Is Your Delaware Loan Officer Licensed?

Is Your Delaware Loan Officer Licensed?

How can you check to see if your Delaware loan officer is licensed to do business as a loan originator and even if they are licensed to do business in Delaware? It is real easy to check, every loan originator is required to have a loan originator license number with the National Mortgage Licensing System (NMLS). You can look up anybody at the following website:

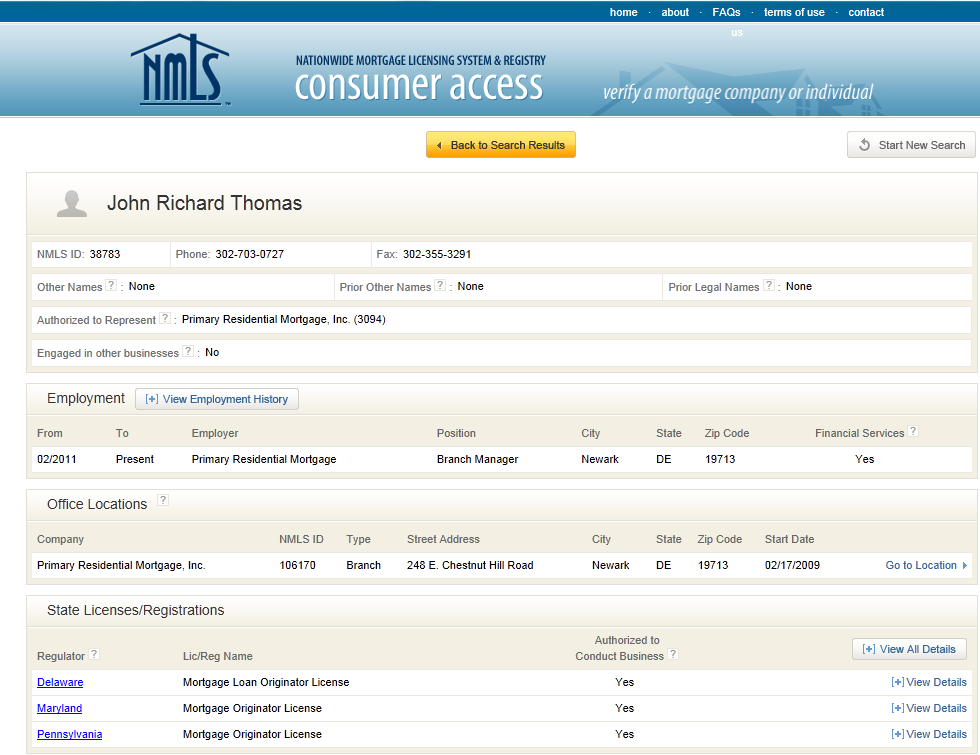

You should always check to see if a loan officer is licensed and they should always be able to provide you with their NMLS number. For example, my NMLS is 38783 so you can look me up by name, John Richard Thomas or NMLS number, 38783. Once you find me, it will tell you what company I work for, Primary Residential Mortgage, Inc., what states I am currently licensed to do business in and if my licensed is active or expired. See below for picture from NMLS consumer website:

Is there a difference between a Federal Charter Bank Loan Officer and Non-Depository Loan Officer?

Yes! There is a big difference when working with a loan officer that has been licensed by Federally Chartered Bank such as Wells Fargo or Bank of America versus working with a Loan Officer with a Non-Depository bank because the licensing process is completely different.

Requirements for Federally Chartered Bank Loan Officer to be Licensed:

- Register with NMLS

- No education requirements and not required to pass a national licensing test

- No continuing education requirements

Requirements for Non-Depository Bank Loan Officer or Mortgage Broker Loan Officer:

- Complete 20 Hours of Pre-licensing education

- Pass National Licensing Exam

- Complete Annual Licensing continuing education of a minimum of 8 hours for Federal and any state requirements

As you can see working with a loan officer that has taken the time to complete a 20-hour pre-licensing course and to pass a National Licensing exam will have much more knowledge and skill than a loan officer who is not required. A person that is not able to pass the National licensing test can still go work for a Federally Chartered bank and it licensed whereas they cannot get licensed otherwise it can’t pass the test.

Delaware Loan Officer John Thomas with Primary Residential Mortgage

If you are looking for an experienced local Delaware mortgage loan officer that has the knowledge and skill to lead your through the complex mortgage process, then please give me and my team a call at 302-703-0727 and we will be happy to assist you with the purchase or refinance of a home in Delaware. We are experts on the following loan programs:

- Delaware Conventional Loans

- Delaware FHA Loans

- Delaware FHA 203k Loans

- Delaware FHA Streamline Refinance Loans

- Delaware FHA One Time Close Construction Loan

- Delaware USDA Loans

- Delaware USDA Streamline Refinance Loans

- Delaware VA Loans

- Delaware VA IRRRL Refinance Loans

- Delaware HomeStyle Renovation Loans

- Delaware home ready 97% Loans

- Delaware Reverse Mortgages

- Delaware First Time Home Buyer Programs

- Delaware Down Payment Assistance Programs

If you would like to apply for a Delaware mortgage loan to purchase or refinance a home in Delaware call 302-703-0727 or APPLY ONLINE.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713