Delaware Mortgage Rates Weekly Mortgage Market Update February 11, 2013

Delaware mortgage rate weekly mortgage market update for the week of February 11, 2013, by John Thomas with Primary Residential Mortgage in Newark, Delaware. John is the Newark, DE Branch Manager and the author of the book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 to get a free mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Delaware mortgage rates tried to move lower last week but ended the week higher after good economic news was reported coming out of China. The mortgage bonds tried to rally but failed to move above the 200 days moving average and were turned lower on Friday after China reported signs of economic recovery, as exports, imports, and lending soared. Mortgage bonds are still trading in a tight range and would need to break above the 200 days moving average in order for home loan rates to move back toward all-time historic lows. We are recommending carefully FLOATING your Delaware mortgage rate on Monday to see if mortgage bonds can move above the 200 days moving average if bonds move lower then I would recommend LOCKING your Delaware mortgage rate.

Last week saw goods news on the housing market, 2012 saw home prices increase by 8.3%. This was the first home price increase since 2006 and is proof that the housing market may have hit bottom in 2012. Projections for the housing market for 2013 is for home prices to appreciate by between 7-10%.

Last week saw goods news on the housing market, 2012 saw home prices increase by 8.3%. This was the first home price increase since 2006 and is proof that the housing market may have hit bottom in 2012. Projections for the housing market for 2013 is for home prices to appreciate by between 7-10%.

The Congressional Budget Office (CBO) released projections on the economy for 2012 and it was not good news. CBO projected the GDP to only grow by 1.4% which is not enough to move the unemployment rate lower. GDP predicted the unemployment rate to stay at 7.9% in 2013. The economy will be slowed by cuts in government spending and higher taxes. On March 1, 2013, automatic spending cuts from fiscal cliff will create an $85 billion cut in federal government spending between March 1 through September, the first installment of $1.2 trillion in planned, decade-long reductions. The Pentagon budget would be cut 7.3% and domestic discretionary programs by more than 5%.

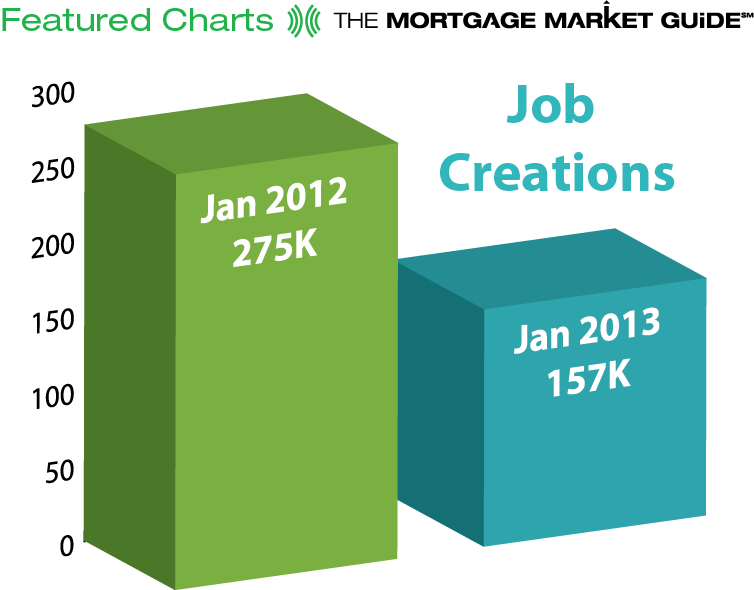

We also saw job creation for January 2013 came in below expectations at 157,000 and it is also way below January 2012 which was 275,000. This is showing the labor market is still struggling and explains why unemployment is staying stubbornly high at 7.9%.

We also saw job creation for January 2013 came in below expectations at 157,000 and it is also way below January 2012 which was 275,000. This is showing the labor market is still struggling and explains why unemployment is staying stubbornly high at 7.9%.

We also saw more bad news out of Europe as Greece is not going to be able to meet its third bailout terms as Greece remains in a depression. Spain also continues to have double-digit unemployment and has the second largest debt load in the European Union. Other countries in the Union are continuing to struggle as well so this may help mortgage bonds move higher if safe haven trade were to pick up again. Mario Draghi, the Ben Bernanke of Europe, announced that its key lending rate would remain at a record low 0.75%. He acknowledged weakness in the overall European economy for the fourth quarter of 2012 and the beginning of 2013, but he said the ECB believes a gradual recovery should begin later in 2013.

Italy goes to the polls later this month. The former Prime Minister Silvio Berlusconi is running from behind in the polls but gaining, on a platform that is anti-austerity. The current center-left coalition has promised to continue the reforms of Mario Monti and what has been called his style of “technocratic government. If voters are seen as rejecting austerity, it might put some unwanted attention on Italy, and it could spook the markets.

In local housing news, the Delaware State Housing Authority (DSHA) announced that it is ending the Rebuilding Our Communities (ROC) Program as 100% of the funds have been already allocated. So effective immediately there is no more ROC program available for Delaware home buyers. There are still our Delaware down payment assistance programs available.

USDA Rural Housing Program will be changing eligible areas effective March 27, 2013, when it switches to using the 2010 census data to determine which areas qualify. The newly updated areas should be available after February 28, 2013. In Delaware it is projected that Middletown and Smyrna will no longer be eligible for USDA financing.

The next Free Delaware First Time Home Buyer Seminar is Saturday, February 16, 2013, in Newark, Delaware and Tuesday, February 19, 2013, in Dover, Delaware. Register by calling 302-703-0727 or Register online at http://www.delawarehomebuyerseminar.com/

Then next Free Maryland First Time Home Buyer Seminar is Saturday March 23, 2013, in Towson, Maryland. Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713