Mortgage Rates Weekly Update for January 5, 2015

Mortgage Rates weekly market update for the Week of January 5, 2015, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware.

Call 302-703-0727 to get a mortgage planning consultation or APPLY ONLINE for Delaware mortgage loan

Mortgage Rates were able to rebound last week and move lower after mortgage bonds bounced off support. If you look at the mortgage bond chart below you can see mortgage bonds rallied off support after Christmas and have continued to move higher. Friday the bond jumped up to record high for the past 12 months. We are recommending FLOATING your Mortgage Rate to start the week as the technical trading pattern is a very bullish signal for bonds to continue to move higher and move mortgage interest rates lower.

In Economic News, the rally higher in the bond market on Friday was because of two disappointing economic reports that caused the U.S. Stock Market to sell off. The first report showed that Construction Spending took an unexpected decline in November 2014 and showed its first negative number since June. The second report was a survey that showed Manufacturing Growth slowed in December 2014 to slowest in 6 months. We also saw foreign manufacturing slowing in China & Europe.

Weekly Initial Jobless Claims jumped higher last week to 298,000 claims which were an increase of 17,000 claims from the previous week and was well above expectations of 286,000 claims. Even though claims did move higher, this is the 14th out of the last 15th weeks that claims were below 300,000 claims.

In Housing News, Pending Home Sales of Existing Homes for November 2014 increased by 0.8% from October 2014. Pending Home Sales is a leading indicator of the housing market to come because they track new purchase contracts. Existing home sales are calculated after a deal closes, usually a month or two after the pending home sale statistic. Year over Year pending home sales was up 4.1% which is the highest annual gain in almost 4.5 years. This is a solid housing report and a good sign for future existing home sales.

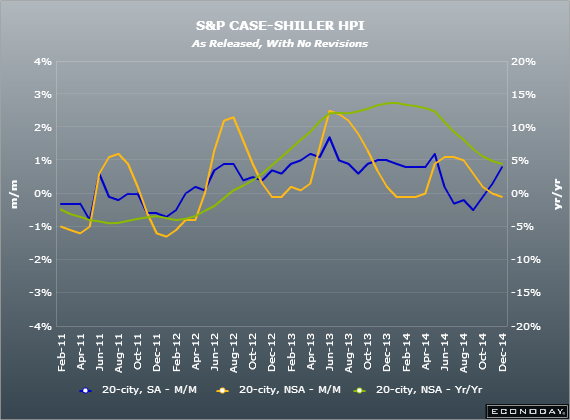

The Case-Shiller Home Price Index for October 2014 came out better than expected at 4.5% but still down from 4.8% in September 2014. Robert Shiller was interviewed on CNBC after the release of the report and he was still optimistic on housing predicting a 4.5% increase in home prices over the next 10 years. This would mean a home that is worth $200,000 today would be worth $310,000 in 10 years.

The VA Loan Limits were released for 2015 by the Department of Veteran Affairs. VA Loan limits were reduced in 84 counties in 14 states effective January 1, 2015. Delaware VA Loan Limits remained the same in 2015 as 2014 as follows:

The VA Loan Limits were released for 2015 by the Department of Veteran Affairs. VA Loan limits were reduced in 84 counties in 14 states effective January 1, 2015. Delaware VA Loan Limits remained the same in 2015 as 2014 as follows:

Delaware VA Loan Limits for 2015:

New Castle County – $417,000

Kent County – $417,000

Sussex County – $417,000

Reports for the Coming Week:

The Labor Sector will be front and center, with Friday’s Jobs Report for December the highlight.

- Look for the ISM Services Index on Tuesday.

- The first report from the jobs sector comes Wednesday with the ADP Employment Report.

- As usual, Weekly Initial Jobless Claims will be delivered on Thursday.

- Friday brings the December Jobs Report, which includes Non-farm Payrolls and the Unemployment Rate.

First Time Home Buyer Seminars Coming Up:

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday, January 17, 2015, n Newark, Delaware.

There is a Dover Delaware First Time Home Buyer Seminar Saturday, January 10, 2015, in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713