Ground Up Construction Loans for Builders & Investors

Flexible Financing for Experienced Builders & Real Estate Investors

Ground Up Construction Loans for experienced home builders. We provide funding to get your next building project off the ground. Whether you’re building to sell or creating a long-term rental portfolio, this flexible construction loan program is designed to help experienced builders and investors break ground faster and smarter.

This isn’t your average construction loan. With fast approvals, interest-only payments, and options for SPEC and build-to-rent projects, it’s tailored to support professionals ready to scale. If you’re planning to build a new home or investment property from the ground up, traditional financing often falls short. That’s where the Ground Up Construction Loan Program from the John Thomas Team comes in. Looking to get started ASAP? Call us at 302-703-0727 or APPLY ONLINE.

This program is designed to keep construction projects moving forward with:

- A Seamless transition to permanent financing

- Fast Approvals

- Flexible Interest-Only Payment Options

Who Qualifies for Ground Up Construction Loans?

This program is built specifically for experienced builders. To be eligible, applicants must meet one of the following criteria:

- Complete 3 New Construction Builds, or

- Complete 2 New Builds & 1 Major Renovation (valued over $200,000)

Additional borrower qualifications include:

- Good credit history

- Strong asset position (to cover reserves and overruns)

- Valid business entity (LLC or Corp)

- Ability to provide project plans, permits, cost breakdown, and exit strategy

Key Features of Ground Up Construction Loan

- Finance up to 85% of total project costs (land + construction)

- Up to 80% of construction costs based on approved plans and permits

- Reimbursement for up to 60% of lot purchase price

- No income documentation required

- 12-month and 18-month term options

- Interest-only payments during construction

- Loan Origination fees can be rolled into the loan to reduce upfront cash required

- Designed for SPEC builds and build-to-rent investment properties

All construction financing is based on detailed project plans, builder experience, and a review of credit and assets—no income docs or tax returns required.

Ideal for SPEC Builders and Real Estate Investors

Whether you’re planning to sell after construction or retain the property as a rental, this program can support either strategy. This loan is built for investors using one of these models:

- SPEC builds: Construct homes to sell after completion

- Build-to-rent: Create long-term rental assets with construction-to-hold financing

- Multi-unit developments: Build multiple homes or townhomes on subdivided land

- Land banking: Purchase and hold land with improvement potential

This construction loan program is ideal for new home developments or investment property portfolios.

Flexible Terms, Interest-Only During Construction

With 12-month and 18-month interest-only terms, you can maintain more control over cash flow while construction is underway. This structure is ideal for managing labor and material costs without straining your monthly budget.

How Draws and Disbursements Work

Construction funds are not released all at once—they’re paid in draws based on completed work stages.

Typical draw schedule milestones include:

- Foundation completed

- Framing finished

- Mechanical, Electrical & Plumbing (MEP) rough-ins complete

- Drywall and interior finish

- Final inspection and certificate of occupancy

Interest is charged only on the funds drawn—not the full loan amount—helping preserve cash flow during construction.

Construction-to-Permanent Financing Option

While this loan is primarily structured as construction-only financing, we offer optional construction-to-perm transitions for qualified projects.

What this means:

- We can offer a DSCR Refinance out of the Construction Loan into a permanent Loan

- Ideal for rental properties

How Loan Approval Works

Unlike traditional construction loans that require income verification and lengthy underwriting, this program is evaluated based on:

- Builder qualifications and project history

- Construction plans, permits, and timeline

- Credit and asset review

Everything is designed to move quickly—so you can focus on building, not chasing paperwork.

Example Ground Up Construction Loan Fee Worksheet

Related Program: Construction-to-Permanent Loans

Looking for one loan that covers both the build and long-term financing? Check out our Construction-to-Perm options for primary residences and custom home builds.

