Mortgage Rates Update for November 7, 2016

Mortgage Rates update for the Week of November 7, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Play

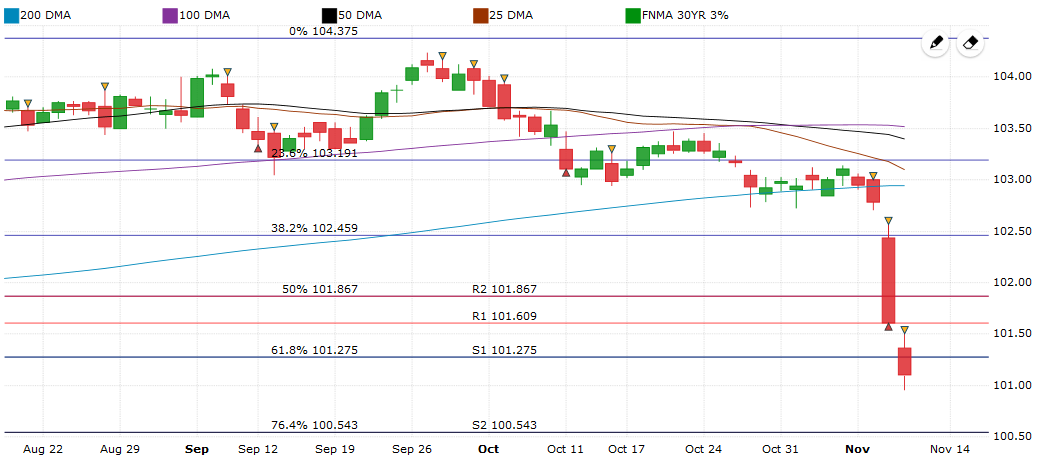

Mortgage Rates finally stabilized and stopped moving higher last week as mortgage bonds found support at the 200 day moving average. If you look at the mortgage bond chart below you can see mortgage bonds sold off and were able to stabilize at the 200 day moving average which is the blue horizontal line. We are recommending FLOATING Your Mortgage Rates to Start the week to see if bonds can bounce off the support and move interest rates lower.

In Economic News

The Labor Bureau released the October 2016 Jobs Report on Friday which showed 161,000 jobs were created in October below expectations. New Job creations in 2016 has averaged 181,000 jobs per month which is down the 229,000 jobs for 2015. The unemployment rate ticked down to 4.9% from 5.0% in September. This is almost no change in unemployment rate since August of 2015. The unemployment rate ticked down by 0.1% for the wrong reason, 195,00 people left the work force not because more people went back to work.

Fed’s favorite measure of inflation, Personal Consumption Expenditure (PCE), was released last week and showed inflation was tame. PCE was up 1.2% year over year but the Core PCE was actaully flat which strips out food and energy.

Weekly Initial Jobless Claims were released on Thursday and moved up 7,000 claims to 265,000 claims for the week. Even though claims moved up this past week, it was still a good number and was the 87th consecutive week jobless claims remained below 300,000 claims.

In Housing News

CoreLogic Released it Home Price Index for September 2016. It showed the national average home price increased 1.1% from August 2016 to September 2016 and was up 6.3% nationally year over year. Locally, Delaware home prices were up 0.70% on average from August to September and are up 1.4% year over year. Projects for Delaware for next year are to be up 3.8%.

FHA Mortgage Loan Update – HUD Condo Approval Process Update

FHA made changes to their FHA Condo Approval process with mortgagee letter released October 26, 2016 which allows for the percentage of owner occupied units in a condo development to be less than the current guideline of at least 50 percent to qualify for a FHA Condo Loan. HUD may approve an occupancy percentage as low as 35 percent if requirements stated in Mortgagee Letter 2015-15 are met. The requirements for 35 percent occupancy are as follows:

Applications must be submitted under HRAP process for FHA condo approval

Funding of replacement reserves for capital expenditures and deferred maintenance of at least 20 percent of budget

No More than 10 percent of units can in arrears of 60 days or more past due

Must provide 3 years of acceptable financial documents

Keep Reading...