with the unexpected drop, New Home Sales are still up 0.5% year over year and last month’s revised number of 642,000 was the strongest report in nearly 10 years so New Home Construction is doing very well and will continue to do so with such low inventory of homes for sale.

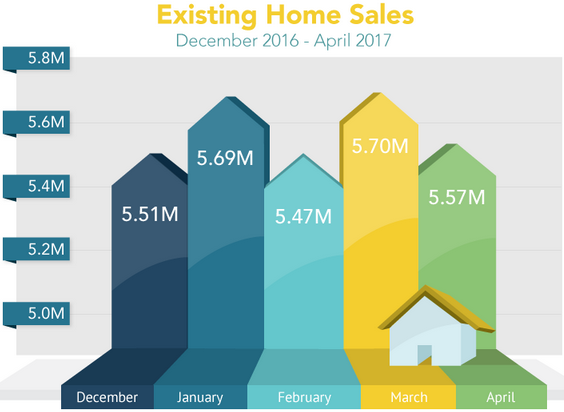

Existing Home Sales for April 2017 dropped 2.3% from March 2017 to 5.57 Million Units on an annualized basis. March’s reading of 5.70 million units was the best reading in 10 years so a pull back in April was expected and doesn’t not signal anything wrong in the housing market. The low inventory will continue to be a challenge home buyer’s but will support increased home prices throughout 2017. The Median Existing Home Price was up 6% to 244,800 as a result of the high demand and low inventory.

USDA Rural Housing Loan Announcement:

USDA announced increases in the household income limit for its USDA Rural Development Loan Program for some parts of the country effective May 17, 2017. New Castle County Delaware increased the household income limit to $95,650 for family of 1 to 4 people. The income limit for Kent County Delaware and Sussex County Delaware remained $79,200 for household of 1-4 people.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday June 17, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday June 24 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate