FHA Manufactured Home Loans: What You Need to Know

FHA Manufactured Home Loans: Purchase & Refinance Guide

Learn how FHA manufactured home loans work for purchasing and refinancing HUD-code manufactured homes. FHA loans are for primary residences only.

Manufactured homes can be an affordable path to homeownership, and the FHA manufactured home loan can make financing more attainable. In this guide, we cover eligibility, property requirements, how to use an FHA manufactured home purchase loan, and your options to refinance a manufactured home with FHA. Important note: FHA loans are for primary residences only—not second homes or investment properties. If you would like to apply for a FHA Manufactured Home Loan to purchase or refinance a property, give John Thomas Team with Primary Residential Mortgage a call at 302-703-0727 or APPLY ONLINE.

FHA Manufactured Home Loan Overview

FHA offers pathways for eligible HUD-code manufactured homes (built on or after June 15, 1976) when they meet installation and foundation standards. Two common approaches you’ll hear about:

- Title I (Manufactured Housing Program): Can finance the home, the lot, or both. In some cases, the home may be on leased land if the lease meets HUD requirements.

- FHA 203(b) / Standard FHA (as Real Property): When the manufactured home is permanently affixed to an acceptable foundation and classified as real estate with the land owned by the borrower.

Both routes still require that the home meets HUD construction standards and that you use the property as your primary residence. FHA Manufactured Home Loans allow Single Wide, Double Wide & Multi-Wide Homes. You can read more about Manufactured Home Loan options

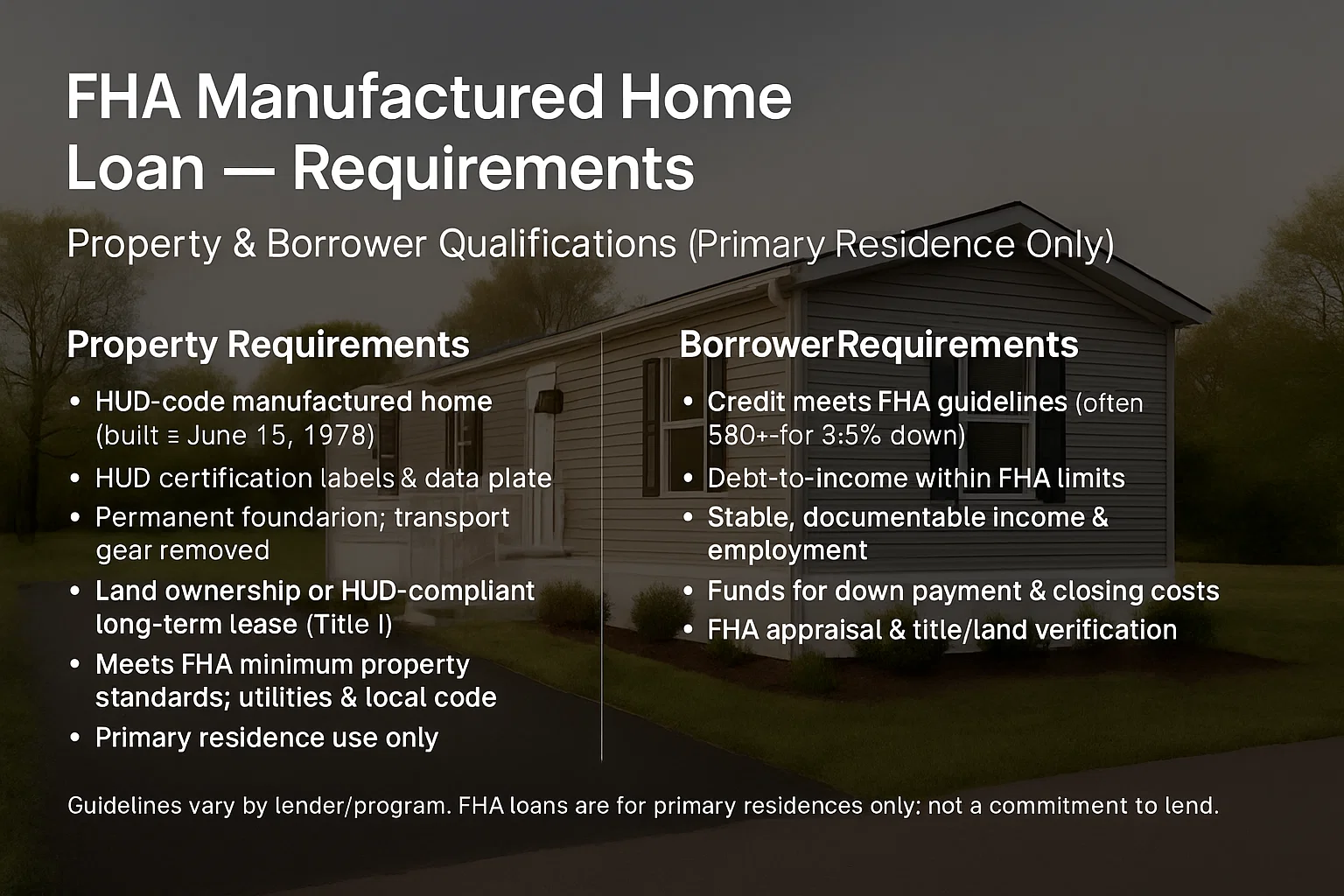

Property & Borrower Requirements

Potential borrowers will need a minimum 580 Credit score for 3.5% down payment on a purchase or a minimum 500 credit score with 10% down payment. Here are the typical guidelines lenders look for when evaluating an FHA manufactured home mortgage:

