Mortgage Rates Weekly Update [May 5 2019]

Mortgage Rates Weekly Update for May 5, 2019

Mortgage Rates Update for May 5, 2019 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

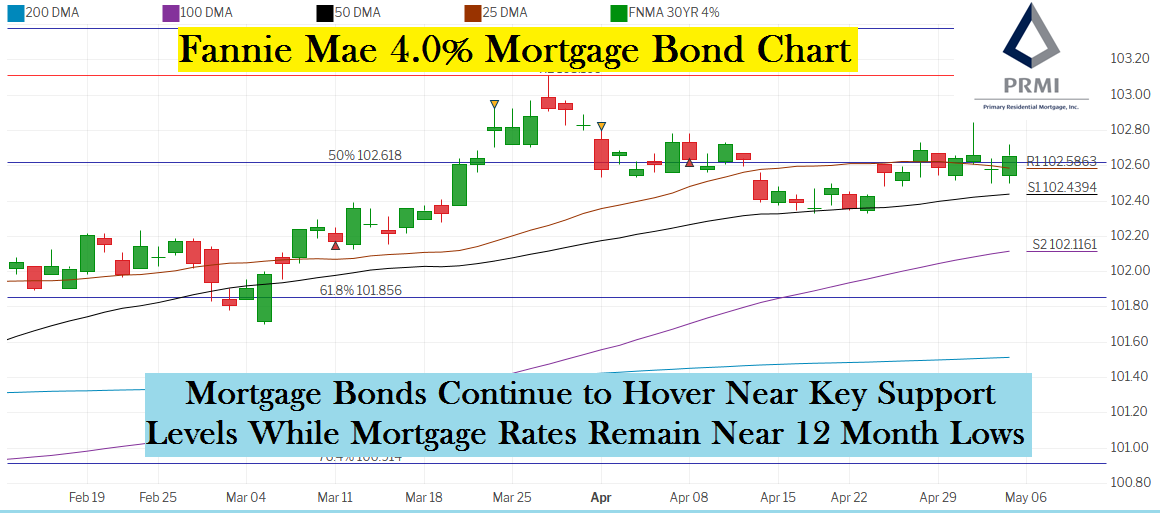

Mortgage Rates ended the week about where they started after a roller coaster week for bonds. If you look at the mortgage bond chart below, you can see mortgage bonds started the week selling off on Monday with Red Candle and broke below important floor of support at 25 moving average. Bonds were able to rally higher on Wednesday after Fed Meeting but lost steam sold back off to end the day. Bonds were not able to break above the 25 day moving average until Friday when Jobs Report showed lower inflation data.

With mortgage bonds above the 25 moving average again, we are recommending FLOATING Your mortgage rate to start the week to see if bonds can rally higher but if bonds fall below 25 day moving average again we would quickly switch to a locking stance.

In Economic News

The Jobs Report for April 2019 was released on Friday by the Bureau of Labor Statistics (BLS) and it showed 263,000 jobs created, which was stronger than the 180,000 jobs expected. This is the 103rd Straight month that the economy has added jobs. The Unemployment Rate dropped from 3.8% to 3.6% which is the lowest level since 1969. BUT the unemployment rate fell because 490,000 people dropped out of the labor force. The Labor Force Participation Rate (LFPR) dropped from 63% to 62.8% as the pool of available labor fell to the least amount since 2001. The Weekly Earnings declined from 3.2% to 2.9% which is bond friendly news as it shows wage pressure inflation actually decreased.

Federal Reserve left the Feds Fund Rate unchanged at meeting last week and the market does not expect the Feds to raise rates at all this year. There is still a 53% chance of a Fed Rate Cut later this year. The Fed also announced that they would begin reinvesting more of their proceeds that would normally fall off their balance sheet into US Treasuries. This could benefit Mortgage Bonds as these purchase begin to take place.

Weekly Initial Jobless Claims were released on Thursday showed 230,000 claims which remained the same as the previous week. This was 15,000 worse than expectations of 215,000 claims. The 230,000 claims the previous week was thought to be because of the holidays but with the same reading again this week, could this be a turning point? If the unemployment rate bottoms out and moves higher, it’s a very reliable recession indicator.

