DSHA First State Home Loan DPA Program

DSHA First State Home Loan Down Payment Assistance Program was formerly known as the Preferred Plus DPA Program. The First State Home Loan is a second mortgage loan to help Delaware home buyers with down payment and closing costs. The program is a 0% interest loan and requires no payments for 3% of the mortgage loan amount. The program can only be used in combination with a DSHA Welcome Home Mortgage Loan or a DSHA Home Again Mortgage Loan. Get Started by calling the John Thomas Team at 302-703-0727 or APPLY ONLINE.

What are the Guidelines for the DSHA First State Home Loan Program?

The DSHA First State Home Loan Down Payment Program will be a soft second mortgage loan with the following terms and guidelines:

- Minimum 620 Credit Score for all borrowers to be eligible

- Must attend 8 hours of HUD approved home buyer counseling if credit score is less than 660

- Manual Underwritten Loans require a 660 Credit Score for all borrowers

- Must be under the total household income limit for the first mortgage program

- Must be purchasing a home at or below the maximum purchase price per county

- Will receive 3% of the first mortgage loan amount

- Must use one of DSHA’s first mortgage programs through an approved DSHA Mortgage Lender such as the John Thomas Team with Primary Residential Mortgage

- Must sign a Note and Mortgage for the Soft Second Mortgage at closing

- Must purchase property as your primary residence

What are the Eligible Property Types for this Program?

If you would like to qualify for a DSHA First State Home Loan DPA then you must be purchasing the property in the state of Delaware as your primary residence. The program is available in all three counties of Delaware: New Castle County, Kent County & Sussex County. The following is a list of the eligible property types for this DPA Program:

- Single Family Residence (SFR)

- Townhomes & Row Homes

- Warrantable Condominiums

- 2-4 Family Units

- Double Wide Manufactured Homes for FHA Loans Only (Must have 660 Credit Score)

The following property types are NOT Eligible property types:

- Investment Properties

- Second Homes

- Non-Warrantable Condos

- Co-ops

- Mobile Homes on Leased Land

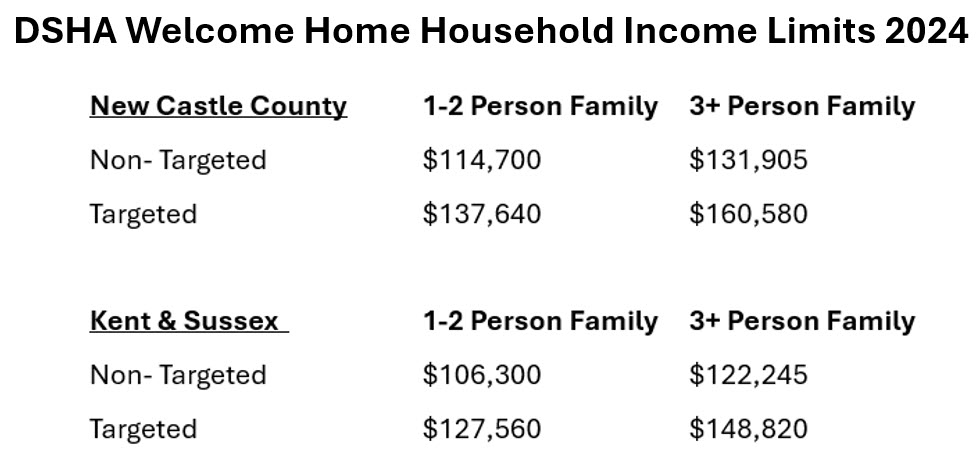

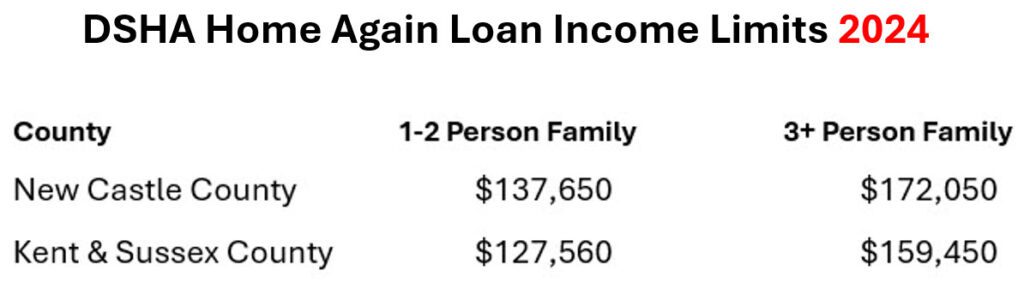

What are the Household Income Limits for the First State Home Loan Program?

The Household income limits are set by DSHA and are based on the county in which the property is located, the number of people in the household and which first mortgage program being used. Below is the household income chart for the Welcome Home Mortgage Loan Program:

Below is the household income chart for the Home Again Mortgage Loan Program:

Example of DSHA First State Home Loan DPA Calculation

If you are purchasing a home in Delaware for $350,000 and are pre-approved for the DSHA Welcome Home FHA Loan through an approved lender and want to use the First State Home Loan DPA Program then below would be calculation of how much money you would receive:

Purchase Price – $350,000

Down Payment – $12,250 (3.5%)

FHA Loan Amount – $343,660 (Includes FHA upfront mortgage insurance premium)

DSHA First State Home Loan DPA – $10,309.80

When Do You have to Pay the DPA Loan Back?

The DSHA First State Home Loan DPA is termed a soft second mortgage and is recorded as a lien against the property you are purchasing. The interest rate is 0% fixed for the whole time you have the loan. You are not required to make any payments on the loan and only have to pay the loan back if one of three things happen:

- When you Sell the Home – Must pay loan back

- When you Refinance your First Mortgage – Must pay loan back

- When you no longer occupy the property as your primary residence – Must pay loan back

How Do You Apply for the DSHA First State Home Loan Grant?

You can apply to take advantage of the First State Home Loan DPA Program by calling DSHA approved Lender, the John Thomas Team with Primary Residential Mortgage at 302-703-0727 or APPLY ONLINE.