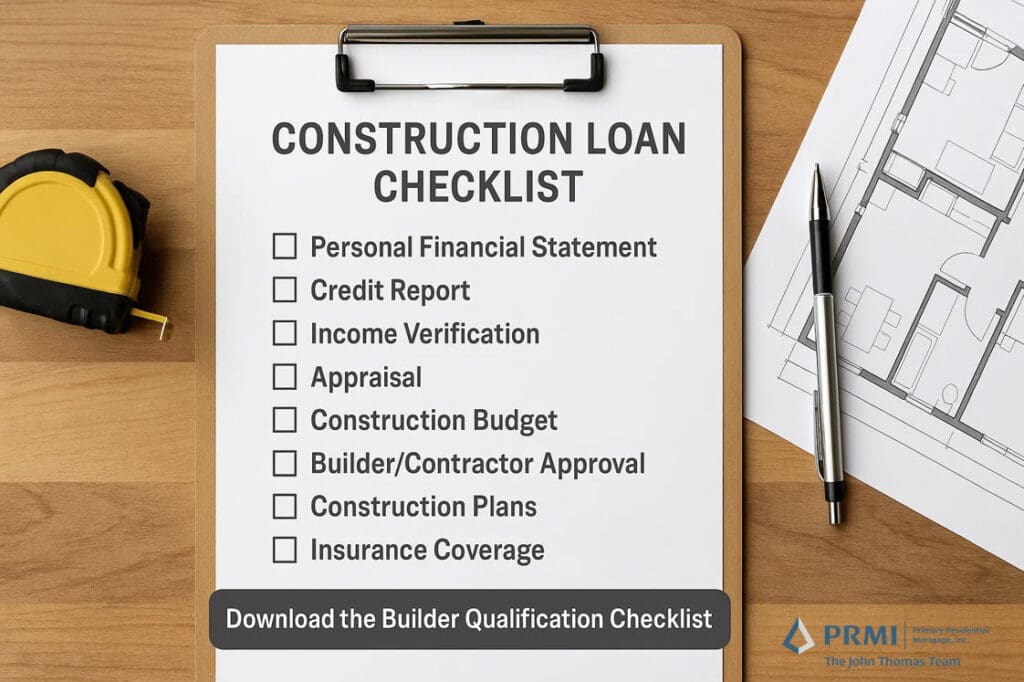

What You Need to Apply:

You don’t need income docs or tax returns, but you will need:

- Builder resume or list of completed projects

- Approved plans and permits

- Detailed project budget and cost breakdown

- Project timeline and draw schedule

- Lot purchase documentation (if reimbursement is requested)

- Entity documents (for LLC/Corp applicants)

- We will need to obtain a tri-merge credit report

- Asset statements (cash or reserves)

Download the Builder Qualification Checklist

Want to know if you qualify? Use our free checklist to find out what you’ll need to apply.

Download the Builder Qualification Checklist (PDF)

Common Pitfalls to Avoid

Experienced investors know the risks—here’s what to watch for:

- Cost overruns: Always include a 10–20% contingency buffer

- Timeline delays: Weather, permits, or subcontractor delays can push you past the loan term

- Underqualified builder: Lender must approve the builder and confirm track record

- Lack of exit clarity: Be sure you have a clear plan for sale, refinance, or tenant occupancy before applying

Get Started with Ground Up Construction Financing Today

If you’re an investor or builder searching for a reliable Ground Up Construction Loan in Delaware, this program was built for you.

Schedule Your Free Construction Loan Consultation

Or call us directly:

John Thomas (NMLS 38783) Construction Lending Specialist with Primary Residential Mortgage

- 302-703-0727

- Team@johnthomasteam.com

- APPLY ONLINE

Frequently Asked Questions: Ground Up Construction Loans in Delaware

What is a ground up construction loan?

A ground up construction loan is a short-term loan used to finance the construction of a new property from the ground up. It typically covers land, permits, labor, and materials, and is followed by permanent financing after completion.

How much of my project can I finance?

You can finance up to 85% of the total project cost, including the land and construction expenses.

Can I get reimbursed for a lot I already purchased?

Yes. This program allows reimbursement of up to 60% of the lot purchase price if it’s part of your approved plan.

Who qualifies for this loan program?

Experienced builders who have completed either 3 new construction projects, or 2 new builds and 1 major renovation over $200,000.

Do I need to verify my income to qualify?

No income documentation or tax returns are required. Approval is based on builder experience, credit, project scope, and available assets.

Is this program available for investment properties?

Yes. Financing is available for both SPEC builds (to sell) and build-to-rent projects.

What are the loan terms and payments like?

You can choose a 12- or 18-month term. Payments during construction are interest-only to help maintain cash flow.

How fast can I get approved?

This program is designed for fast review. Turnaround depends on how quickly you submit your builder resume, plans, and credit/assets info.

Do I need final permits to apply?

No. Permits aren’t required to begin the application, but approved plans and permit details will be reviewed before final approval.

What happens after construction is complete?

You’ll transition into permanent financing—either through a new loan or a pre-arranged construction-to-perm structure.

How do I apply?

You can APPLY NOW or call 302-703-0727 to speak with a construction loan expert.