Mortgage Rate Weekly Update 11-14-2016

Mortgage Rate Weekly Update for November 14, 2016

Mortgage Rate Weekly update for the Week of November 14, 2016 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

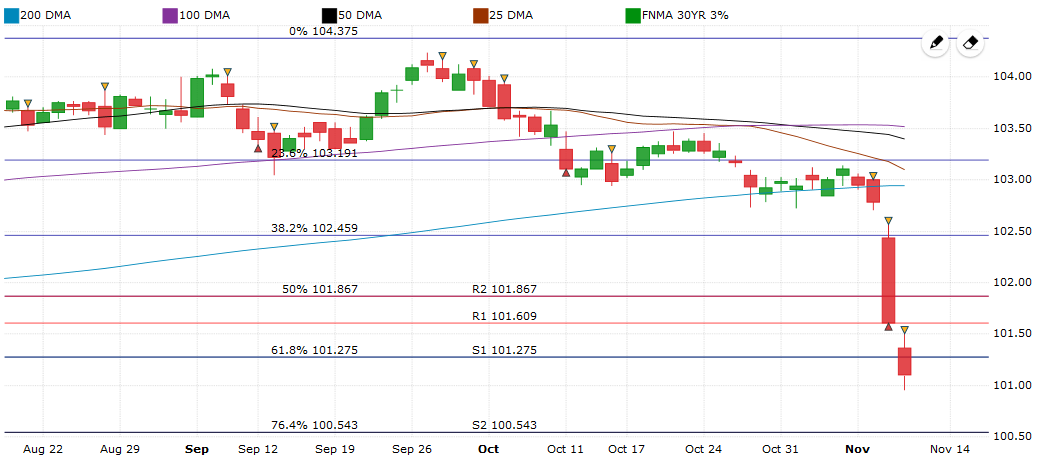

Mortgage Rates Spiked Higher after Donald Trump was elected the new President of the United States. If you look at the bond chart below you can see mortgage bonds broke through support at the 200 day moving average on Tuesday Election day. This was a bad sign for bonds and on Wednesday bonds follow through by selling off again and breaking through 2 more floors of support to end down almost 100 bps. Thursday mortgage bonds again sold off and broke through 2 more floors of support. This is very bad technical data and bonds more room to sell of before hitting the next floor of support. Mortgage Rates moved higher as the market priced in the risk of a Donald Trump Presidency with his stated policy anticipating a rise in inflation. Inflation is bad for fixed investment assets like bonds so bonds sold off in dramatic fashion jumping mortgage rates anywhere from 0.25% to 0.5% higher depending on your qualifying factors. We recommend to LOCKING your mortgage rate as interest rates could continue to rise as the market digests what affect a Trump Presidency will have on the markets.

On Economic News

The Stock Market reacted very erratically to the election results of the next U.S. President. The market dropped 800 points in Dow futures during Tuesday night but when the market opened on Wednesday the DOW surged higher. The DOW ended the day Thursday to set a new all time record high. This pulled money out of the bond market and traders also were pricing in the possibility of rise in inflation as Donal Trump takes office and begins to implement his proposed policies.

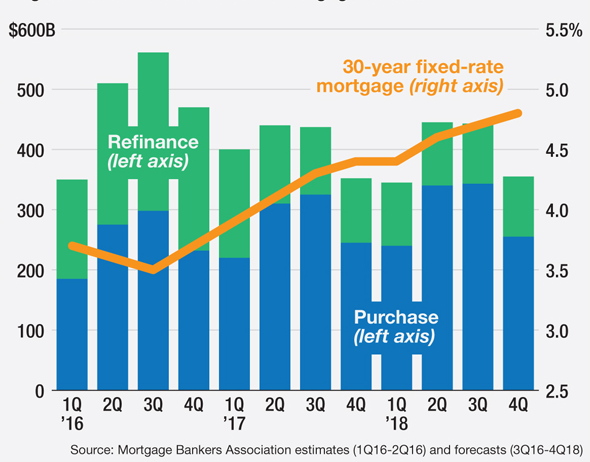

Lower income taxes and spending money on infrastructure as well as canceling free trade agreements are all things that could cause a rise in inflation and give a boost to the stock market which both are bad for bonds. Prediction for mortgage rates are to average 4.2% for 2017 and be at about 5% by end of 2018. This means if you are looking to purchase a home, now is the time to purchase a home to take advantage of record low rates. The market will not crash and the housing market will continue to do well as 5% rates are still very low rates historically.

President elect Trump looks like he won’t remove Janet Yellen as Federal Reserve Chair and will let her stay on to finish her term in February 2018. This is change from what he said during campaign and may add some stability to the markets. It also looks like the odds of the Feds hiking their short term Fed Funds Rate in December 2016 went from less than 50% chance the day after elections to 81% on Friday as the market viewed Trump’s policy as inflationary so will force Feds to raise rates.

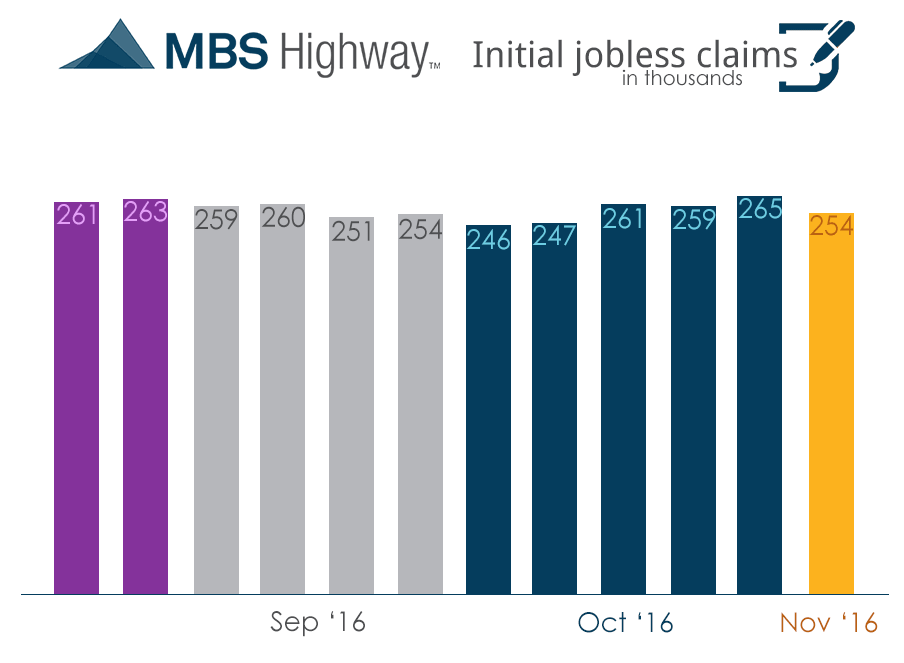

Weekly Initial Jobless Claims were released on Thursday and dropped 11,000 clams to 254,000 claims . This supports a very strong labor market. This week’s initial jobless claims will be watched closely as this is the sample week to be used in the November 2016 Jobs Report. This shows that the Jobs Report should be very good which would be bad for mortgage bonds.

In Housing News

Update on Dodd-Frank & CFPB – President Elect Donald Trump’s transition team released information that Trumps’s “Financial Services Policy Implementation team will be working to dismantle the Dodd-Frank Act and replace it with new policies to encourage economic growth and job creation.” This could see mortgage lending loosen up as some of the regulations holding back growth could be changed.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday November 19, 2016 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage

#MortgageRate