| Requirement | What It Means |

|---|---|

| HUD Certification | Home built on or after June 15, 1976 with HUD data plate and certification label (HUD tag). |

| Foundation & Installation | Permanently affixed to an FHA-acceptable foundation; transport equipment (wheels, tongue) removed. |

| Real Property or Eligible Lease | Borrower owns the land (fee simple) or has a HUD-compliant long-term lease (Title I). |

| Condition & Utilities | Meets FHA’s minimum property standards, with safe utilities and local code compliance. |

| Primary Residence | FHA financing is for principal residences only |

| Borrower Qualifying | Credit, income, and debt-to-income must meet FHA guidelines. Minimum down payment typically 3.5% with qualifying credit. |

Using FHA to Purchase a Manufactured Home

- Confirm Site/Land: Will you own the land, or is it an eligible long-term lease? Verify zoning and utility access early.

- Verify Home Eligibility: HUD tags, data plate, and a compliant foundation/installation are required.

- Get Pre-Approved: Determine your price range, down payment, and estimated payment.

- Appraisal & Title Work: FHA-approved appraisal and title/land documentation are required.

- Close & Move In: Once installation and inspections are complete, you can close and take occupancy.

Down Payment: As low as 3.5% for qualified borrowers. Loan Terms: Up to 30 years when classified as real property; Title I terms may vary based on whether the lot is included.

Can You Use a Down Payment Assistance Program with a FHA Manufactured Home Loan?

Yes, you can use a Down Payment Assistance Program with a FHA Manufactured Home Loan. For Example in Delaware, DSHA offers their First State Home Loan DPA Program for FHA Manufactured Home Loan as long as each borrower has a minimum 660 Credit Score. The PRMI Empower Down Payment Program allows either a 3.5% or a 5% DPA for Manufactured Homes with a minimum 600 Credit Score and is available in every state but New York.

Can You Use a FHA203k Rehab Loan with a Manufactured Home?

Yes, you can use a FHA 203k Rehab Loan when purchasing or refinancing a manufactured home. You can use the FHA 203k Limited Version which limits the repair amount to $75,000 or you can use the FHA203k Full version which doesn’t set a repair loan limit and only limits you by the FHA county loan limit.

Can You Use a FHA One Time Close Construction Loan to Purchase a New Manufactured Home?

Yes, you can use a FHA OTC Construction Loan to purchase land and a manufactured home to be placed on the land. The purchase of the land and the manufactured home are done in one. The home is placed on the land after closing. The construction interest is built into the loan so there are no mortgage payments required during the construction of the home. The closing costs can also be rolled into the purchase price. A minimum credit score of 620 is required for the FHA One Time Close Construction Loan.

FHA Refinance Options for Manufactured Homes

FHA Streamline Refinance (Existing FHA Loans)

-

Reduced documentation; often no appraisal depending on lender and program rules.

-

Typically used to lower interest rate and/or monthly payment (no cash-out).

-

Must meet FHA’s net tangible benefit requirements.

FHA Rate-and-Term Refinance

-

Refinance to adjust rate, term, or both when the home is classified as real property.

-

Cash-out may be limited and requires stronger qualifications and adequate equity.

Title I Refinance

-

Available for eligible manufactured housing and, in some cases, the lot.

-

Maximum terms can be shorter than standard 30-year mortgages, depending on what is financed.

Common Pitfalls & How to Avoid Them

- Lender Availability: Not every lender offers manufactured housing; work with a team that does this regularly.

- Classification Issues: Converting from personal property to real property can be complex without a compliant foundation and proper title work.

- Leased Land Rules: No Eligible for Traditional FHA Loan.

- Appraisal Comparables: Manufactured homes can have fewer comps, which may impact value—set expectations early.

Why Work with John Thomas Loan Officer

- Experience with FHA manufactured home loans (purchase and refinance).

- Guidance on HUD tags, foundations, appraisals, and title classification.

- Local expertise and a streamlined process from pre-approval to closing.

If you’d like a free consultation to see if an FHA manufactured home loan is viable in your situation—or to check whether a refinance makes sense—feel free to reach out to me at (302) 703-0727 or via my contact page.

Helpful Resources

FHA Manufactured Home Loans – FAQ

Are FHA manufactured home loans only for primary residences?

Yes. FHA financing is limited to principal residences—not second homes or investment properties.

Do I need to own the land?

For standard FHA as real property, yes—you’ll own the land and home. Under Title I, leased land may be allowed if the lease meets HUD requirements.

What documentation proves my home is HUD-compliant?

Homes must display HUD certification labels (HUD tags) and a data plate. Your lender/appraiser will verify these.

Can I refinance my manufactured home with FHA?

Potentially, yes. Options include FHA Streamline (for existing FHA loans), FHA rate-and-term, or Title I—depending on how the home is classified and your goals.

How much do I need for a down payment?

Many borrowers qualify with as little as 3.5% down with a minimum 580 credit score or 10% Down with a minimum 500 Credit Score. Your exact requirement depends on credit, income, and overall profile.