Mortgage Rates Weekly Update [September 25 2017]

Mortgage Rates Update for September 25, 2017 by John R. Thomas with Primary Residential Mortgage, Inc. in Newark, Delaware. Get advice on Locking or Floating your Mortgage Rate to start the week as well as the latest housing and finance news updates. John Thomas is the Branch Manager, a Delaware Loan Officer and the author of the best selling book, Your Guide to Buying Your First Home in Delaware. Call 302-703-0727 for a Rate Quote or Apply Online for Rate Quote

Mortgage Rates moved slightly higher last week as mortgage bonds sold off after Federal Reserve announced the “Great Unwind” of its balance sheet. If you look at the mortgage bond chart below, you can see the trend is for mortgage bonds to sell off and move rates higher but on Friday bonds were able to bounce off support and close just below the 50 day moving average. The technical trading patterns point to bond prices moving higher which would move interest rates lower so we are recommending FLOATING your mortgage rate to start the week.

In Economic News

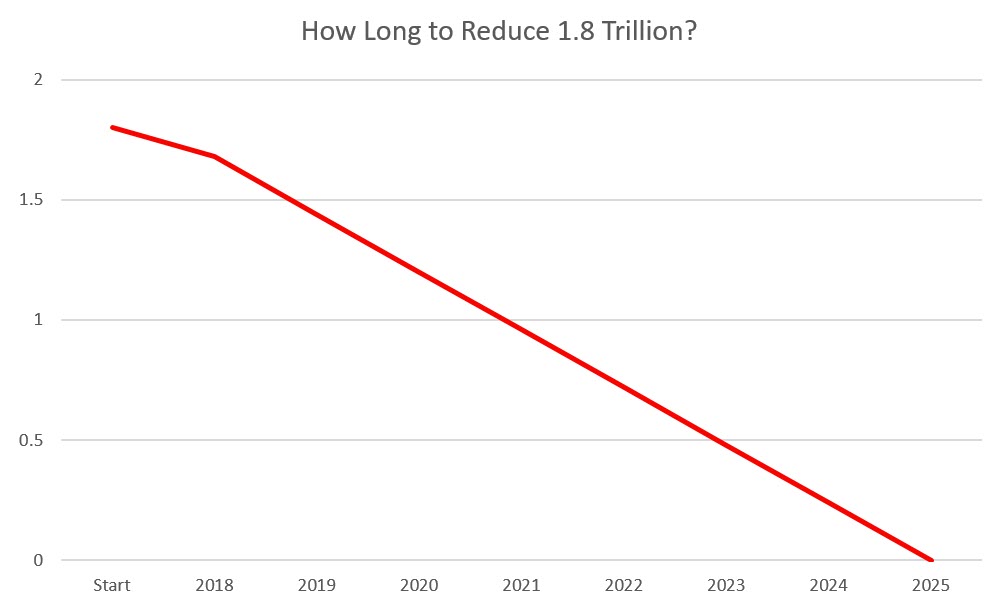

The Federal Reserve announced last Wednesday that it will begin to unwind its massive $4.5 Trillion balance sheet starting October 9, 2017 by reducing the amount of money they re-invest into mortgage by purchases and treasury purchases. The Feds receive money when people pay on the mortgages they are holding or when a mortgage pays off from a refinance or a sale of the home. This money the Feds have been reinvesting back into new mortgage bonds. Currently the Feds have been reinvesting about $25 Billion of these proceeds back into new mortgage bonds. Starting October 1st the Feds will let $6 Billion in Treasuries run off the balance sheet and $4 Billion in mortgage bonds.

The Feds currently have $1.8 Trillion in Mortgage Bonds on its balance sheet. The plan to reduce the balance sheet will take at least 7 years. You can see the timeline in the graph below:

