Mortgage Rates Weekly Updates [August 14 2017]

Mortgage Rates Weekly Update for August 14, 2017

Mortgage Rates Weekly Update for August 14, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved lower last week as the US stock market sold off and moved money into mortgage bonds. If you look at the mortgage bond chart below, you can see the trend is for bonds to move upward in price which moves mortgage interest rates lower. Mortgage bonds touched just below the highs of 2017 which means mortgage interest rates are at the lowest they have been all year. Mortgage bonds closed above support for the third day in the row so we are recommending FLOATING your mortgage rate to start the week.

In Economic News

Tensions between the United States and North Korea were heightened this week after exchange of words between the leaders of both countries. This caused uncertainty in the financial markets which caused stock prices to move lower and money flowed into the bond markets moving mortgage interest rates lower.

Wholesale Inflation remained very tame with the release of the Producer Price Index (PPI) for July 2017 dropped -0.1% from June which was below expectations of a 0.2% increase and year over year the Core PPI was 1.9%.

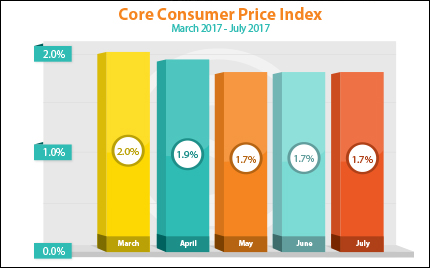

Consumer inflation was measured by the Consumer Price Index (CPI) for July 2017 which was only 1.7% year over year and well below the 2.0% Federal Target for consumer inflation. The Core CPI has been declining since February 2017. Low inflation is good news for mortgage bonds and will help keep mortgage interest rates low.

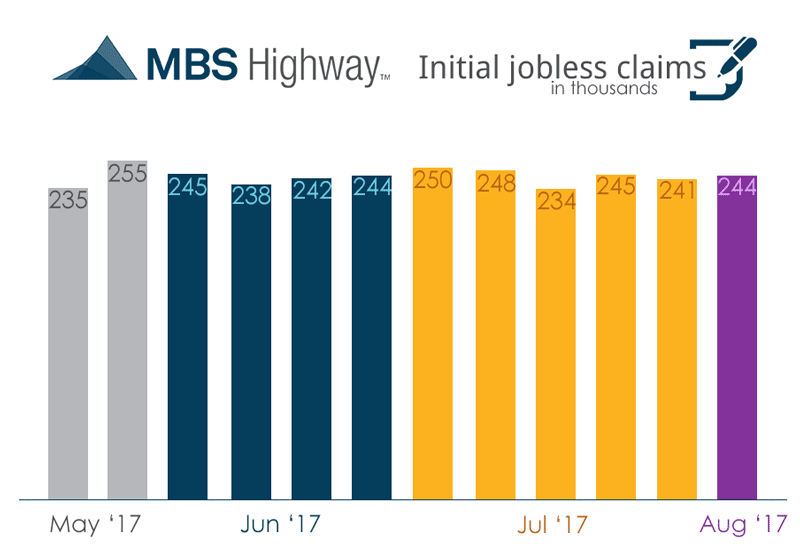

Weekly Initial Jobless Claims were released on Thursday and moved higher by 3,000 claims to 244,000 claims for the week. This was the 127th consecutive weeks of jobless claims below 300,000 claims. Next week’s initial claims report will be the sample week used in the August Jobs Report.

In Housing News

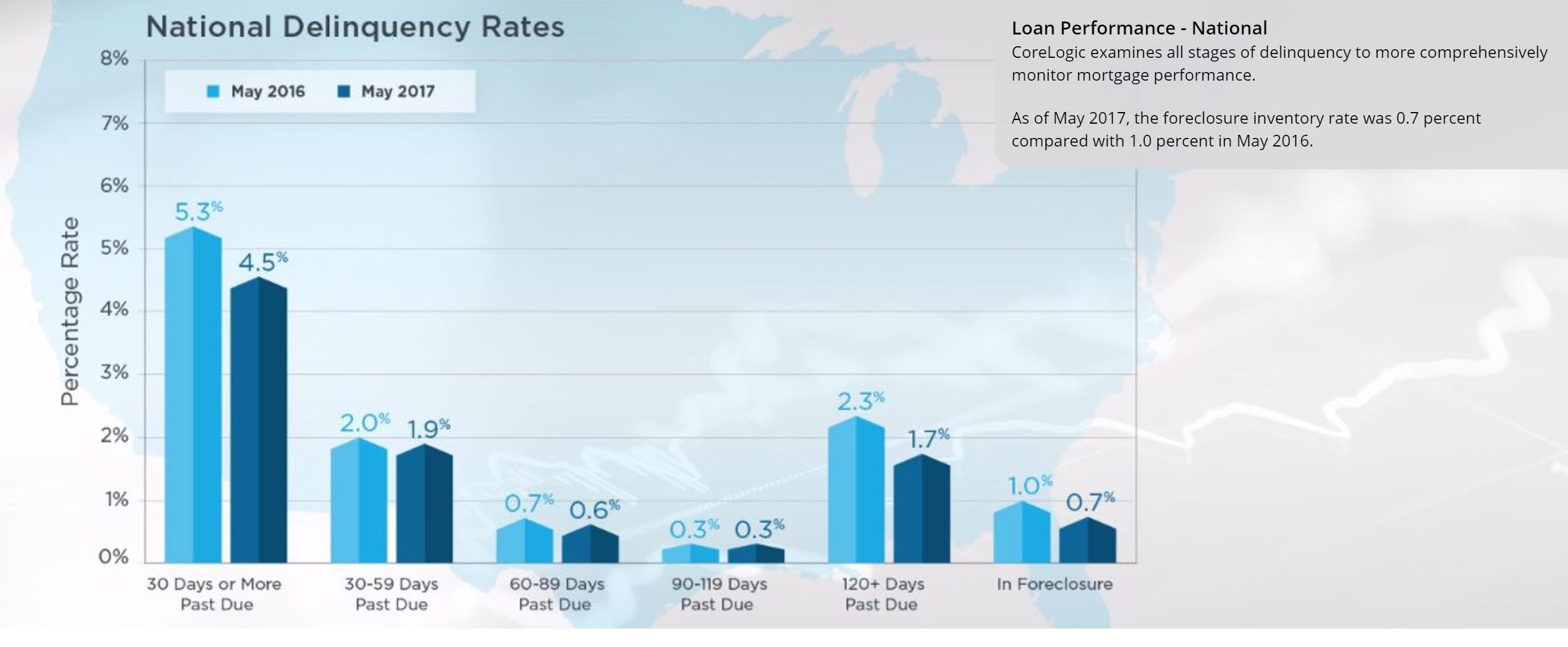

CoreLogic released its Loan Performance Insights for May 2017 which showed loans that are 30 days or more past due dropped from 4.8% in April to only 4.5% in May and were also down from 5.3% in May 2016. The number of homes in Foreclosure remained the same from April at 0.7% but were down from 1.0% of May 2016. As home prices rise, National Delinquency Rates are declining.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday August 19, 2017 in Newark, Delaware.

The next Dover Delaware First Time Home Buyer Seminar is Saturday September 16 , 2017 in Dover, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage