Mortgage Rates Weekly Update for Dec 29, 2014

Mortgage Rates weekly market update for the Week of December 29, 2014, by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager and the author of the best selling book, Your Guide to Buying Your First Home in Delaware.

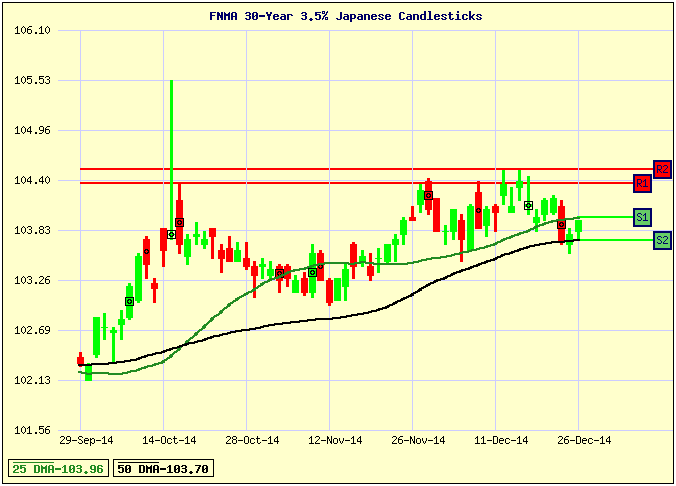

Mortgage Rates moved higher last week on Wednesday after the release of the GDP which caused the stock market to rally. If you look at the mortgage bond chart below you can see the big red candle down on Tuesday which corresponds to the release of the GDP Report. Bonds were able to bounce off support on Wednesday and followed through again on Friday as you can see with the two green candles. This is a good sign that bonds could continue to move higher so we are recommending FLOATING your mortgage interest rate to start the week.

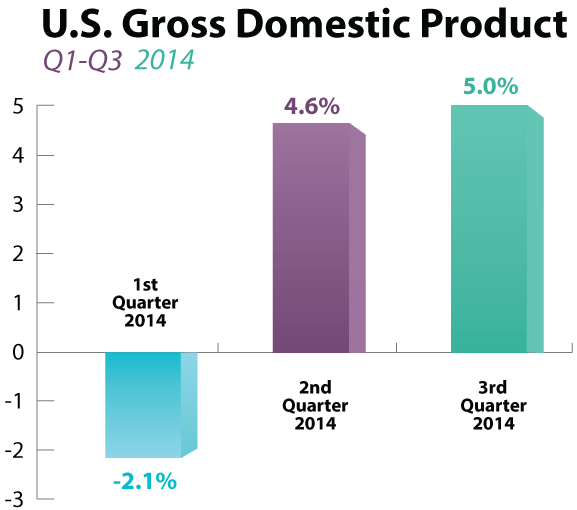

In Economic News, the Bureau of Economic Statistics released the Gross Domestic Product (GDP) for the third quarter of 2014 on Tuesday which came in at a blistering 5%. This is the fastest pace of economic growth since the third quarter of 2003. The big gains were led by a surge in both consumer spending and business spending.

Consumer Sentiment for December 2014 was released last week at 93.6 which was up from last month and the best reading in 8 years. Consumer Sentiment measures how consumers are feeling about the economy. Personal Consumption Expenditures (PCE) was also released last week which is a measure of inflation and it showed inflation is pretty much non-existent with a reading of -0.2% for November 2014 which brings the year over year down to 1.2%.

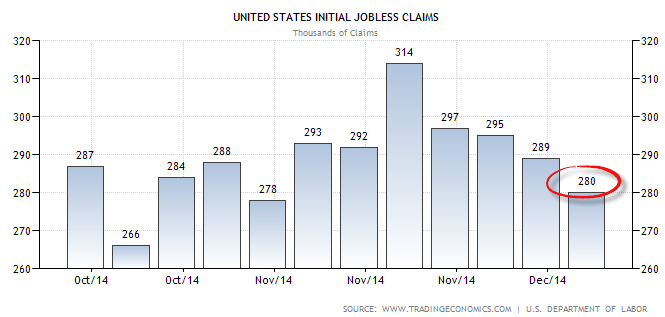

Weekly Initial Jobless Claims were reported on Wednesday at 280,000 claims which are a drop of 9,000 claims from the previous week and below expectations. This was another good jobless claims report and shows that the labor market continues to improve as the economy improves.

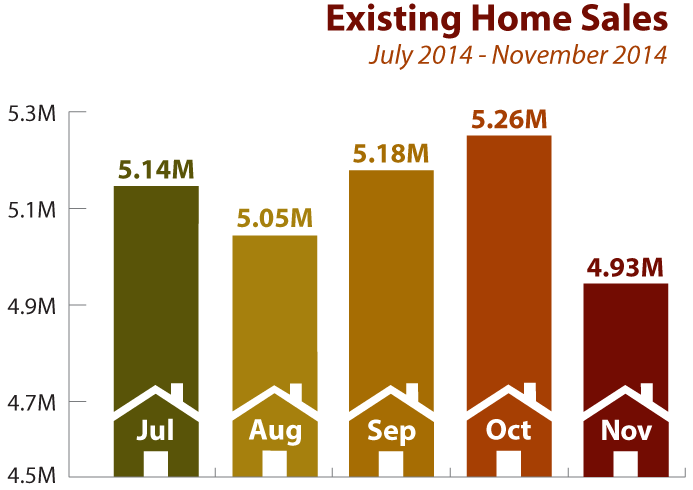

In Housing News, the National Association of Realtors (NAR) reported that Existing Home Sales for November 2014 fell by 6.1% from October 2014 to 4.93 Million units. This was below expectations of 5.20 Million units and shows that the housing market continues to be choppy despite an improving labor market and economy. Existing Homes Sales is a measure of the number of pre-owned single-family homes that were sold in that month. The Median Home Price for an Existing Home was $205,300 which was up 5% from the previous year. So this means the median home buyer last year made $10,000 on their equity in 2014 with a 5% price increase on their home.

The Federal Housing Finance Agency (FHFA) released their Home Price Index for October 2014 which showed home prices up 0.6% from the previous month which was above expectations of only 0.2%. This brings the national year over year price appreciation to 4.5% which is up from 4.3% in September.

In New Construction Housing News, New Home Sales for November 2014 were reported last week down 1.6% to 438,000 units. This was lower than expectations of 460,000 units for new home sales.

In other housing news, Congress passed the Tax Increase Prevention Act of 2014 which had two important bills that passed for housing. The first is the passage of the Mortgage Debt Forgiveness Act of 2014 which makes it so that anybody that had a short sale or foreclosure in 2014 on their primary residence would not have to count the forgiven debt as taxable income on 2014 tax return. The second big item was making Mortgage Insurance Tax Deductible for 2014. This allows mortgage insurance to be tax deductible for homeowners on their 2014 Federal Tax Return.

The next Delaware First Time Home Buyer Seminar is Saturday, January 17, 2015, n Newark, Delaware.

There is a Dover Delaware First Time Home Buyer Seminar Saturday, January 10, 2015, in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

If you would like to apply for a Mortgage Loan, you can APPLY ONLINE HERE, you can call John Thomas at 302-703-0727.

John R. Thomas – NMLS 38783

Certified Mortgage Planner – Primary Residential Mortgage, Inc.

302-703-0727 DE Office / 610-906-3109 PA Office / 410-412-3319 MD Office

248 E Chestnut Hill Rd, Newark, DE 19713