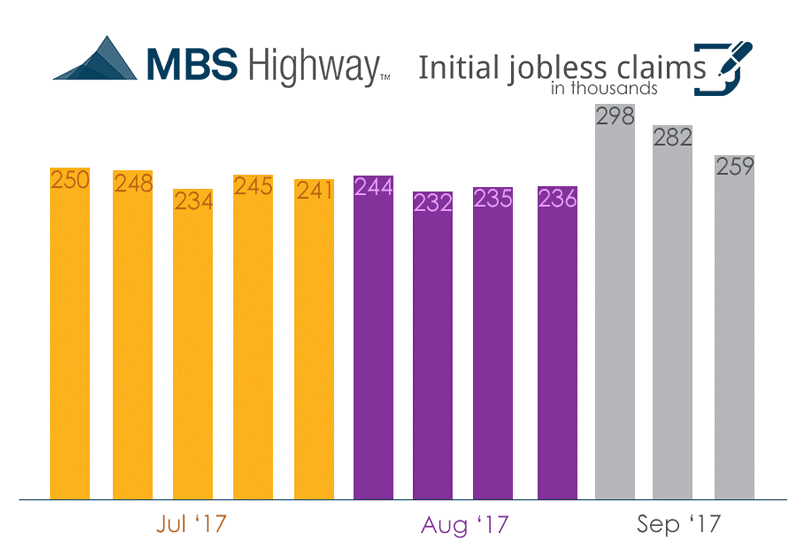

Weekly Initial Jobless Claims were released on Thursday and dropped 23,000 claims to 259,000 initial claims for the week from first time filers. This was much better than expectations of 303,000 claims and last weeks was revised lower from 289,000 to only 282,000 claims. This week is the sample week which will be used in the September jobs report.

In Housing News

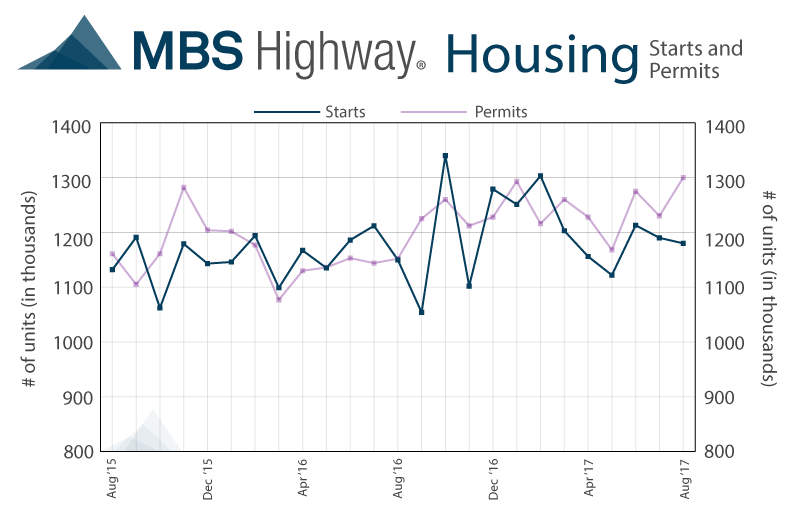

Housing Starts for August 2017 were reported at 1.18 Million units which was better than expectations but was a drop of 1.7% from July. The drop from July ONLY happened because July’s numbers were revised higher, prior to the revision housing starts would have been up 0.2%. Most of the drop in housing starts was from multi-family unit buildings as single family units were actually up 13,000 units from last month. So this report was not a bad report at all and still shows a strong housing market for single family homes.

Building Permits for August 2017 were up 5.7% to 1.3 Million Units which is an indication of future construction so this bodes well for new home builders going into the end of the year.

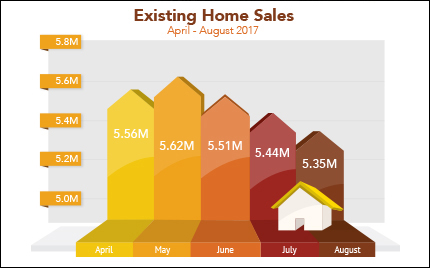

Existing Home Sales for August 2017 were reported at 5.35 Million Units which was a drop of 1.7% from July. Existing home sales measures the number of re-sale homes that were sold for that month. Sales were up 0.2% from August of 2016 on a year over year basis. The Median Existing Home Price for August 2017 was up 5.6% from August 2016 marking the 66th consecutive month of home price gains.

First Time Home Buyer Seminars Coming Up:

The next Delaware First Time Home Buyer Seminar is Saturday October 21, 2017 in Newark, Delaware.

Register by calling 302-703-0727 or Register online at http://www.DelawareHomeBuyerSeminar.com

DE Mortgage Rates remain near all time record low rates but having been moving higher as of late, so it is the perfect time to purchase or refinance a home before interest rates move even higher. Call 302-703-0727 for a free mortgage consultation with a licensed mortgage loan officer that can review your options with you or APPLY ONLINE

Mortgage Rates Weekly Update

#DelawareMortgageRates

#DelawareMortgages

#DelawareMortgage