In Housing News

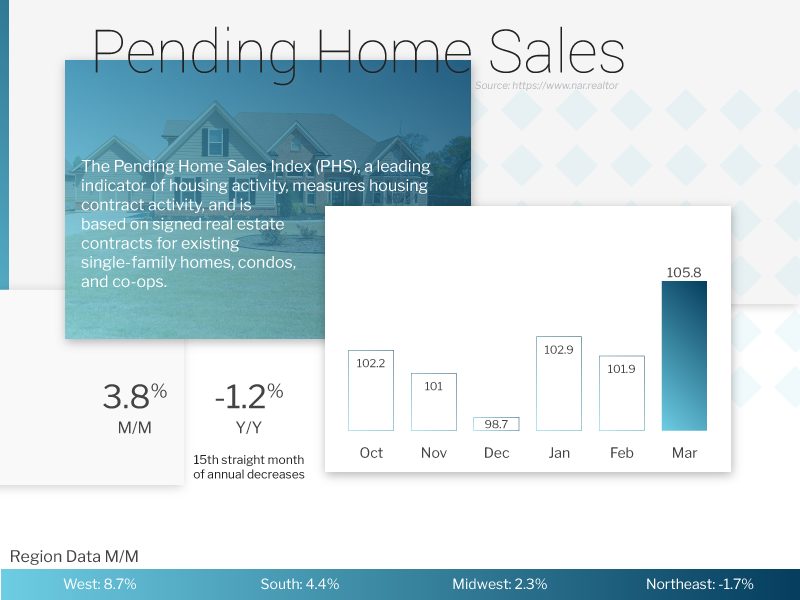

Pending Home Sales for March 2019 were up 3.8% to 105.8 on the index which was stronger than an expected 0.7% gain on Pending Home Sales. Pending Home Sales are down 1.2% year over year. We are looking for Pending Home Sales to get stronger in April and May

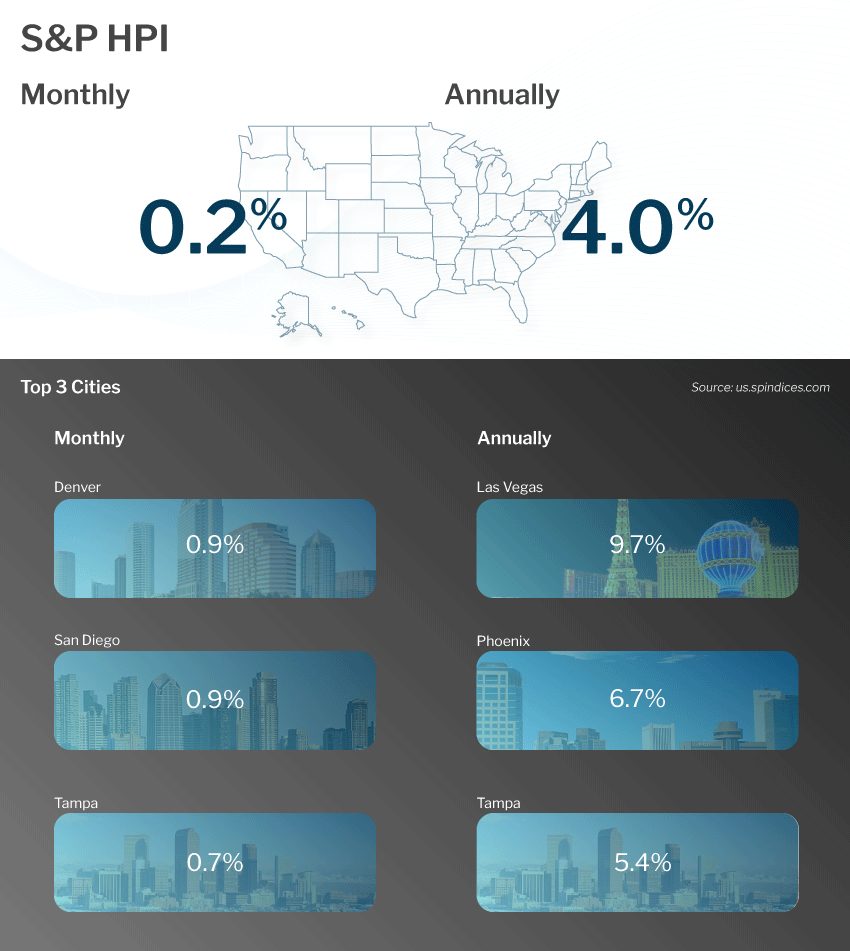

S&P Case-Shiller Home Price Index for February 2019 was released last week. There are two indexes which people pay the most attention to: 20 City Index and the National Index. The 20 City Home Price Index edged Lower to 3.0% year over year from February 2018 to February 2019. The National Home Price Index increased 4% annually which was a drop from 4.2% seen in January. The monthly increase was 0.2% from January to February.

PRMI DPA Advantage Grant Program Released!

New 2% Grant Program for home buyers. Get a forgivable grant of 2% of the purchase price with PRMI DPA Advantage Grant Program. No Income Restrictions for first time home buyers! Minimum 580 FICO Score. Seller can pay up to 6% toward Closing costs. Find out more or apply today at https://delawaremortgageloans.net/prmi-dpa-advantage-grant-program/

First Time Home Buyer Seminars Coming Up:

Delaware Home Buyer Seminars:

Delaware First Time Home Buyer Seminar is Saturday May 11, 2019 in Newark, Delaware.

Delaware First Time Home Buyer Seminar is Wednesday May 22, 2019 in Wilmington, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

Maryland Home Buyer Seminars:

Maryland First Time Home Buyer Seminar is Saturday June 22, 2019 in Largo, Maryland

Register by calling 410-412-3319 or Register online at http://www.MarylandHomeBuyerSeminars.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgageLoans

#JohnThomasTeam