Mortgage FICO® Credit Scores vs Online Consumer Credit Scores

There is constant confusion about the difference between consumer credit scoring models and the credit scores that mortgage lenders pull which are Mortgage FICO® Credit Scores. Mortgage Lenders only use the FICO® scoring model while Consumer Credit Scores used the Vantage Scoring model.

What is the Consumer Credit Scoring Model?

The Consumer Credit Scoring Model is the Vantage Credit Score created by Experian, Equifax and TransUnion. There are 4 different scoring models:

- Vantage 1.0

- Vantage 2.0

- Vantage 3.0

- Vantage 4.0

Most consumer credit monitoring service companies use Vantage 3.0. The credit scores range from 300-850 on Vantage 3.0 which was updated from earlier versions to match the range that FICO® uses.

Why is My Credit Karma Credit Score So Much Higher than my Mortgage FICO® Score?

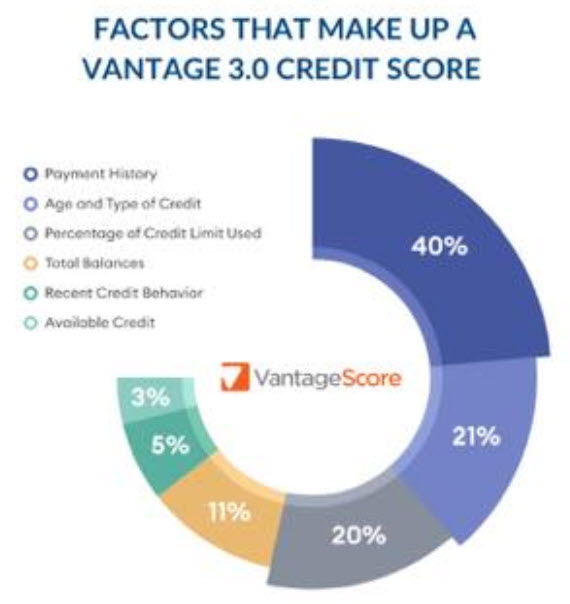

Credit Karma is a Consumer Credit Scoring Model using Vantage 3.0 so even though it has the same score range of 300-850 like FICO®, it has a very different model of what determines the score. The Vantage 3.0 Score is make up of Payment history 40%, Age & Type of Credit 21%, Percentage of Credit Limit Used 20%, Total Balances 11%, Recent Credit Behavior 5%, and Available Credit 3%

What is the Mortgage Credit Scoring Model?

The Mortgage Credit Scoring Model was created by a third party company called Fair, Isaac and Company. This model uses the data reported by the 3 major credit bureaus to calculate credit scores. There are 186 different versions of the FICO® Credit Scoring Model. Mortgage Lenders use very specific versions. The versions used by mortgage lenders are below:

- FICO Score 2

- Fair Isaac Risk Model v2

- FICO Score 5

- Equifax Beacon 5.0

- FICO Score 4 or TransUnion FICO Risk Score 04

FICO® Scores are used in over 90% of lending decisions in the United States so this is what causes confusion. FICO scores range from 300-850. Consumers are looking at Vantage Scores and Lenders are looking at FICO scores.

The mortgage FICO® Credit Scoring Model is based on Payment History 35%, Amounts Owed 30%, Credit History 15%, Credit Mix 10%, and New Credit 10%.

What are Mortgage FICO® Scores Need to Apply for a Mortgage Loan?

The credit score used to determine if you qualify for a mortgage loan is called your qualifying credit score which is simply the middle of your three FICO® scores. For example if you have the following credit scores:

- TransUnion – 663

- Experian – 710

- Equifax – 661

The lender will use your middle score of 663 from TransUnion as your qualifying score. The minimum qualifying score for a mortgage loan is determine by the loan type minimum score and if the lender has any overlays. Below are example minimum qualifying scores by loan type

FHA Loan – 580 minimum for 3.5% down and 500 minimum with 10% down

VA Loan – 580 minimum score

Conventional Loan – 620 minimum score

USDA Loan – 620 minimum score

First time home buyer program – 620 minimum score

If you need help getting pre-approved for a Mortgage Loan to purchase or refinance a home, please give the John Thomas Team with Primary Residential Mortgage a call at 302-703-0727 or APPLY ONLINE

FICO® disclaimer: FICO® is a registered trademark of Fair Isaac Corporation.