Mortgage Rates Weekly Update [May 12 2019]

Mortgage Rates Weekly Update for May 12, 2019

Mortgage Rates Update for May 12, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

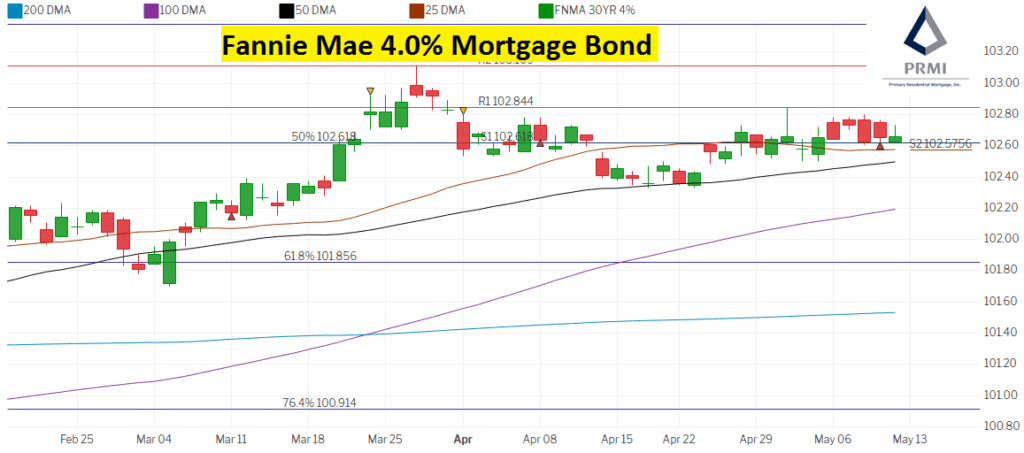

Mortgage Rates ended the week right where they started as mortgage bonds failed to mount a rally. If you look at the mortgage bond chart below, you can see mortgage bonds rallied each day with long candle but closed down with the red candle. Mortgage bonds still closed above the 25 day moving average which is acting as a strong floor of support so we are recommending FLOATING Your mortgage rate to see if bonds can mount a rally and move mortgage interest rates lower.

In Economic News

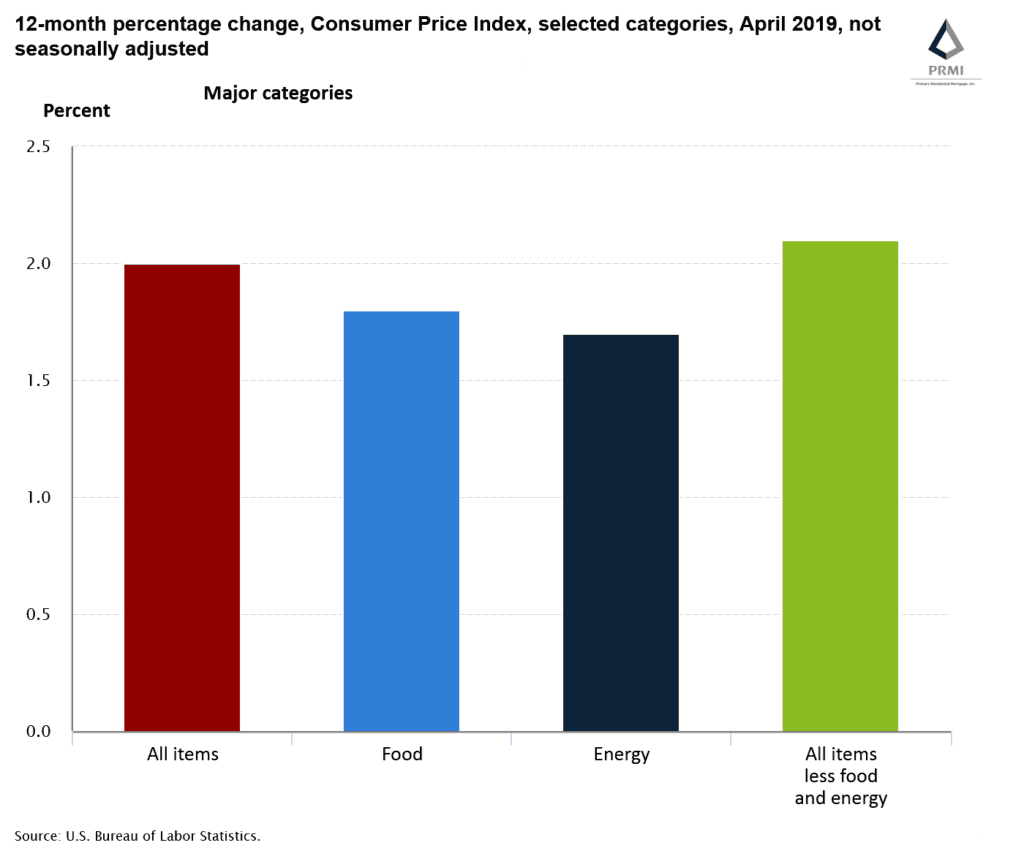

The Consumer Price Index (CPI) for April 2019 increased 0.3% to 2.0% year over year. The Core CPI which strips out food and energy was at 2.1% year over year.

Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services so it is a good measure of inflation at the consumer level.

The Producer Price Index (PPI) for April 2019 remained stable at 2.2% year over year. The PPI measures inflation at the wholesale level which shows if the cost to produce goods is going up or down. If the price of goods go up this could be eventually passed on to consumers so could be an indicator if consumer inflation is likely to rise,

Weekly Initial Jobless Claims were released on Thursday showed 228,000 jobless claims which was worse than expectations of 215,000 claims. This is the third week in a row of higher than expected claims. Even though claims are still historically low, we are now seeing an upward trend in jobless claims.

In Housing News

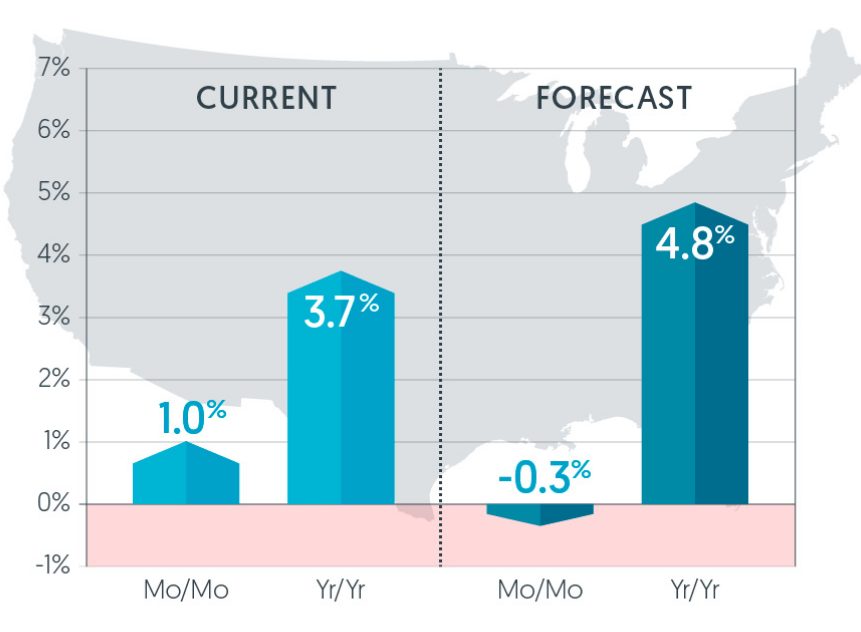

CoreLogic Home Price Index for March 2019 rose 1.0% from February and is up 3.7% year over year. CoreLogic is predicting home prices to rise 4.8% from March of 2019 to March 2020.

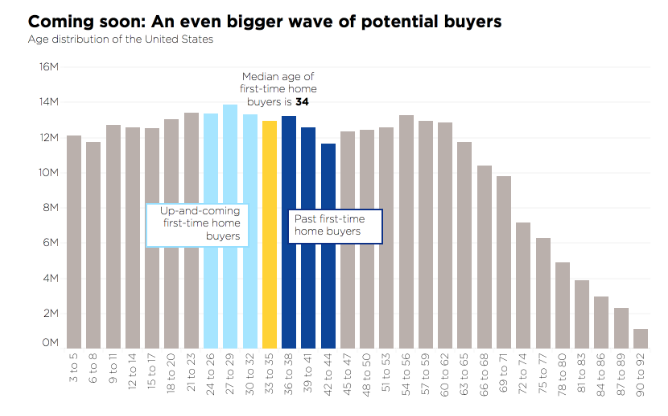

Homebuyer Surge could be coming as more people are coming into the home buying years. The number of individuals turning turning the median home buying age, which is 34, is increasing significantly over the next several years which is termed “the next wave” of home buyers. That means there will be a larger amount of individuals coming to market to either purchase or rent a home. Zillow estimates that 3.11 million people are projected to enter the market by 2028, which is an increase of 7.4% from the past 10 years.

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday June 15, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday May 22, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday June 22, 2019 in Largo, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam